Fixed income

Kuberre Systems Picks Up Interactive Data Fixed-Income Pricing

Data management and analytics provider will offer Continuous Evaluated Pricing Service through its platform

Redline Adds eSpeed to InRush Ticker in Fixed Income Push

eSpeed's treasury platform is the first fixed income market for which Redline has added support to its feed handlers and ticker plant.

Celoxica Adds Bond Feed Support

Officials say the addition of Brokertec and eSpeed is in response to increased electronification of bond markets.

APFIC Panelists Call for More Data, Greater Electronification to Fix Fixed Income Liquidity Crisis

Industry calls for more fixed income data in Asia

Off the Chain: The Blockchain Battle

Tim Bourgaize Murray surveys industry perspectives on Blockchain's potential, and finds a battle brewing.

NovaSparks Adds BrokerTec ITCH Feed in First Fixed Income Foray

The vendor is expanding its low-latency datafeed handling to the liquid US Treasuries market.

Thomson Reuters Adds Evaluations for Marketplace Loans

The vendor has partnered with fixed income valuations specialist MountainView IPS for hard-to-value loans.

ICE Positions as Valuations Vendor with Interactive Data Buy; Data Consumers Concerned by Potential Impact on Competition

User firms remain wary of potential price increases for IDC data under ICE ownership.

China Broker CCT-BGC Inks Bond Data Deals with Shanghai Wind, Sumscope

BGC's market data division will manage distribution of the joint venture's data via the vendors.

MUFG Fund Services Taps Markit for Bond Pricing

The prices will support MUFG's NAV calculations for fund clients

Markit Launches Evaluated Prices for TruPS, ABS CDOs

The prices will bring transparency to the securitized markets

MTS Expands Delivery Options for B2Scan Bond Inventory Data

B2Scan's bond inventory data can now be accessed via APIs and downloads from MTS in addition to B2Scan's portal.

Exegy Enters Fixed Income Data with BrokerTec Handler

The BrokerTec ITCH feed is the first fixed income feed supported by the vendor.

Interactive Data Introduces New Fixed Income Best Ex Service

Pricing provider to give trade-by-trade measure of execution quality.

Interactive Data Unveils Bonds BestEx Service

The new best execution service leverages Interactive Data's existing Continuous Evaluated Pricing service.

SocGen Bolsters Rates Business with Quartet’s ActivePivot

SocGen's Jérôme Cazes and Quartet's Georges Bory discuss the implementation of ActivePivot at SocGen and future enhancements of the analytics tool.

Australia to Implement T+2 For Fixed Income By 2016

$1 trillion bond and fixed income markets follow similar move for equities.

Bringing Standardization to the Fixed Income ETF Space

BlackRock and several other fixed-income heavyweights are joining forces to provide a new standard to calculate yield, spread and duration for fixed income ETFs.

Bringing Standardization to the Fixed Income ETF Space

BlackRock and several other fixed-income heavyweights are joining forces to provide a new standard to calculate yield, spread and duration for fixed income ETFs.

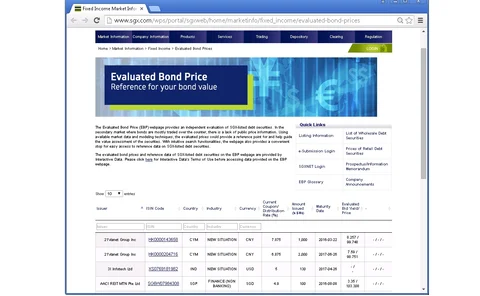

SGX Taps Interactive Data for Evaluated Bond Prices

The prices, covering nearly 2,000 bonds, will be published daily on SGX's website.

Thomson Reuters Adds Intraday Bond Evaluations to DataScope

The intraday prices will allow users to value portfolios at any point during the day for greater accuracy.

Northern Trust Taps Interactive Data Continuous Pricing for Bond Index Calculation

Northern Trust will soon be using Interactive Data's continuous bond pricing to drive five products.

Interactive Data to Provide Evaluated Pricing for New Northern Trust Fixed Income Index

New pricing will focus on US credit.

Thomson Reuters Adds CBID Bond Data to Eikon, Elektron

Content deal will give Thomson Reuters clients access to CBID's real-time Canadian bond data for greater transparency.