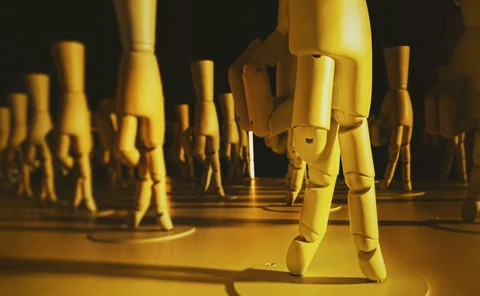

Automation

Traders: Consolidated tape could drive corporate bond market automation

The EC is pushing for a tape for fixed-income instruments, and market participants say it could speed up electronification, if implemented properly.

OTC FX options market gears up for faster electronification

The share of electronic trading in the market remains low, but a host of factors promise to change that for good.

Waters Wrap: A useful use-case for blockchain? (And Broadridge’s bond play)

While not a fan of blockchain, Anthony looks at some potential use-cases for the tool in the world of capital markets. He also gives his thoughts on Broadridge’s soon-to-launch LTX platform.)

Bloomberg AIMs enhancements on portfolio implementation, trade management

The tech giant has been updating the portfolio implementation and trade management workflows on its buy-side order management system as systematic and factor-based investing needs evolve.

Start-up VCs look ahead to post-pandemic world

Emerging venture capitalists saw reduced investor inflows during the pandemic. Will this dent B2B fintech investment?

Back-office automation key to breaking open private markets

Trading in large, privately-held stocks has hitherto been the domain of large private equity investors. A new technology platform aims to make these markets more accessible to broker-dealers by integrating with the back-office processes that firms…

Fed could require senior management to explain AI models

A new era of accountability might see the Federal Reserve demand model explainability to keep financial system safe.

GreenKey aims to productize new research chatbot after winning Symphony hackathon

The company is consulting with buy-side and sell-side clients on how its newly developed GK Research Bot can best solve their research and information overload woes.

OpenFin Builds Out Notification Center

The desktop interoperability provider will continue building other 'standard' desktop components.

Waters Wrap: App Interop in 2020 (And Tony’s Fave Stories From Last Year)

Anthony takes a look at some of the major projects that involved application interoperability from last year. The list includes feats by Goldman Sachs, BlackRock, Barclays, ICE, State Street, Refinitiv, and FactSet.

MarketAxess Eyes Predictive Capabilities for Fixed Income Liquidity

The trading platform is working to develop its pre-trade automation capabilities to predict a bond’s likelihood of execution, and helping buy-side clients navigate fixed income trading protocols.

ICE ‘Bonds’ Acquisitions into Fixed-Income Powerhouse

In this profile of the Intercontinental Exchange, Lynn Martin explains how the company’s ICE Data Services unit is creating a unified offering with fixed income data at its core, after a series of acquisitions that began with its purchase of IDC in 2015.

This Week: Janus/SS&C; Wolters Kluwer; Tora/Neptune; Standard Chartered/Northern Trust; SimCorp; & More

A summary of some of the past week's financial technology news.

Point Break: How Vendors Push Their Products to the Limit

Vendors don’t release new products or updates without putting their software through rigorous testing. What does that testing involve, and what different approaches do companies employ? Max Bowie finds out.

Fitch Solutions Revamps FitchConnect Using Micro-Frontend Technology

The use of agile development techniques and adoption of micro-frontend technology has yielded significant improvements in development productivity, officials say.

Waters Wrap: Blockchain is Still Overhyped (And Ion/Broadway Thoughts & the Consulting Boom)

In 2016, Anthony wrote that the blockchain revolution was overhyped—unsurprisingly, his opinions have not changed. He also delves into the Ion-Broadway deal, and looks at new consulting/advisory firms that have recently come to market.

Small Change, Big Challenge: Battling the Rising Tide of Data Notifications

With data notifications growing in volume and complexity, firms are finding it harder to keep track of these changes. Some vendors are looking to help.

Refinitiv’s API Rebrand Rankles Users

Because of its acquisition and subsequent rebrand, Refinitiv is being forced to change instances of its old branding that remain embedded in many of its APIs. This might sound like a simple change, but end-users are worried that it could be a costly fix.

Goldman Sachs Takes Aim at Interoperability, Analytics with Marquee Enhancements

The bank’s recent moves signal what could become a managed services offering, as Goldman further embraces cloud, open source, and APIs.

New Research Grapples with Corporate Actions

Veteran analyst Virginie O’Shea’s new business turns its attention to the ‘soul-destroying’ realm of corporate actions, which is weighed down by inefficiencies, manual processes, and lack of standards.

Covid-19 Disrupts Innovation in US Treasuries Market

The pandemic has caused setbacks in electronification and streaming in the US government bonds market.

Waters Wrap: The M&A Market Heats Up (And Some Quantum Computing News)

What do Liquidnet and Trading Technologies (and others) have in common? Anthony explains. He also discusses advancement—and disillusionment—in the quantum space.

RPA Provides ‘Quick Wins’, But at What Cost?

Banking experts urge firms to consider re-engineering a process before turning to robotic process automation.

Waters Wrap: Is Low-Code a Movement or a Mirage (Plus the ODRL Gambit & AI’s Afterthought Problem)

Anthony Malakian looks at the industry’s digital rights project and new tech platforms that aim to revolutionize the capital markets.