Feature

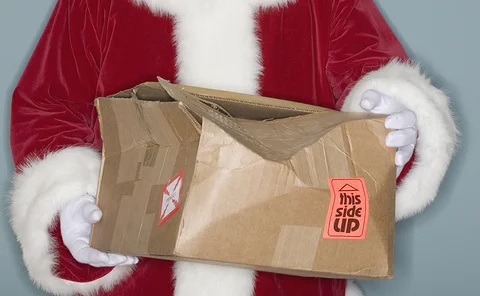

Esma’s LEI Xmas Extension: Last-Minute Gift or Lump of Coal?

Jamie Hyman talks with an LEI issuer, advocate and end-user about how Esma’s LEI grace period will impact operations during the first half of 2018.

Derivatives Market Prepares for Emerging Tech Implementation

2018 is the year when large numbers of participants in the derivatives market expect to see emerging technologies being integrated into their existing technology ecosystems

Breaker of Chains: The Appeals and Perils of Quantum Computing

“We need to seriously rethink encryption and seriously rethink things that rely on encryption, like blockchain. Anything that is heavily dependent on complexity needs to be reconsidered in a quantum world.”

Chicago Code: A Profile of DRW's Seth Thomson

Seth Thomson, CIO of DRW, talks to Waters about his career, innovation and how the firm has expanded into new asset classes, including cryptocurrencies.

The Kids Aren’t Alright: A Look at How K-12 Schools Are Failing to Teach Programming

The jobs of tomorrow will require computer skills and, to a growing extent, the ability to code. What happens if a generation of kids is left behind?

Artificial Intelligence: From Winter to Spring

AI is experiencing a renaissance, but some are concerned that it could carry hidden risks.

UPDATE: Markets, Regulators Not Yet United on Mifid II

Just over a week into Europe’s new financial regulatory regime, Joanne Faulkner assess the key challenges that still lie ahead as market participants and regulators alike grapple with the data and reporting requirements of Mifid II.

Law & Disorder: US Preps Defense Against Mifid II

As Mifid II's deadline approaches, US firms affected by the rules are still waiting for regulators to resolve crucial conflicts between European and American laws, and are likely to be making adjustments well after the deadline has passed, reports…

Shining a Light on ‘Dark’ Data

Financial firms are drowning in data, yet for many, information that delivers genuine value remains a scarce resource. Joanne Faulkner investigates whether new approaches to managing internal data could yield new insights, or whether new data privacy…

The KIDs Are Alright (But the Priips Still Have Issues)

Europe’s Packaged Retail and Insurance-based Investment Products becomes law on January 1, 2018. In-scope market participants racing to meet its significant data and reporting challenges all face the same hurdle: how to calculate implicit costs. Jamie…

The Dark Art of Pre-Trade Analytics

Financial firms commonly review trading activity after the fact to improve their execution strategies. But what they’d really love to do is perform that in real time, pre-trade. Max Bowie looks at how far along market participants are in pursuit of this…

The Great Fintech Con(version)

The fintech "revolution" of the past few years is looking less like it will displace traditional finance, and more like it will join it.

After Scandals, Banks Release Chat Back into the Wild

Chat tools are being embraced again as the industry seeks more efficiency in the workflow.

Peeling Back European Regulations in 2018: What to Expect Next Year

Waters runs through the key facts you need to know about Mifid II, GDPR, BMR and Brexit.

Mifid's Architect: Esma Chair Steven Maijoor

Europe’s top markets cop talks to Waters about Mifid II and III, Brexit, no-action letters, clearinghouses and the regulator’s future.

EU Gets Tough on ‘Research’ Unbundling

Mifid II will force sell-side firms to unbundle research fees from dealing commissions they charge to buy-side clients. The banks claim their front-office notes meet the criteria of being a minor non-monetary benefit, but EU watchdogs aren’t convinced,…

UPDATE: Bloomberg’s Chat Gambit: The Feint Before a Knockout?

Some suggest that Bloomberg’s decision to introduce a cut-price version of its Instant Bloomberg messaging is a sign that the data giant is rattled by bank-backed secure messaging startup Symphony. Joanne Faulkner investigates whether the move reflects…

Systematic Internalizer Ranks Swell Ahead of Mifid II

While buy- and sell-side firms grapple with the reporting obligations imposed on so-called systematic internalizers under Mifid II, the number of registered SIs continues to grow. Jamie Hyman investigates why more firms are opting in to the designation…

Out with the Old: Australia’s APRA Takes Aim at EFS Data

The Australian Prudential Regulation Authority is overhauling its core regulatory reporting requirements, which includes the modernization of the Economic and Financial Statistics data submissions required from Australian banks and various other…

Will Eonia Sink or Swim in Hunt for Euribor Replacement?

The European Central Bank has intervened to rescue stalling benchmark reform and find a new risk-free rate for swaps. But the Eonia rate has seen dwindling transaction volumes in recent years, and while the ECB’s new overnight rate is regarded as the top…

The Agility of DevOps

C-level executives from buy-side firms discuss how they're experimenting with DevOps, what its benefits are and where the challenges remain.

Ground Zero: Digital Currencies in Asia

As cryptocurrencies gain interest from investors around the globe, Wei-Shen Wong examines the splintered Asian marketplace to see how regulators are adopting different strategies when it comes to overseeing these complex instruments.

The Entrepreneur: Furio Pietribiasi, Mediolanum Asset Management

The Italian managing director of Mediolanum AM explains why technology is critical to today's financial services industry.

Brexit Looms Over Future of European Financial Markets

A lack of clarity about the UK’s departure from the European Union is an ongoing source of concern for the financial services industry, leading to continuing questions around investor protection, transition costs and regulatory obligations.