March Madness: The Financial Technology Trends Tournament

Dan analyzes eight of the biggest trends in the space.

The calendar has turned to March, which can only mean one thing: The madness is officially upon us.

On Thursday (no, I don't count the "First Four" as the start of the tournament), we'll start with 64 teams, all, to varying degrees, believing they have a shot at a national title. Four days and 48 games later, there will only be 16 left, many of which will not have been expected to make it as far as they did. What a time to be alive!

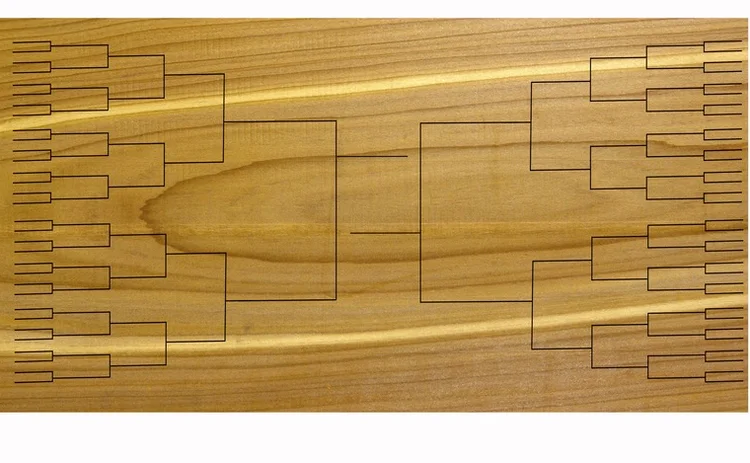

I could wax poetic about the NCAA tournament forever, but these columns are about technology in the capital markets. That's why I'm going to piggyback on the popularity of NCAA tournament and make a bracket of my own.

I'm a big-picture guy, so I like to look at trends that are gaining steam in the industry. I picked eight topics that are fairly big in the financial technology space, seeded them, and pitted them against each other.

Without further ado, your 2016 Financial Technology Trends (FTT) tournament bracket!

First Round

No. 1 Bitcoin/Blockchain vs. No. 8 Fixed-Income Trading

There is a reason these two are seeded where they are. Bitcoin/blockchain and fixed-income trading are a world apart. There are plenty of interesting technology issues in the fixed-income space, but those pale in comparison to the chatter around the potential use-cases for bitcoin and blockchain in financial services.

This is one of those games where it's over as soon as two teams line up for the opening tip. Bitcoin/blockchain in a landslide.

Winner: Bitcoin/Blockchain

No. 2 Big Data Analytics vs. No. 7 Mergers

As the unparalleled former Buy-Side Technology editor Tim Bourgaize Murray once said, "A day in financial technology without an acquisition is like an afternoon in London without a little rain: It happens, but not often." That sentiment has been especially true in recent months, specifically, as US editor Anthony Malakian and I discussed last week, when it comes to risk platforms servicing the buy side. However, the ability to leverage big data is on the forefront of every financial firm's agenda. Firms are looking to really take advantage of the big data platforms they've spent the last few years building.

Gonzaga is the NCAA equivalent of mergers, always in the tournament, but never really in the conversation. On the other hand, big data analytics is a true rising star in the bracket. It makes it on to the next round comfortably.

Winner: Big Data Analytics

No. 3 Cybersecurity vs. No. 6 Machine Learning

Classic match-up between old hot trend (cybersecurity) and new hot trend (machine learning). Cyber was all the rage 16 months ago, but the topic has cooled down. It's still a major issue, but it's one that firms are much more aware of than they were five years ago. Machine learning is a new up-and-comer with plenty of potential, as detailed by Anthony in a recent feature. While many would argue the hype around cybersecurity has already peaked, there is no denying the ceiling for machine learning is still unclear.

In an upset, the upstart takes down the established. Machine learning on a buzzer-beater.

Winner: Machine Learning

No. 4 MiFID II vs. No. 5 Dark Pools/High-Frequency Trading

In one corner we have a topic that first took the mainstream spotlight a couple years ago and has managed to stay in the public eye, whether it be for good reasons or bad, on a consistent basis. In the other, we have a massive European regulation that was delayed in the fall and won't be enforced until January 2018. While interest in MiFID II has continued to climb, its implementation date is still almost 22 months away. HFT and dark pools are more consistent issues, whether it's new regulations affecting them, or the technology backing them.

Just like Duke, you might not like HFT, but it's always going to be a contender. The speed guys move on.

Winner: Dark Pools/High-Frequency Trading

Second Round

No. 1 Blockchain vs No. 5 Dark Pools/High-Frequency Trading

If this was HFT from 2014, we might have a real fight on our hands, but it's not. Bitcoin/blockchain is just too hot in the streets right now.

Winner: Blockchain/Bitcoin

No. 2 Big Data Analytics vs. No. 6 Machine Learning

Can the Cinderella story continue?

No. Maybe in a few years, but right now big data analytics are much more important to firms' immediate future.

Winner: Big Data Analytics

Final

No. 1 Blockchain vs. No. 2 Big Data Analytics

You kind of knew it was always going to come to this. Favorites don't always fair well in the NCAA tournament, but sometimes there are just two powerhouses that seem destined to meet. That was the case here. Both technologies account for an innumerable amount of projects currently under way in financial services.

The differentiator, however, is actual use-cases. And while plenty of firms will tout their proofs of concepts around the blockchain, big data analytics are already an integral part of most financial firms. That's why it will be big data analytics cutting down the nets this year and taking home the first FTT title. Cue the music!

Winner: Big Data Analytics

This week on the Waters Wavelength podcast ─ Episode 8: Consolidation of Risk Platforms, Open Source

If you haven't already, subscribe to the podcast on iTunes here. Also, check out our SoundCloud account here.

Food for Thought

- As for the actual tournaments: On the men's side I like Michigan State. The Spartans will be fueled by the disrepect they feel from not getting a one seed. For the women, UConn. 'Nuff said. For my Final Four picks, listen to Thursday's Waters Wavelength podcast.

- Just over a month away from the North American Trading Architecture Summit 2016. For more info, click here.

Like the column? Hate the column? Let me know via email (dan.defrancesco@incisivemedia.com) or Twitter (@dandefrancesco).

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Bank of America and AI, exchanges feud with researchers, a potential EU tax on US tech, and more

The Waters Cooler: Broadridge settles repos in real time, Market Structure Partners strikes back at European exchanges, and a scandal unfolds in Boston in this week’s news roundup.

Bloomberg rolls out GenAI-powered Document Insights

The data giant’s newest generative AI tool allows analysts to query documents using a natural-language interface.

Tape bids, algorithmic trading, tariffs fallout and more

The Waters Cooler: Bloomberg integrates events data, SimCorp and TSImagine help out asset managers, and Big xyt makes good on its consolidated tape bid in this week’s news roundup.

DeepSeek success spurs banks to consider do-it-yourself AI

Chinese LLM resets price tag for in-house systems—and could also nudge banks towards open-source models.

Standard Chartered goes from spectator to player in digital asset game

The bank’s digital assets custody offering is underpinned by an open API and modular infrastructure, allowing it to potentially add a secondary back-end system provider.

Saugata Saha pilots S&P’s way through data interoperability, AI

Saha, who was named president of S&P Global Market Intelligence last year, details how the company is looking at enterprise data and the success of its early investments in AI.

Data partnerships, outsourced trading, developer wins, Studio Ghibli, and more

The Waters Cooler: CME and Google Cloud reach second base, Visible Alpha settles in at S&P, and another overnight trading venue is approved in this week’s news round-up.

Are we really moving on from GenAI already?

Waters Wrap: Agentic AI is becoming an increasingly hot topic, but Anthony says that shouldn’t come at the expense of generative AI.