Automation

‘Very careful thought’: T+1 will introduce costs, complexities for ETF traders

When the US moves to T+1 at the end of May 2024, firms trading ETFs will need to automate their workflows as much as possible to avoid "settlement misalignment" and additional costs.

Prepare now for the inevitable: T+1 isn’t just a US challenge

The DTCC’s Val Wotton believes that firms around the globe should view North America’s move to T+1 as an opportunity—because it’s inevitable.

European firms prime for lopsided settlement in North America and at home

With T+1 imminent in North America and increasingly likely to traverse the Atlantic, operations and trading professionals in Europe are fighting on two fronts.

Modernizing architecture can reduce long-term costs

A perfect storm of regulation and accelerated tech advancement is forcing modernization unlike anything the markets have seen before, says Nasdaq’s Gil Guillaumey.

As T+1 looms, non-US firms consider out-of-hours trading

Pruned settlement cycle forces foreign buy-siders to explore automating the FX leg of securities trades.

Interoperability is not AI

Dan Schleifer, co-founder of Interop.io, explains how desktop interoperability underpins new AI developments.

ASX CHESS replacement to be delivered in phases, with clearing first in 2026

The Australian Securities Exchange announced in November it had chosen Tata Consulting Services to run the new CHESS replacement project after initial plans with Digital Asset were scrapped in 2022.

Waters Wrap: T+1 and too many proposals

Anthony believes that there’s a growing chasm emerging between regulators, senior business execs, and technologists—which is especially evident when it comes to the T+1 debate.

MarketAxess sees returns from new trading tools

Recently added portfolio trading, automation, and algo offerings drove the vendor’s revenue growth in Q4 2023.

Run the bank, change the bank: CTOs juggle needs and wants

Voice of the CTO: In part two of a five-part series, bank technologists explain where firms go wrong when trying to modernize their tech stacks and manage technical debt.

‘When, not if’: EU plots course for T+1 transition

Not everyone saw eye to eye at a European Commission roundtable discussing how to shorten settlement cycles, but most participants recognized the need to make the transition to T+1.

Managing the FX challenge for T+1

As firms prepare for T+1 in May 2024, DTCC’s Val Wotton says they should also consider the complexities for cross-border trades.

The move to T+1: This time is different

This whitepaper, created by Broadridge, focuses on leveraging robotic process automation and AI to ensure a smooth transition from T+2 to T+1 settlement.

Better tech brings threat of two-speed trading in fixed income

Smaller asset managers may get left behind as automation allows the big players to prosper.

Interop tech buys time for buy-side fixed-income traders

A few buy-side traders and portfolio managers spearheading a drive for greater interoperability are reaping the rewards of increased workplace efficiency. Is interoperability the fixed-income panacea the buy side has been looking for?

Bulletproof building: DTCC, AWS debut app resiliency prototype

The cloud provider and industry utility have jointly released a prototype and guidelines for building resilient financial services applications.

FactSet lays out AI blueprint for discoverability, workflows, and innovation

The data provider is utilizing generative AI and large language models to provide a conversational interface in FactSet Workstation that will complement AI-powered workflows and products.

Settlement ‘instructions’: Firms look to US for guidance as Europe braces for T+1

Operations professionals in Europe look across the pond for lessons in managing shorter settlement cycles.

Isda doubles down on digital push with new tech team

The new division is tasked with identifying new areas for standardization.

Broadridge’s LTX looks to GenAI as it competes for market share

LTX has pinned its hopes of breaking into the fixed-income market on innovative use of AI. But how successful has its approach been, and what is it up against?

IBM outlines ‘hybrid’ AI approach as revenues rise

It’s been two years since IBM’s pivot to a hybrid cloud and AI strategy, and the tech giant saw strong earnings as it continues to invest in the watsonx platform.

BNY Mellon streamlines the hunt for liquidity with LiquidityDirect updates

The bank spent the last three years evolving and expanding LiquidityDirect to include additional asset classes, and will white label the platform to customers.

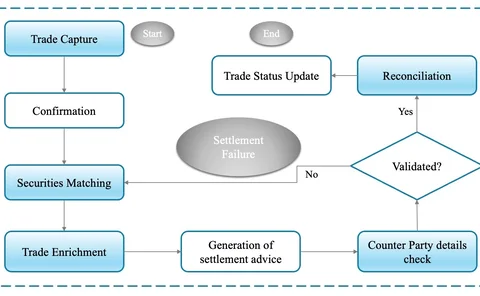

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.

Waters Wrap: Operational efficiency and managed services—a stronger connection

As cloud, AI, open-source, APIs and other technologies evolve, Anthony says the choice to buy or build is rapidly evolving for chief operating officers, too.