Futures

Slow Road to Consensus: CFTC's Behnam Talks Climate Risk

As CFTC commissioner Rostin Behnam’s report on climate risk to the financial system is published, WatersTechnology speaks to Behnam about data, greenwashing, and gaining support in Washington.

AxeTrading To Roll Out More Automation for Fixed Income Platform

Vendor integrates open source stream processing software Apache Kafka for real-time event data.

Eventus Systems to Add ML-Driven Trader Profile Feature to Validus

The new functionality will help to give context to market manipulation alerts.

OneMarketData Advances on Cloud Migration and Extends Asset Class Coverage

The vendor will roll out new coverage across OTC derivatives, fixed income, and FX in the third and fourth quarters.

SteelEye to Hire CME Reg Reporting Talent

While many firms have enforced hiring freezes during the pandemic, the regulatory reporting vendor has plans to aggressively grow its staff count.

Stevens Institute, Capco Lay Out Commercialization Efforts for New Artificial Exchange

The platform will initially target the HFT crowd, as well those looking to better understand market microstructure in equities.

Eventus Systems Uses $10.5m Funding to Advance AI, Double Workforce

The trade surveillance technology provider plans to expand over the next 12 months.

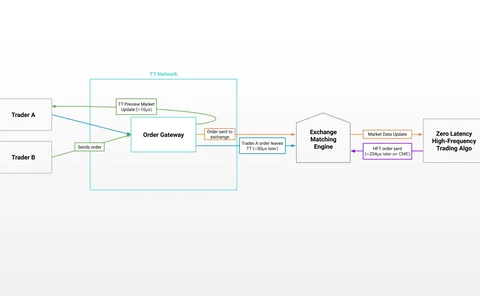

Trading Technologies Unveils New Futures Market Data Feed

As the fight over market data fees in the futures market heats up, the Chicago-based trading platform provider is rolling out a new platform that provides a free view of market order flow for TT platform users.

TMX Forges Ahead to Offer Round-the-Clock Derivatives Trading

Despite the coronavirus, the exchange is on track with plans to offer near 24-hour derivatives trading, new interest rate contracts, and increased transparency into ESG risks.

People Moves: Euronext, RJO, CloudMargin, And More

A look at some of the key people moves from this week, including Georges Lauchard, new chief operating officer at Euronext (pictured).

This Week: Nasdaq, Trading Technologies/Nodal, Finantix, GLMX/UnaVista

A summary of some of the past week’s financial technology news.

Swap Data Proposals Raise Existential Questions

Regulators around the world collect massive amounts of data, but Jo wonders if there’s any point to these efforts if they can’t use it?

Cboe Plans Comeback in Crypto Markets

The US exchange is again planning to offer crypto derivatives, while after previous attempts to gain regulatory approval to list crypto ETFs were thwarted.

Support Swells for Developer in Spoofing Software Case

Petition for Chicago programmer Jitesh Thakkar nears its goal as industry worries about precedent CFTC enforcement case could set.

After Fidessa Exodus, Some Users Brace For Trouble

WatersTechnology spent three months examining Fidessa to see what has transpired inside the vendor since the Ion acquisition. During a period of great change, a lot of questions—and worry—remain.

DTCC Explores Gatekeeper Role for DLT Networks

Post-trade company looks to stay ahead of DLT curve with plans to act as CCP for firms trading on permission-based blockchains.

People Moves: Finra CAT Fills CTO and CISO Positions

Also, a look at new hires for IHS Markit, UBS, TickSmith, BitGo and Amber Group.

The KYC Headache Worsens: An Examination of the Onboarding Process

Despite technological advancements, the onboarding process is still a slog. Banks and vendors are trying to change that.

Could CFTC Bring Back Reg AT?

The CFTC's new chair could reopen the controversial algo-trading rules—if he gets time.

NYSE President Sees Tech as Key to Big Board's Next Evolution

A look at the massive tech projects (and legal battles) underway at the NYSE, which are being led by Stacey Cunningham.

Safe as Houses

If you want the definition of a circular argument, talk to anyone involved with clearing about resilience and recovery. But more pernicious risks remain unaddressed.

Crypto at the Crossroads as Exchanges Weigh Traditional Market Structures

Questions of price discovery and centralized infrastructure point to an asset class that may have to lose its rebellious luster to become more widely accepted.

Trading Technologies Debuts Infrastructure-as-a-Service Offering

Vendor embarks on new strategy with Graystone Asset Management as its first client on the platform.

SGX Marches On

The SGX is focusing on "smaller" projects, rather than big-bang investments as it seeks to renovate and integrate its technology.