Settlement

European firms prime for lopsided settlement in North America and at home

With T+1 imminent in North America and increasingly likely to traverse the Atlantic, operations and trading professionals in Europe are fighting on two fronts.

As crypto ETFs become reality, benchmark providers take center stage

The SEC’s approval of the first spot bitcoin ETFs will expose a growing number of traditional market participants to the maturing world of crypto data, a moment that some—such as CF Benchmarks, BlackRock’s benchmark provider—have been eagerly awaiting.

Settling scores: industry pushes back on new penalties in settlement efficiency drive

Esma is asking for feedback on proposals that could see penalties for settlement fails increase by 25 times. But affected parties say adapting to the new system would be a technical upheaval and are calling for more structural reform.

JP Morgan DLT exec: Settlement rails needed for digital bonds to gain traction

At an Afme conference, Scott Lucas, head of markets DLT for JP Morgan, noted DLT’s progress in the bond space. Others said the tech has a long way to go before wider adoption.

How GenAI could improve T+1 settlement

As well as reducing settlement failures, researchers believe generative AI can provide investment managers with improved research, prioritization, and allocation resources.

Modernizing architecture can reduce long-term costs

A perfect storm of regulation and accelerated tech advancement is forcing modernization unlike anything the markets have seen before, says Nasdaq’s Gil Guillaumey.

As T+1 looms, non-US firms consider out-of-hours trading

Pruned settlement cycle forces foreign buy-siders to explore automating the FX leg of securities trades.

ASX CHESS replacement to be delivered in phases, with clearing first in 2026

The Australian Securities Exchange announced in November it had chosen Tata Consulting Services to run the new CHESS replacement project after initial plans with Digital Asset were scrapped in 2022.

Waters Wrap: T+1 and too many proposals

Anthony believes that there’s a growing chasm emerging between regulators, senior business execs, and technologists—which is especially evident when it comes to the T+1 debate.

‘When, not if’: EU plots course for T+1 transition

Not everyone saw eye to eye at a European Commission roundtable discussing how to shorten settlement cycles, but most participants recognized the need to make the transition to T+1.

Ticking clock: Firms in Asia face unique T+1 challenges

Firms in Asia worry about unintended consequences of massive change to settlement cycle.

Citi details API for HKEX’s Synapse

New pieces of technology, like Synapse, assist Citi in migrating clients to newer technologies, and newer ways to settle and clear more efficiently.

Waters Wrap: A glimpse of 2024 through the looking glass of 2023

Anthony examines some of the biggest stories from the past year to preview what might be ahead.

Managing the FX challenge for T+1

As firms prepare for T+1 in May 2024, DTCC’s Val Wotton says they should also consider the complexities for cross-border trades.

The move to T+1: This time is different

This whitepaper, created by Broadridge, focuses on leveraging robotic process automation and AI to ensure a smooth transition from T+2 to T+1 settlement.

Waters Wrap: Examining ASX’s CHESS do-over

The Australian exchange was the first exchange to be all-in on DLT—and the project failed. Anthony speaks with ASX’s Tim Whiteley to discuss the lessons learned and why he thinks the second attempt will succeed.

Bulletproof building: DTCC, AWS debut app resiliency prototype

The cloud provider and industry utility have jointly released a prototype and guidelines for building resilient financial services applications.

Settlement ‘instructions’: Firms look to US for guidance as Europe braces for T+1

Operations professionals in Europe look across the pond for lessons in managing shorter settlement cycles.

T+1: Complacency before the storm?

This paper, created by WatersTechnology in association with Gresham Technologies, outlines what the move to T+1 (next-day settlement) of broker/dealer-executed trades in the US and Canadian markets means for buy-side and sell-side firms

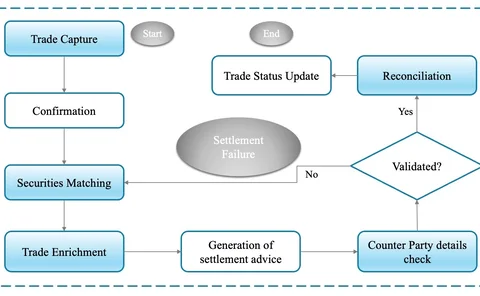

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.

What firms should know ahead of the DSB’s UPI launch

Six jurisdictions have set deadlines for firms to implement the derivatives identifier, with more expected to follow.

Has cloud cracked the multicast ‘holy grail’ for exchanges?

An examination of how exchanges—already migrating to the cloud—are working to solve the problem of multicasting in a new environment.

Waters Wrap: ICE, Nasdaq and differing views about cloud

As exchanges continue to embrace cloud, the decisions they make today will have long-lasting implications.

Increasing securities settlement successes with unique transaction identifiers

Major improvements have been made to the securities services operating model over the past decade, but inefficiencies in trade settlement processes remain, leading to thinning margins and longer settlement cycles. Key to addressing these challenges is…