North America

Artificial intelligence, like a CDO, needs to learn from its mistakes

The IMD Wrap: The value of good data professionals isn’t how many things they’ve got right, says Max Bowie, but how many things they got wrong and then fixed.

Data costs rose in 2024, but so did mitigation tools and strategies

Under pressure to rein in data spend at a time when prices and data usage are increasing, data managers are using a combination of established tactics and new tools to battle rising costs.

In 2025, keep reference data weird

The SEC, ESMA, CFTC and other acronyms provided the drama in reference data this year, including in crypto.

Asset manager Saratoga uses AI to accelerate Ridgeline rollout

The tech provider’s AI assistant helps clients summarize research, client interactions, report generation, as well as interact with the Ridgeline platform.

CDOs evolve from traffic cops to purveyors of rocket fuel

As firms start to recognize the inherent value of data, will CDOs—those who safeguard and control access to data—finally get the recognition they deserve?

LSEG rolls out AI-driven collaboration tool, preps Excel tie-in

Nej D’Jelal tells WatersTechnology that the rollout took longer than expected, but more is to come in 2025.

Band-aids vs build-outs: Best practices for exchange software migrations

Heetesh Rawal writes that legacy exchange systems are under pressure to scale to support new asset classes and greater volumes, leaving exchange operators with a stark choice: patch up outdated systems and hope for the best or embark on risky but…

As vulnerability patching gets overwhelming, it’s no-code’s time to shine

Waters Wrap: A large US bank is going all in on a no-code provider in an effort to move away from its Java stack. The bank’s CIO tells Anthony they expect more CIOs to follow this dev movement.

People Moves: Wilshire, Big xyt, Liquidnet, Roko Labs, Tasksize, and more

A look at some of the past month’s people moves in the capital markets technology and data space, including Brian Rosenberg as president and CRO of Wilshire Indexes.

An AI-first approach to model risk management

Firms must define their AI risk appetite before trying to manage or model it, says Christophe Rougeaux

Tech VC funding: It’s not just about the money

The IMD Wrap: It’s been a busy year for tech and data companies seeking cash to kick-start new efforts. Max details how some are putting the fun into fundraising.

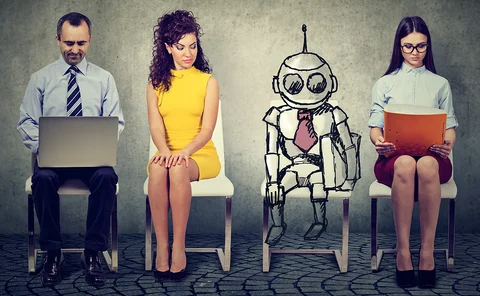

The AI boom proves a boon for chief data officers

Voice of the CDO: As trading firms incorporate AI and large language models into their investment workflows, there’s a growing realization among firms that their data governance structures are riddled with holes. Enter the chief data officer.

FactSet launches conversational AI for increased productivity

FactSet is set to release a generative AI search agent across its platform in early 2025.

MIAX taps DataBP for exchange data licensing, custom contracts

To support planned growth of its data business, the exchange group has implemented DataBP’s platform to strengthen its licensing process and scale up its distribution capabilities in anticipation of end-user demand.

Chief data officers must ‘get it done’—but differ on what that means

Voice of the CDO: After years of focus on data quality, governance, and compliance, CDOs are now tasked with supporting the business in generating alpha and driving value. How can firms put a value on the CDO role?

In a world of data-cost overruns, inventory systems are a rising necessity

The IMD Wrap: Max says that to avoid cost controls, demonstrate the value of market data spend.

After acquisitions, Exegy looks to consolidated offering for further gains

With Vela Trading Systems and Enyx now settled under one roof, the vendor’s strategy is to be a provider across the full trade lifecycle and flex its muscles in the world of FPGAs.

BofA deploys equities tech stack for e-FX

The bank is trying to get ahead of the pack with its new algo and e-FX offerings.

Banks seemingly build more than buy, but why?

Waters Wrap: A new report states that banks are increasingly enticed by the idea of building systems in-house, versus being locked into a long-term vendor contract. Anthony explores the reason for this shift.

The Waters Cooler: ‘Tis (almost) the season

Outer-space datacenters, a bumper week for data product announcements … and did I mention that I sing?

T+1 shift sees out-of-hours human resourcing costs spike by as much as 20%

New research finds that trading firms are experiencing increased labor costs—which could be a boon for outsourced trading.

The Waters Cooler: Drink wine and avoid talking to morons

UBS’ narrative alpha ML tool; SS&C fighting a ‘Frankenstein’ perception; why Citadel (and others) aren’t IPO’ing; and even more tape providers emerging. Lots to get to.

What hedge funds are missing about messaging

When a mere microsecond delay can impact the bottom line, hedge funds need high-performance technology stacks and infrastructure. Himanshu Gupta outlines four key considerations for a firm’s messaging architecture.

Moral models: The ethics of data management

The IMD Wrap: You may be managing data efficiently, but are you managing it ethically? And is that something you should be concerned about? Yes, says Max, you should.