Ratings

‘The opaque juggernaut’: Private credit’s data deficiencies become clear

Investor demand to take advantage of the growing private credit markets is rising, despite limited data, trading mechanisms, and a lack of liquidity.

FCA declines to directly regulate market data prices

A year-long investigation by the UK regulator to determine whether competition is hindered in the wholesale data markets has concluded with its decision not to directly regulate much-maligned data pricing and licensing structures.

Price gouging? New study finds market data providers consistently inconsistent in pricing, discounts

As the industry awaits the FCA’s findings from its Wholesale Market Data Study, end-users pin their hopes on the prospect of relief. But a new study from Substantive Research details the enormous pricing disparities that must be tackled.

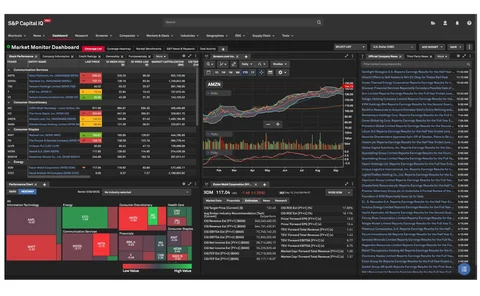

S&P tests ‘ChatIQ’ genAI search tool in revamped CapIQ desktop

The new tool is the culmination of integrating recent acquisitions, including IHS Markit, ChartIQ and Kensho.

Asset managers seek greater transparency into ESG index providers’ ratings

While there is no consensus on whether ESG ratings providers should be regulated, asset managers largely agree that more transparency into their vendors’ methodologies is needed.

UBS equities team gets to grips with SFDR funds, ramps up ESG scoring

An active equities team at UBS is refining its approach to ESG integration as it converts funds to Article 8.

Regulators turn gaze on ESG rating providers—for better or worse

Governments around the world are looking to clamp down on providers of ESG ratings and data products. Jo wonders what the implications could be for a still nascent market.

The perfect climate risk metric does not exist

Buy-side risk survey 2021: Even the keenest searches fail to find a reliable system of climate disclosure.

Refinitiv’s CodeBook targets financial programmers with built-in data access

Since it soft-launched the coding environment last year, Refinitiv has added an item browser to allow coders to look up financial information.

BlackRock to grant funds power to track climate risks

The Aladdin platform, which holds trillions of dollars, aims to show whether funds are burning the Earth or saving it.

Risky business: Moody’s attempts to carve out space in overrun ESG market

In the past two years, Moody’s Analytics has acquired four vendors that the ratings specialist hopes to integrate for ESG offerings in a crowded market.

The ESG Holy Grail doesn’t exist… yet

As buy-side firms strive to stand out in a maturing ESG-driven market, they will look for data in areas where coverage is still poor.

Putting the ‘green’ in green data: Rise of impact investing drives ESG M&A

Socially responsible investors are putting their money where their mouth is—in ever-increasing amounts. With insatiable demand for new datasets and analytics to support these strategies, it’s not surprising that every data vendor wants a slice of the ESG…

Beyond ratings: Vendors look to fill ESG data gaps

Start-ups and non-traditional data providers are exploiting niches where investment professionals can't rely on ratings.

Asset managers look to raw NGO data for ESG insights

Data from non-profits can be combined with ESG ratings for more bespoke investment insight, investment professionals say.

Data disruptors face uphill battle to overcome credit ratings stagnation

With traditional ratings agencies facing increased hostility from financial firms, new entrants are hoping to reshape ratings. But will fresh approaches appeal to an industry underwhelmed by existing offerings?

State Street focuses on 6 data vendors for ESG analysis

State Street’s Chris Berry explains how the asset servicer winnowed 60 ESG data providers down to six, and why this strategy has proved to be effective.

Cohesion on ESG Standards Still Elusive, Despite Biden Win

While many expect the president-elect to take a bullish stance on environmental issues, it's unclear what a new dispensation can do for the dilemmas around ESG standards.

Fulcrum AM Looks to Quantify ESG Risk by Honing Hard Numbers

ESG risks will become part of investment and risk management processes across all funds at the firm.

MackeyRMS Launches ESG Scorecard

Ratings toolkit includes features to help investment teams grade securities and funds to meet sustainability mandates.

Synechron Aims to Normalize ESG Ratings

The company is launching a new workbench in Q4, along with other prototypes and new accelerators.