Feature

Shedding Light: Blackstone CISO Jay Leek Flips the Security Script

The April Waters Profile.

On Everyone’s Radar: The Short History of Cyber Crime

Cyber crime is not a new trend and as the volume of attacks increase lessons can be learned from historic cases.

Patch and a Prayer: An Inside Look at the Art of Patching

Patching is a thankless job. But when it comes to securing capital markets firms' operating environments, it is absolutely necessary. Anthony Malakian examines the challenges involved with updating systems and looks at how best practices have changed.

Finding the Right Allies to Fight the Cyber War

Marina Daras talks to cyber security experts and technology vendors to establish what the vendor landscape looks like, who the potential allies are in the ongoing cyber war.

Rise of the CISO

CISOs from across the industry talk about how their role has grown in prominence in the capital markets industry.

Shared Understanding

BCBS 239 risk data aggregation principles drive broader view of available data

Controlling the Flows

Enhanced Liquidity Ratios for Europe Bring Extra Burden to Firms

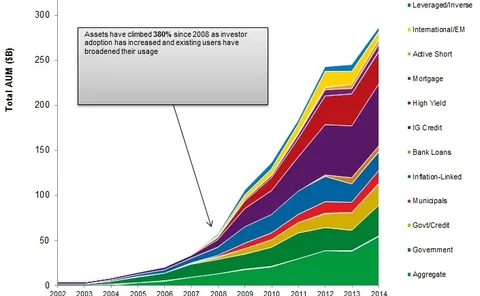

Fixed-Income ETFs: Pricing, Tech Evolve in This Rapidly Growing Space

The fixed-income ETF market is not yet 15 years old, but since 2007 the space has grown exponentially as institutional investors have taken notice of these increasingly liquid products. Anthony Malakian explores the reasons behind the interest in fixed…

Mifid II : The Quest for Clarity

Marina Daras speaks to market participants about their thoughts and concerns on Mifid II ITS.

Vanguard CIO John Marcante: The Big Leap

The March 2015 Waters Profile

Transaction-Cost Analysis' Fixed-Income Evolution

TCA is moving from equities into fixed-income towards becoming a real-time analysis tool.

2015: Year of the LEI Break-Out?

MiFID II, CSDR and Other Regulations Make LEI Harder to Ignore

What to Factor in for Fatca

Three Key Dates Coming Up for Firms Trying to Comply with Fatca

Striving To Streamline

Total automation of corporate actions processing may be impossible, but digitization could go a long way

Shedding Light on Dark Data

Making connections among sources yields predictive information

The #CIO: UBS Group CIO Oliver Bussmann

How the Swiss giant's information chief derives value in 140 characters or less

Lean on Them: Funds Increasingly Turn to Administrators

As a result of 2008, fund admins are having to build out their data mgmt capabilities.

Communication Surveillance: A Daunting Challenge

Marina Daras talks to banks and vendors to see how they approach communication surveillance, and what kind of technology can be deployed to help them with this challenge.

The Big Deal with BYOD

The journey of BYOD policies in financial services

Pawar to the People: AQR CTO Neal Pawar

AQR CTO Neal Pawar’s background in theater has given him the benefit of being able to relate to different people while managing projects. Dan DeFrancesco sits down with Pawar to talk about his path to AQR and what lies ahead.

Gliding Down: Pensions Seek to Match Tech to LDI Strategies

After fits and starts, defined-benefit corporate pension plans on both sides of the Atlantic are now in steady pursuit of liability-driven investment strategies that more closely align future responsibilities and current assets. This has had a meaningful…

Fintech Takes the UK by Storm

A quiet current of growth in financial technology has built into a storm over the past few years, driven in large part by a start-up culture that seeks to both disrupt and complement the efforts of traditional vendors and investment banks. London has…

FIX-ing Liquidity in Fixed Income

Project Neptune aims to help firms access liquidity in fixed income.

Evaluated, Scrutinized

Risk and Regulation Put Pressure on Pricing Services