Futures

Interactive Data Puts Nasdaq Futures Prices on Feed, FutureSource

The data will support risk management for futures traders on the new NFX market.

Redi Adds Access for Options on Futures

Redi users can now access contracts from BNP Paribas, Credit Suisse, JPMorgan and Morgan Stanley.

Traquair Discusses SunGard's Utility Play to help FCMs Cut Costs

SunGard's new utility service is designed to help firms achieve cost cuts of up to 20 %.

Beast Apps, Icap, CME Ally on OTC vs. Exchange-Traded Analysis Tool

The application displays and analyzes trading opportunities between Icap's OTC brokered derivatives and CME's listed futures markets.

Barclays First to Tap SunGard's OTC Post-Trade Utility

New service to be aimed at FCMs.

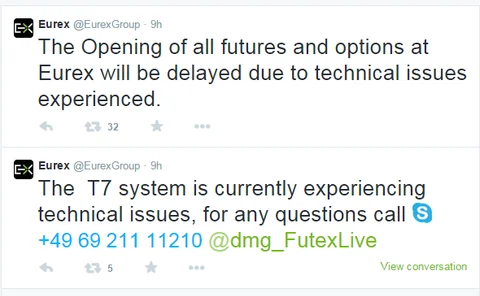

Data Glitch Delays Eurex Open

Officials say the issue, which caused a 75-minute delay to market open, is now fully resolved.

Cleartrade to Retain Data Feed Format Amid Deutsche Börse Platform Migration

The exchange has elected to keep its data feeds despite switching trading platforms

RiskVal, Quantitative Brokers Partner on Fixed Income Trading Platform

RVQB will use QB's algorithm Legger in an end-to-end platform

Barchart Adds Eris Data

Chicago-based data vendor Barchart has begun providing market data from swap futures marketplace Eris Exchange via its Barchart Trader datafeed and trading platform, in response to client demand for access to the exchange's data, officials say.

ICE Licenses Eris Methodology for 2015 Product Development

Pair target margin benefits with multi-year deal

OptionsCity's CEO Discusses Optionshop Acquisition

Clients will see new products/functionality over next 6-12 months

OneChicago Introduces Weekly Futures

The equity finance exchange today announced it will offer a new suite of products called OCX.Weekly beginning on Friday, June 20. The exchange will continue to list weekly futures each subsequent Friday.

Quincy Extends Microwave Data Service to Europe

Oakland, Calif.-based low-latency microwave connectivity and market data provider Quincy Data has expanded its Quincy Extreme Data service into Europe, to provide automated trading firms in London and Frankfurt with low-latency futures market data from…

Simulation Tools Key as Managed Futures Funds, CTAs Optimize Execution

A potent mixture of in-house, futures commission merchant, and boutique brokerage-provided algorithms now play a part in commodity trading advisors’ and managed futures funds’ trading activities. Tim Bourgaize Murray examines why a new cadre of…

Eris Exchange Achieves Open Interest Milestone: What's Next?

The venue's chief operating officer, Michael Riddle, discusses why more of the same is in store. After all, why fix what isn't broken?

Saxo Bank Adds Futures Spread Trading for Mobile

The e-trading specialist says clients can now trade futures spreads across its platforms, including SaxoTrader smartphone and tablet apps, covering intra-market spreads as well as named calendar spreads on a range of gold, oil and commodities, rates,…

Bohemian Rhapsody: CIO Michal Sanak Leads Prague's RSJ with Smart Speed

RSJ, tucked on the left bank of the Vltava River in the Czech capital of Prague, has quietly become one of the world’s most active proprietary trading firms, despite its boutique size. As CIO and shareholder Michal Sanak tells Tim Bourgaize Murray, the…

Bloomberg Supplies Fixings Valuation for Tradition's Volatis

Volatis, the interdealer broker's newly-launched hybrid platform for negotiation and trading of realized volatility futures, will use daily fixing observations from Bloomberg.

New FIA Study Suggests Futures Volatility Not Influenced by HFT

Research conducted for the Futures Industry Association by Nicholas Bollen and Robert Whaley at Vanderbilt University's Owen School of Management suggests that recent trading in 15 futures contracts has not become more volatile, despite increased…

Quantifi Tapped for ICE Futures Price-Spread Calculator

The analytics provider has released a new tool for pricing credit index futures listed by IntercontinentalExchange (ICE) Futures U.S., backing increased demand for exchange-traded futures, which trade more cheaply than OTC derivatives under new global…

GFI Builds Out SEF, DCM Capacity with Violin Memory

Wholesale brokerage and electronic execution provider GFI will deploy Violin's solid-state Flash Memory Arrays for increased speed and capacity across all its trading platforms.

Trading Technologies, MexDer Link Via CME's Globex

Trading Technologies' X-Trader has linked with MexDer, a leading venue for Mexican benchmark derivatives, as activity in the Central American market steadily ramps up.