Feature

Light at the End of the Tunnel, But Will Mifid Dark Pool Rules Add Up?

Esma has released the first figures to support Mifid II’s caps on the percentage of equities trading that can be transacted on dark pools. However, critics warn that although the delay has given Esma more time to validate data and clean up queries, the…

Asia’s New Tigers: Exchanges Overhaul Aging Systems

Waters looks at major projects being rolled out in 2018 at exchanges in Japan, Australia, Hong Kong and Singapore.

The Big Crunch: Traditional Tech’s Great Contraction

Waters examines how this recent wave of consolidation is different than previous periods of contraction.

Hurricane Mike: Urciuoli Storms JPMorgan Asset & Wealth Management

JPMorgan Asset and Wealth Management's CIO brings the pace of the trading floor to asset management.

The Curious Case of the Trader–Vendor

Tradeworx, now Thesys Group, is the latest in a series of firms that has decided to pull back from trading activities and focus on fintech. And it’s unlikely to be the last.

Bitcoin Futures Face Turbulent Times in the Windy City

Bitcoin conquered the world in 2017, but the performance of the futures looks like it will have to wait longer for take-off.

Hard Labor: Dealing With Alternative Data

Everyone’s excited about the potential untapped alpha promised by “alternative data,” yet those who work with it are far from excited about the prospect of evaluating unwieldy and unstructured datasets. Max Bowie looks at the practical challenges of…

Lock, Stock & Barrel: Securities Lending Under the Gun

Securities finance has a new battlefront: two lawsuits alleging anticompetitive behavior in stock lending. At the center of the allegations lies the difficulty of finding actionable price and inventory data for borrowers and lenders alike. Will this…

London Calling: TP Icap’s Sinclair Eyes Client-Driven Data

Six years after the collapsed merger between TMX and LSE thwarted his plans to relocate from Canada to London, Eric Sinclair is bringing his start-up spirit and focus on client experience to TP Icap, where he told Jamie Hyman and Joanne Faulkner about…

Fee Fight: Ye Olde Market Data Battleground

Market data fees charged by exchanges continue to be a bone of contention for banks, electronic trading firms and asset managers. And although recent events playing out in the US are adding fuel to the fee fire, frustration levels are rising in Europe…

An Officer and a Regulation: Finding A GDPR Superstar

When the General Data Protection Regulation comes into force on May 25, most financial companies will require a data protection officer. With an entire industry racing to meet GDPR’s compliance deadline, will there be enough candidates to go around?…

Europe’s Mifid Monster Lurches to Life

January 3 went smoothly for many, but the launch of Europe's far-reaching reform package wasn't without problems.

CAT Got Your Tongue?: An Inside Look at the Consolidated Audit Trail's Sluggish Rollout

When the Consolidated Audit Trail failed to go live in November last year, questions came as to why—but answers were not easy to come by.

Scott Blandford's Random Collisions

TIAA's chief digital officer sits down with Waters to discuss how the retirement giant is using big data to improve the customer experience and what the institutional side of finance can learn from retail.

Putting the Fintech House in Order

Without adequate standards in place that are globally coordinated, the rampant growth of fintech may introduce more problems than it solves.

Cryptocurrencies Come of Age, But Is Crypto Data Ready?

Once used as payment for shady deals, digital currencies have long been the domain of speculators and retail investors. But the wild price increases of the past year have led institutional investors to sniff excitedly at the loins of the cryptocurrency…

Industry Fears Neutered CAT in 2018

The SEC’s Consolidated Audit Trail (CAT) of US equities trade data hit a fresh snag in late 2017, missing a major deadline for reporting, blaming insufficient cyber defenses. As it marches into another crucial year, Tim Bourgaize Murray reports on the…

Getting ‘Carded’: Current and Future Uses for FPGAs in Finance

With their origins in industries such as defense, aerospace, and medicine, FPGAs have been used by certain aspects of financial markets for about a decade to gain speed. Wei-Shen Wong examines the current uses for this specialized hardware in finance,…

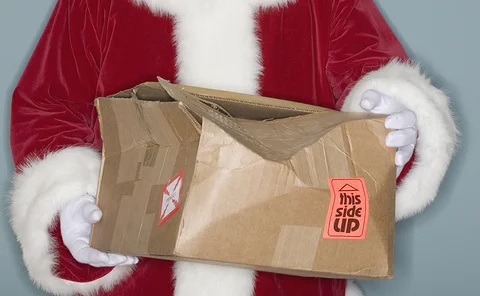

Esma’s LEI Xmas Extension: Last-Minute Gift or Lump of Coal?

Jamie Hyman talks with an LEI issuer, advocate and end-user about how Esma’s LEI grace period will impact operations during the first half of 2018.

Derivatives Market Prepares for Emerging Tech Implementation

2018 is the year when large numbers of participants in the derivatives market expect to see emerging technologies being integrated into their existing technology ecosystems

Breaker of Chains: The Appeals and Perils of Quantum Computing

“We need to seriously rethink encryption and seriously rethink things that rely on encryption, like blockchain. Anything that is heavily dependent on complexity needs to be reconsidered in a quantum world.”

Chicago Code: A Profile of DRW's Seth Thomson

Seth Thomson, CIO of DRW, talks to Waters about his career, innovation and how the firm has expanded into new asset classes, including cryptocurrencies.

The Kids Aren’t Alright: A Look at How K-12 Schools Are Failing to Teach Programming

The jobs of tomorrow will require computer skills and, to a growing extent, the ability to code. What happens if a generation of kids is left behind?

Artificial Intelligence: From Winter to Spring

AI is experiencing a renaissance, but some are concerned that it could carry hidden risks.