Analysis

No Buy-Side OMS/EMS to ‘Rule Them All’—Yet

Hedge funds are diversifying, says ITG's Will Geyer, and he expects trading desk tools to follow suit.

Quants' Conundrum: Funding Valuation Adjustment Comes Into Its Own

While firms, regulators, and academics continue to debate a suitable role for FVA, technologists and quants are forging ahead with implementations.

Prospera Praises SunGard's Social Media Surveillance Technology

Texas-based broker-dealer Prospera Financial Services has hailed the impact of SunGard's Protegent social media surveillance tool since going live with the technology in November last year.

Equinox Turns to Cloud, Triples AUM

The CTO at a small Denver alternative asset manager opts for private cloud.

We Can’t Upgrade, the Data Model’s Changed!

Although Knight Capital lost $440 million with just one faulty software upgrade, the cost of system maintenance and product upgrades are far greater, albeit less dramatic, than that much-publicized financial systems failure. Seemingly “simple” software…

'Interconnectivity' the Word as Risk Shifts to Front Office

Algorithmics' latest whitepaper highlights the challenges and opportunities facing buy-side firms as they react to regulatory changes.

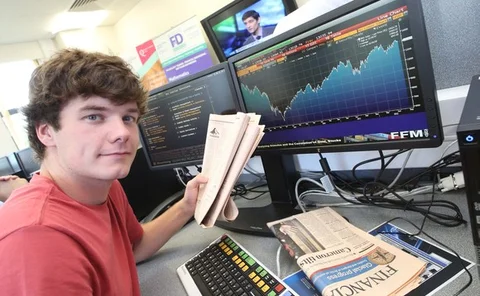

Queen's University and First Derivatives Build Trading Floor

Consultancy and software vendor First Derivatives has co-funded a mock trading floor at Queen's University Belfast, in order to provide students with a hands-on experience of a stock exchange environment.

Major Banks Complete Swap Trading Standard

The Fixed Income Connectivity Working Group (FICWG) has agreed on a set of standards for the way in which participants in swap trades will interact with execution venues, ahead of regulatory reform.

CFTC Under Fire from Asia-Pacific Regulators

Singaporean, Hong Kong and Australian bodies express concern over extraterritorial implications for OTC reform.

CFTC Under Fire from Asia-Pacific Regulators

Singaporean, Hong Kong and Australian bodies express concern over extraterritorial implications for OTC reform.

Growing Pains: Bär–BAML Deal Highlights IT’s Role in Wealth Management Consolidation

Details of last week's agreement signal a steady rise in costs devoted to IT as acquisition activity in the space continues.

Race to the Finish as Euro Short-Selling Ban Nears

Firms are considering their strategies over impending regulation for trade practices.

The Dust Settles in Knight's Arena

It's been two weeks since one of Knight Capital’s systems went haywire and nearly sunk the market-maker. Already, the situation has stabilized, and the industry can start thinking about the bigger picture.

Infographic: Major Bank Fines in 2012

A visualization of some of the largest regulatory penalties levied this year.

What's Cooking For September's Waters

Jake Thomases and Tim Bourgaize Murray give a sneak peak at the stories they're working on for the September issue of Waters.

TSE Must Restore Confidence After Second Outage

On Tuesday, the Tokyo Stock Exchange had to halt trading for the second time in six months after a technology glitch hit its derivatives system. With the Knight fiasco fresh in public consciousness and a takeover bid with the Osaka exchange looming,…

Knight Rises—and Falls

A look at Knight Capital's rapid ascent offers a few clues, and hints for lessons to be learned, as details are still emerging from Knight Capital's NYSE algo mishap on Wednesday.

Trading Infrastructure Hamstrung by Familiar Concerns

Cost concerns and legacy issues continue to temper enthusiasm among investment managers for wholesale changes in their trading architecture.

Ahead of Solvency II, Asset Liability Management Looms Large for Managers

Asset managers with insurer clients are searching for new data management and portfolio optimization platforms as the European regulation inches closer.

Single-Dealer Platforms Not Dead as Banks Shape Up for SEFs

SEF aggregation can ensure banks keep hold of clients as regulation looms.

SEF Survival Depends on Differentiation

GreySpark research outlines the current picture of the swap execution facility landscape.

Ospero Wants to Popularize a New As-a-Service Offering

Distribution-as-a-service may or may not catch on, but Ospero's vendor data center grid seems to be doing well.

New Tech Benchmarks Required After HSBC AML Failure Probe

The US Senate Permanent Subcommittee on Investigations found the bank's monitoring of correspondent relationships and bulk cash transactions wanting. Enterprise-level solutions are required to solve complex anti-money laundering problems.

Banks Chained to Legacy Systems as CVAs Suffer

SAS report claims legacy technology is leaving banks vulnerable to slow risk assessment.