Fixed-Income ETFs: Pricing, Tech Evolve in This Rapidly Growing Space

The fixed-income ETF market is not yet 15 years old, but since 2007 the space has grown exponentially as institutional investors have taken notice of these increasingly liquid products. Anthony Malakian explores the reasons behind the interest in fixed-income ETFs, and the technologies underpinning this rapid growth.

To understand the incredible growth of the fixed-income exchange-traded fund (ETF) market, one must first understand the product's origins, and for that you really only need one source: BlackRock and its iShares division.

In 1988, BlackRock was founded as a fixed-income manager. Though it has grown into a multi-asset class, global behemoth, the firm's fixed-income unit had always been a source of pride. In 2001, it had the idea to take the fixed-income market—which was (and still is) largely traded over-the-counter (OTC)—and deliver exposure to the sector through an ETF that trades on-exchange.

By July 2002, iShares—BlackRock's ETF unit—launched its first fixed-income ETFs in the US: a corporate bond fund (LQD) and three treasury funds (SHY, IEF and TLT). In 2003, those four pioneering funds were followed by a TIPS bond fund (TIP) and an aggregate index fund (AGG).

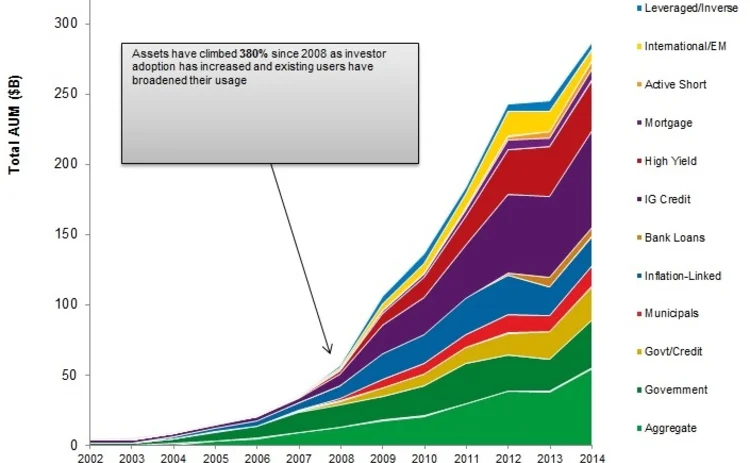

These products would prove the forefathers to today's market, but by the end of 2006, in the US those six iShares offerings were still the only fixed-income ETFs available and they held a relatively paltry $20.5 billion in assets, according to Bloomberg data. [See chart in Photo Gallery above.]

Eight years later—thanks to new regulation in 2007 and, ironically, the global financial crisis in 2008 [See 'All In' section, below]—there are more than 260 fixed-income ETFs available in the US, comprising a market that this year eclipsed the $300 billion milestone.

It's like saying, ‘You're a nice guy because your sister was a really great gal and your father was standup, too.' Nobody in the world would price stocks like that, but they all seem to price bonds like that. -- Bob Smith

According to etfgi.com, which conducts research on the ETF industry, fixed-income products saw inflows of $13.3 billion in January 2015, the third-largest month of inflows on record. The market has grown globally, as well, with Asia seeing a strong desire for these products. According to BlackRock, $455 billion is held globally in fixed-income ETFs, with iShares alone accounting for $235 billion of that.

"The OTC market is traditionally difficult to access for individuals and institutions to buy and sell bonds—there isn't an exchange; you're dependent upon broker-dealers supplying inventory when inventory is available; it's hard to know what liquidity there is; and it's hard to measure bid-offer spreads. It's just a very difficult market to transact in," says Matthew Tucker, head of fixed income iShares strategy at BlackRock. "ETFs allowed people to take that opaque OTC market, wrap it into an ETF and put it on the equity exchange. Suddenly you have real-time pricing, visibility of bid-offer spreads and holdings, depth of liquidity, and, most importantly, access for everybody."

Yes, new regulations and the financial crisis were the sparks that helped to ignite interest in this sector, but it is technology that has spurred its growth and moved the market from one that was dominated by retail investors and wealth managers to one that is increasingly attracting institutional investors on the buy side. It is through pricing matrixes and platforms, new forms of risk modeling, and inventive ways of creating and redeeming fixed-income ETFs that the market could exceed $2 trillion over the next decade.

The Matrix

Because of their very nature, pricing fixed-income ETFs is more difficult than equity ETFs and other products that have readily available information. A high-yield bond ETF could comprise hundreds of underlying cusips and most of those stocks—upward of 85 percent—do not trade on a daily basis, Tucker says. Some stocks might only trade a couple of times a year.

So firms have to create a pricing matrix where 10-20 percent of the cusips in the ETF are priced by hand, while the other 80-90 percent is value judged based on a matrix, notes Robert Smith, president and chief investment officer at Sage Advisory Services. These algorithmic-driven platforms need to make valuations that attempt to mathematically place a value on a bond in relationship to another bond of a similar nature and construct.

"When I tell people how you find value in fixed income, you're now living in the world of the matrix, and everything is relational," Smith says. "It's like saying, ‘You're a nice guy because your sister was a really great gal and your father was standup, too.' Nobody in the world would price stocks like that, but they all seem to price bonds like that. But it's also natural to us; we don't see that as a flaw. It's just the inherent nature to the market—it's always been that way."

While there's much tradition at play, John Keller, global head of fixed-income ETF portfolio management for State Street Global Advisors (SSGA), explains that the broker-dealer community has had to invest in these matrix-driven platforms and capabilities as the market has expanded.

"Over the years, broker-dealers have built systems that let them create intra-day estimates of the value of the securities inside the ETF," he says. "So if you're looking at a corporate bond fund that could contain hundreds of corporate bonds, broker-dealers have a way of estimating the value on that basket of bonds and then comparing that to the value of where the ETF is trading to help them create markets, and help them create liquidity when needed."

[For more on the challenges of making a market in fixed income ETFs, click here.]

Vendor Community

The vendor community has increasingly entered the space to fill some voids or improve functionalities. MarketAxess, Tradeweb, and Interactive Data Corporation (IDC) have proven effective pricing sources for the fixed-income market. During the past year, IDC has built out its indicative net-asset value (iNAV) calculations for ETFs.

In 2013, IDC teamed up with Vanguard Asset Management to provide a real-time engine to back its iNAV calculations, taking in continuous data and building relationships between assets, rather than using closing prices of constituent assets to build an iNAV. IDC is now testing this functionality with other market participants, according to SSGA's Keller, who adds that the industry, when it comes to fixed income, is still not up to par with equities on the pricing front, but improvements have come forth relatively rapid.

"Trying to calculate that intra-day NAV is in some ways more art than science," Keller says. "Being able to price each one of those on a timely basis throughout the day is almost impossible. Now, IDC is a pricing source for a lot of the fixed-income market and they are coming out with continuous pricing. That will be a solid advancement for the industry because a lot of the ETFs do use IDC to price at the end of the day, where NAVs are struck. So I think we're moving in the right direction, but in terms of getting to the point where we have that iNAV that's synonymous with equities, we're still quite a way from that."

SSGA has also teamed up with Bloomberg on an automated fixed-income ETF creation and redemption platform. Keller adds that Bloomberg has been active in developing tools for real-time, front-office-quality pricing solutions.

"The issue here is that a lot of fixed-income institutional investors aren't that familiar with sampling," he says. "So SSGA and Bloomberg decided that the best way to go about expanding the fixed-income ETF market for institutional investors was to build a tool whereby investors can see what comprises a basket on a day-to-day basis."

Unification

If anyone understands the pricing challenges facing the fixed-income ETF market, it's Reggie Browne, global head of the ETF group at Cantor Fitzgerald. Over the years, Browne has built ETF trading desks at Newedge, Knight Capital and now with Cantor Fitzgerald. He's been called the "Godfather" of ETFs.

After Knight's Knightmare software glitch in 2012, which nearly proved terminal for the company, Browne took his ETF team to Cantor after the firm's CEO, Howard Lutnick, wooed him. In an interview with Bloomberg Markets, Browne said he finally agreed to join Cantor when Lutnick guaranteed the group's independence, but also promised to provide the resources needed for the underlying technology.

Browne tells Waters that since joining Cantor to build its ETF desk, he has been given the autonomy to create trading tools for the group with nothing coming off the shelf. He's a big advocate—both in sermon and physicality (he is six foot, five inches tall)—of firms dedicating resources and teams to ETFs, rather than rolling them into siloed products where equities desks have their own ETF operations and fixed income has its own strategy.

Essentially, in addition to the team knowledge that is built around focusing on ETFs exclusively, risk models, pricing platforms and the ability to build and redeem products should be specific to the ETF space. And since you need to pull in data from several pricing sources—because you have to guard against accidently moving the market against yourself—the data load for pricing can become complex and even overbearing.

"In thinking about investment banks and how they're organized, most of our competitors have a structure where their fixed-income businesses aren't together, they're siloed," Browne says. "So they need partnerships across the organization in order to price ETFs. Because you have different groups inside of the organization pricing, the reliance on another group is a weakness and it's difficult to be competitive."

The data component of this undertaking can't be overstated. When it comes to pricing or simply providing research and decision-making tools to clients, data costs can balloon. And even more dangerous, says Lisa McCann, a principal IT leader at Vanguard, is if the data systems become disjointed and scattered across the organization. To address this issue, McCann says Vanguard has built a unified data warehouse. This extends beyond fixed-income ETFs to all ETFs, mutual funds and brokerage accounts, because in many cases, these investors are not just investing in one-or-the-other product.

"Building a platform for our clients to hold brokerage, ETFs and mutual funds together is something that we had to think about from a technology standpoint," she says. "Investors' accounts for mutual funds and ETFs were separate. Developing one streamlined account structure was a big technology undertaking, but it was the right thing to do for our clients to provide investment flexibility and a better client experience."

‘All In'

To understand the incredible estimates in terms of where the fixed-income ETF market is heading, one must first understand where it is and how it got there. In 2007, the US Securities and Exchange Commission (SEC) created certain guidelines to allow fund providers the ability to offer fixed-income ETFs with generic rules for listing and gaining approval of new funds. So rather than having to go to the SEC to give a prospectus and gain approval for every fixed-income ETF product without much guidance, once these rules were released, the market better understood the rules of the game.

At the end of 2007 the fixed-income ETF market stood at $35 billion. Just a year later it was up to $57 billion. The global financial crisis then hit at the end of 2008, and, as liquidity in the fixed-income market seized in the OTC-driven asset class, ETFs became more appealing because they are, obviously, traded on-exchange, BlackRock's Tucker notes.

"What happened after the financial crisis is a lot of institutions looked at the market and said that they were having trouble trading their bond risk like they normally would through individual securities, so they started looking at ETFs. As a result, a lot of institutions flocked to the ETF market because it gave them an alternate source of fixed-income liquidity," he says.

By the end of 2009, the fixed-income ETF market had spiked to $106 billion. Yes, the Flash Crash on May 6, 2010—which has been attributed, in part, to some 14,000 ETF trades being canceled in a span of a few minutes—and the US government bond-driven mini-Flash Crash last year, have raised market structure and infrastructure concerns. But the enthusiasm around the fixed-income ETF space hasn't dissipated.

Joseph Cavatoni, head of iShares Americas capital markets at BlackRock, says the broker-dealer community is focusing more on the space as endowments, pension plans and other large and mid-sized asset managers are increasingly asking about these products.

"We have a team that focuses on the dealer community, and they're realizing that if they do not get into the space of offering a wrapper in the form of an ETF to give people access to the liquidity that is there, they're missing a huge opportunity," he says. "Dealers keep telling us that they're all in, that they're going to better connect fixed income and equities to make these ETFs part of a more cohesive Delta One market for their clients, because those clients are asking a lot more about it. They don't see any reason not to be all in."

Andrew McCollum, managing director of investment management at Greenwich Associates, has been covering the fixed-income ETF space for the consultancy over the past few years and while he isn't willing to give an exact estimate, he believes the impressive growth in the space will only continue.

"It would seem to us that the fixed-income ETF space seems to be evolving much more quickly than what we saw with equity ETFs and the time it took for those markets to evolve," he says. "It took 20 years for this to happen in equities; in fixed income it's happening much more quickly than that."

Salient Points

- Thanks to guidelines provided by the SEC in 2007 and the need to find liquidity in the fixed-income market after the global financial crisis of 2008, the fixed-income ETF market has exploded from $20.5 billion in 2006 to over $300 billion today.

- The fixed-income ETF market was originally dominated by retail investors and wealth managers, although institutional investors on the buy side are now flooding into the space to find liquidity.

- Because it is challenging to price fixed-income baskets as most of the underlying stocks aren't traded daily-and some are only traded a couple of times a year-firms have to create a pricing matrix to value the ETF on an intra-day basis.

- Some estimates see this market surpassing $2 trillion during the next decade, as brokers develop new tools and products to entice institutional investors.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

Stocks are sinking again. Are traders better prepared this time?

The IMD Wrap: The economic indicators aren’t good. But almost two decades after the credit crunch and financial crisis, the data and tools that will allow us to spot potential catastrophes are more accurate and widely available.

In data expansion plans, TMX Datalinx eyes AI for private data

After buying Wall Street Horizon in 2022, the Canadian exchange group’s data arm is looking to apply a similar playbook to other niche data areas, starting with private assets.

Saugata Saha pilots S&P’s way through data interoperability, AI

Saha, who was named president of S&P Global Market Intelligence last year, details how the company is looking at enterprise data and the success of its early investments in AI.

Data partnerships, outsourced trading, developer wins, Studio Ghibli, and more

The Waters Cooler: CME and Google Cloud reach second base, Visible Alpha settles in at S&P, and another overnight trading venue is approved in this week’s news round-up.

A new data analytics studio born from a large asset manager hits the market

Amundi Asset Management’s tech arm is commercializing a tool that has 500 users at the buy-side firm.

One year on, S&P makes Visible Alpha more visible

The data giant says its acquisition of Visible Alpha last May is enabling it to bring the smaller vendor’s data to a range of new audiences.

Accelerated clearing and settlement, private markets, the future of LSEG’s AIM market, and more

The Waters Cooler: Fitch touts AWS AI for developer productivity, Nasdaq expands tech deal with South American exchanges, National Australia Bank enlists TransFicc, and more in this week’s news roundup.

‘Barcodes’ for market data and how they’ll revolutionize contract compliance

The IMD Wrap: Several recent initiatives could ease arduous data audit and reporting processes. But they need buy-in from all parties if all parties are to benefit.