Fixed income

Interactive Data Adds European, Asian Bonds to Liquidity Indicators

The indicators will help users estimate the volume of liquidity to support a trade, and to estimate how long they should hold a position.

IPC, Algomi Partner on DealCall Application for Fixed Income Communications

Collaboration to see voice connection application launched on Algomi Honeycomb network , IPC cloud network.

The Changing Faces of Electronic Fixed-Income Trading

TruMid is set to launch a new trading platform. Anthony says the move is a step in the right direction.

John Brazier: The Buy Side Has Never Had It So Good

The buy side has plenty of options for bond trading, it's a matter of making the right decisions.

Mosaic Smart Data Preps FX Analytics Platform

The vendor is planning to expand from fixed income to other, related derivative asset classes.

Barclays Point Fixed-Income Users Worry About Bloomberg Port Conversion

A recent survey found that the fixed-income community has major concerns about the sunsetting of Barclays' Point platform.

March Madness: The Financial Technology Trends Tournament

Dan analyzes eight of the biggest trends in the space.

S3 Unveils Execution Quality Service for Fixed Income

The Austin, Texas-based company already offers best ex factors for equities and options.

S3 Unveils Execution Quality Service for Fixed Income

The Austin, Texas-based company already offers best ex factors for equities and options.

Bloomberg Launches Liquidity Assessment Tool for Bond Liquidity Risk

New tool powered by machine learning to tackle ongoing bond liquidity issues through a quantitative approach.

ICE Buys S&P Evaluations Biz, CMA to Boost OTC Evaluations

S&P is pulling out of the evaluated pricing business after failing to attract critical mass, officials say.

Fixed Income: Electronic Evolution

The historic liquidity issues plaguing the fixed-income market have been recognized for some time and a number of trading platforms have been launched to facilitate trading, particularly within the secondary bond market.

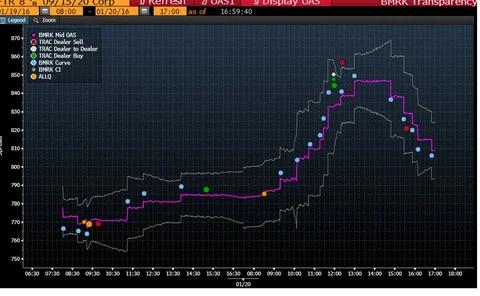

RW Baird Taps Magenta Bond Benchmarks as Bloomberg Completes BMRK Integration

The financial firm can now use the Magenta Line pricing tool more fully now Bloomberg has integrated it into its trading platforms.i

Bloomberg Integrates Magenta Line Pre-Trade Pricing into Professional Terminal

BMRK uses the Magenta Line technology acquired from Benchmark Solutions, which closed in 2013.

Fixed-Income Liquidity: An Alternative FIX

Numerous market participants have responded to the problem of shallow liquidity in fixed-income markets with the launch of new trading platforms, but without any tangible success.

SS&C Expands Evaluated Pricing Survey, Preps 2016 Rankings

The survey shows the most accurate providers of evaluated pricing for specific securities types.

Markit Eyes Regulation-Led Liquidity Tools, Real-Time Bond Pricing for '16

The vendor is expanding its fixed income pricing capabilities in response to opportunities created by new regulations.

Neptune Collaboration to Enhance Standardization, Liquidity to Fixed-Income Markets

Initiative to ease access to fixed-income liquidity through standardized information opens to wider bond markets.

Quincy Eyes Asia, Fixed Income for Growth

After initially focusing on the US and Europe for equities and derivatives, Quincy is now looking to Asia and bond markets.

Solactive Launches Benchmarks, Sets Roadmap for Smart Beta Indexes

Clients will be able to use Solactive's benchmarks as the basis for their own indexes, or to benchmark investment strategies.

2015 Year in Review: FICC Market Evolution Spawns New Low-Latency Data, Tech

Data consumers and vendors are seeking to apply strategies and technologies from equities to other markets.

DelphX Negotiation Tool Allows Dealers to Quote Corporate Bonds Held by Investors

The tool allows dealers to negotiate future transactions that allow them to take advantage of bond inventories held by investors.

Empirasign Opens London Office to Grow EU Bond Market Penetration

Empirasign is adding staff and has adapted its alerts feature to reflect the needs of the local bond market.