Risk

Run the bank, change the bank: CTOs juggle needs and wants

Voice of the CTO: In part two of a five-part series, bank technologists explain where firms go wrong when trying to modernize their tech stacks and manage technical debt.

Investment management ‘one analytics view’ for credit bonds and ESG risk factors

A Chartis and MSCI research report that examines how firms must integrate ESG risk analytics with multiple other performance or risk analytics in credit bond portfolios to obtain a meaningful, quantitative and comprehensive investment view

Finding the investment management ‘one analytics view’

This paper outlines the benefits accruing to buy-side practitioners on the back of generating a single analytics view of their risk and performance metrics across funds, regions and asset classes

Finding the investment management ‘one analytics view’

This paper outlines the benefits accruing to buy-side practitioners on the back of generating a single analytics view of their risk and performance metrics across funds, regions and asset classes.

Quant shop preps NLP-powered index for physical climate risk

Sharp rise in extreme weather events prompts PGIM Quant to aim for better climate-risk pricing

Managing the FX challenge for T+1

As firms prepare for T+1 in May 2024, DTCC’s Val Wotton says they should also consider the complexities for cross-border trades.

Citi’s internal cloud project gets open-sourced

Through Finos, a project that started internally to help Citi get a better handle on its cloud controls now includes the likes of Goldman Sachs, Morgan Stanley, RBC, BMO and LSEG.

This Week: SimCorp/Deutsche Boerse, Moody's, SS&C, and more

A summary of the latest financial technology news.

Waters Wrap: As quantum’s skeptics grow in number, believers need better messaging

As you explore ways to use genAI, do you benefit from having ML and NLP experts on staff who have followed AI evolution for years? Anthony thinks that’s an important question when talking about quantum exploration.

Quantum computing: a problem for another generation?

Some banks have soured on quantum exploration. Others are playing a game of wait and see.

JP Morgan pulls plug on deep learning model for FX algos

The bank has turned to less complex models that are easier to explain to clients.

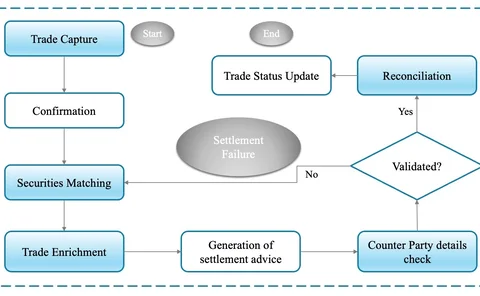

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.

Waters Wrap: Operational efficiency and managed services—a stronger connection

As cloud, AI, open-source, APIs and other technologies evolve, Anthony says the choice to buy or build is rapidly evolving for chief operating officers, too.

Europe’s AI Act is taking shape. How will the UK respond?

As the EU pushes through a historic AI Act, its neighbor is left wondering how to keep up.

Google bullish on AI benefits in the face of fears over unchecked growth

Tech giant quells fears over a Skynet-style reality, stressing a risk-based approach to AI usage during a panel in London on Thursday.

Industry divided on whether Europe should delay FRTB

Most bankers prefer to keep to earlier start date, even though it puts continent out of sync with US.

Third-party guidance spurs US bank rethink on fintech partners

For conventional vendors, banks say due diligence rules will be the toughest challenge

Crypto: Too important to ignore

This WatersTechnology rapid read survey report examines the crypto finance priorities of institutional investors, how far along they are on their crypto journeys, the challenges in entering and participating in this market, and what they value most when…

Gleif hopes to entice LEI laggards with new digital identifier

The vLEI has ambitions to become the backbone of digital trust.

Clients versus compliance: banks hung up over WhatsApp fines

Most opt for outright ban, but some seek technological solutions to monitor private messaging.

Waters Wavelength Podcast: Numerix’s new CEO

Emanuele Conti joins to discuss his new role as the head of Numerix, the company’s M&A strategy, and his vision for the future.

Banks, asset managers look to vendors for T+1 support

This whitepaper focuses on the upcoming move in the US to T+1 (next-day settlement) of broker-dealer-executed trades.

Optical computer beats quantum tech in tricky settlement task

Microsoft’s analog technology twice as accurate compared to IBM’s quantum kit in Barclays experiment

Integrating Pillars 1, 2 and 3: A better way to Basel IV

This Wolters Kluwer report provides actionable insights on how banks can navigate the challenges of Basel IV effectively