Risk

FRTB forces banks to rethink entire data management infrastructure

Data mapping and getting historical time series data are among the challenges banks face in conducting calculations necessary for FRTB. But they have help.

Google urges regulators, market participants to clarify risk guidance for AI models

A new whitepaper from Google finds that existing guidance on the use of AI and ML models for risk management is a start, but leaves room for improvement.

Dora ‘critical tech vendor’ designation could cast a wide net

Experts think cloud services, data providers and software firms are all in regulators’ sights.

What does it take to put a database in the cloud?

There are several ways to migrate an old legacy system to the cloud, but there's always a trade-off.

Tomorrow’s institution cares more about its risk than its performance

Execs from BlackRock, BMO, and Ness Digital Engineering discuss the balancing act of the wildly shifting priorities each of their organizations contend with every day.

Waters Wrap: Regtech hype evolves—for better and worse

As fines levied by the FCA and SEC rise, so too has spending on 'regtech.' But Anthony warns that for the regtech space to evolve further in the future, it must first initiate changes to its ecosystem.

Hacked off: banks demand answers after Ion cyber attack

Clients have been left in the dark about the ransomware attack that disrupted futures trading last month.

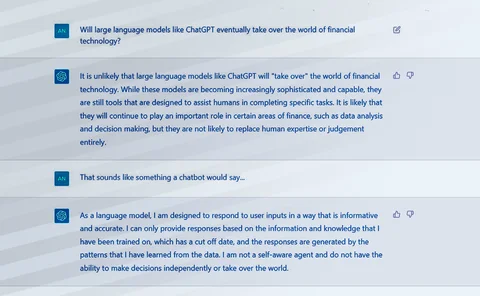

New chatbots reveal limitations of legacy API development

As large language models that underpin the likes of ChatGPT and Bard come to market, vendors and trading firms are starting to see the benefits—and challenges—that open APIs provide.

DTCC’s blockchain for CDS trades finds no takers

Sources say the industry is not yet ready to fully adopt wide-scale implementations of distributed-ledger technologies.

Spreadsheet interoperability: Or how companies learned to stop worrying and love Excel

While Microsoft engages in a tech arms race for chatbot and cloud supremacy, interop firms are attempting to remedy some of the idiosyncrasies of its monolithic spreadsheet software.

Ion in the fire: three banks call in lawyers after hack

Banks are examining service-level agreements for possible breaches

A rough race begins: Industry faces uphill transition to T+1 settlement

With T+1 compliance set to begin next May, firms will likely be burdened by reduced IT budgets, existing legacy systems and manual processes over the next 15 months. So, while faster settlement will help innovate the middle and back office, some argue…

Ion: after the hack, the clean-up

Some clients are now using Ion systems again, but synchronizing data with CCPs could take days.

Ion cyber outage continues as banks rely on workarounds

ABN Amro, Macquarie, RBC among firms hit; ransom deadline tomorrow, but service may be down for days

SEC’s $5M Bloomberg BVAL fine targets ‘dark magic’ in fixed income pricing

Recent actions against Bloomberg and Ice for violations relating to evaluated pricing services suggest the US regulator may be setting the stage for stricter regulations to govern the sector.

Large language models: Another AI wave has come—what could it bring?

Since the release of ChatGPT, excitement and hype have been abundant across industries for this form of generative AI. For capital markets, the wave of innovation that could result may be a few years away but it’s worth paying attention to—and being…

Treasury traders remain wary about adopting algos

Yet proponents insist US government bond market is ‘ready for disruption’

Waters Wrap: For data managers, the new problems are the same as the old

While much attention has been given to cloud, AI, blockchain and other buzzwords, without a proper data foundation, those tools will not deliver the results that have been promised.

Financial firms rethink after cyber insurance premium spike

Brokers say there are signs pressure is easing, but quantum hacking threat could transform market

In 2022, cloud shows true potential to displace legacy data platforms

Once wary of the cloud, financial firms, their suppliers and the marketplaces where they trade are openly embracing it. And there are more signs of big tech firms accelerating buy-in by literally buying in to clients’ migration projects.

Blockchain startup Symbiont files for bankruptcy

Clients included American Century, Citi, State Street and Vanguard

Where does Pyth fit in?

A small number of exchanges have joined the Pyth Network. Nyela wonders whether the on-chain data distribution model fits in with the swift rise of data marketplaces.

Bot’s job? Quants question AI’s model validation powers

But supervisors cautiously welcome next-gen model risk management

The quant investor harnessing the power of ants

Swarm Technology has designed a network of trading algorithms that mimics the hive mind of insects.