James Rundle

Follow James

Articles by James Rundle

Target2-Securities: Give and Take

Work on the Target2-Securities project, the pan-European settlement platform developed by the European Central Bank, continues to gather pace ahead of its 2015 launch date. What will it mean for central securities depositories, which are outsourcing…

In Regulating HFT, Europe Misses the Target

When NYSE announced that it would merge with Chicago-based ECN Archipelago at the turn of the century, it handed out silver bells for the first day of trading.

Sense and Sensitivity

Although compliance spend is skyrocketing upwards in advance of new regulations, and there are technical revamps involved, a lot of the processes involved are described as common sense by many. Despite this, there's still an element of over-reach to some…

FOA Provides Risk Management Guidelines for ESMA Compliance

The Futures and Options Association (FOA), a pan-industry representative body for firms engaged in the trading of derivatives, has published a set of guidelines aimed at providing granular detail for recent European Securities and Markets Authority (ESMA…

Plus Markets Divests Derivatives Exchange

Plus Markets Group has announced the agreed sale of Plus Derivatives Exchange (Plus DX), the last remaining subsidiary in the company, to a former director.

MahiFX Enhances Trading Platform

Online foreign exchange (FX) platform MahiFX has updated its software with further analytics display functionality and user-customizable interfaces.

Monte Titoli Extends Collateral Management Offering with X-COM

The London Stock Exchange Group has announced that Monte Titoli, its Italian Central Securities Depository (CSD) is launching a new tri-party collateral management service.

SolidFX Partners TNS for Market Access

Dutch trading platform SolidFX has selected Transaction Network Services as its primary connectivity provider for foreign exchange (FX) markets in Europe and the US.

Goldman Sachs Takes IO Modular Datacenter Strategy

Goldman Sachs has entered a partnership with datacenter operator IO, utilizing its modular strategy to downsize investment in traditional warehouses.

FIX Protocol Offers Connectivity Solution for Some, But Not All SEFs

The open Financial Information Exchange Protocol (FIX) will allow a relatively painless connectivity method for order book Swap Execution Facilities (SEFs), but not those that operate on a request-for-quote (RFQ) basis, says the latest research from…

Caplin’s BladeRunner Solves HTML5 Issues, Encourages Collaboration

As HTML5 becomes adopted as the standard programming language for web-delivered software, the challenging environment of financial services has exposed some of its key development flaws. With BladeRunner, Caplin Systems believes it has solved the major…

Through the Looking Glass

Sometimes it can feel as if the era of in-house development is over. Outsourcing, software-as-a-service, cloud computing and incoming regulation over capital adequacy requirements and increasingly stringent best practice guidelines have certainly changed…

In China, Galaxy Futures Eyes Western Push

As the oldest and largest joint venture (JV) brokerage in the Chinese market, Galaxy Futures is a high-profile representation of outward-looking securities firms within the country. Originally partnered with ABN Amro before the Dutch bank's acquisition…

Quintillion Offers StatPro Revolution for Cloud Analytics

Hedge fund administrator Quintillion has announced that it will offer StatPro's Revolution package as a cloud-enabled analytics service to its clients.

State Street Extends OTC Clearing to CME

State Street Global Markets announced that it has joined the Chicago Mercantile Exchange (CME) as a clearer for over-the-counter (OTC) interest rate swaps.

BNY Mellon Upgrades AccessEdge for Collateral Monitoring

BNY Mellon has announced the addition of new functionality to its AccessEdge product, now allowing for real-time monitoring of transactions and collateral positions.

Moscow Exchange Launches Efficiency Program

The Moscow Exchange, formerly Micex-RTS, has rolled out its new program aimed at increasing the effectiveness of algorithmic trading in its securities and foreign exchange (FX) markets.

Tibra Selects Redkite for Compliance

Proprietary trading firm Tibra Capital has selected Redkite Surveillance to fulfill its compliance obligations under European Securities Markets Authority (ESMA) guidance.

The Quiet Side of Reform

While regulation grabs headlines, the work that goes on around accommodating new rules, just as important as the process of making laws, is often quietly discussed despite great efforts involved. Ongoing standardization aims to ease the birth of new…

Rapid Addition and Tauri Partner for Orb Launch

Rapid Addition and Tauri Software Systems have launched the Orb FIX Messaging Network in South Africa, following a reduction of trading fees by the Johannesburg Stock Exchange (JSE).

Belfius Bank Selects Numerix CrossAsset

Software vendor Numerix has announced that Belfius Bank has chosen its CrossAsset product for derivatives model valuations.

SEC Bumps Tech Roundtable Date

The Securities and Exchange Commission (SEC) has amended the date of its upcoming technology roundtable, initially scheduled for 14 September 2012.

MarketPrizm Extends DMA Service to TSE

Market data and connectivity provider MarketPrizm has announced its full co-location in the Tokyo Stock Exchange (TSE), further improving its regional direct market access (DMA) offering.

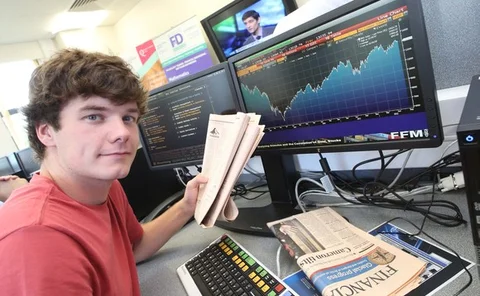

Queen's University and First Derivatives Build Trading Floor

Consultancy and software vendor First Derivatives has co-funded a mock trading floor at Queen's University Belfast, in order to provide students with a hands-on experience of a stock exchange environment.