Quantitative

Refinitiv’s CodeBook targets financial programmers with built-in data access

Since it soft-launched the coding environment last year, Refinitiv has added an item browser to allow coders to look up financial information.

People Moves: Rimes, Broadridge, TP Icap, Sifma, and more

A look at some of the key "people moves" from this week, including Justin Brickwood (pictured), who joins Rimes as head of benchmark data services.

Buy one, get one free: Algos learn to multi-task

For years, brokers have offered suites of algorithms, each geared toward a certain strategy and outcome. Now, firms are compressing these into multifaceted algorithms that can switch between different strategies or markets in response to trading…

Definition of a trading venue: Reg review risks ensnarling tech vendors

Industry participants are divided over the definition of a trading venue and how regulators should revise the regulatory framework.

This Week: Bloomberg, VoxSmart–GreenKey, EDM Council, Northern Trust, Anna-DSB, and more

A summary of some of the past week’s financial technology news.

This Week: Macrobond/FactSet, Tradweb, Bloomberg, DTCC, and more

A summary of some of the past week’s financial technology news.

Alt data’s second inning: Brace for a long M&A game

The alternative data sector is still relatively nascent, and as such buy-side firms have struggled with how best to incorporate these non-traditional sources of information. While sources say that there will be continued M&A in the market, how those…

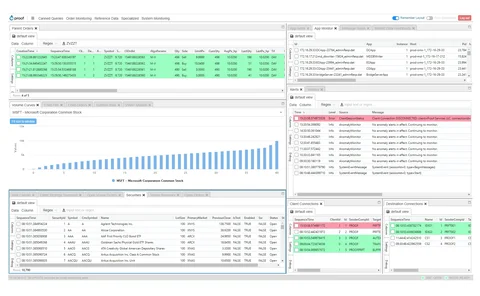

Burden of Proof: Meet the IEX breakaways looking to shake up broker algos

Founded with the principles of “transparency and academic rigor,” some say Proof’s model and technical approach is a test case for a new generation of cloud-native broker startups.

Dutch asset manager turns to decision trees for currency predictions

APG has improved prediction accuracy for G10 currency movements after adopting decision tree-based machine learning.

Waters Wrap: On outages, teamwork & greed (And ESG innovation & consultants)

Anthony examines a proposed protocol in Europe that would help keep liquidity flowing if there’s a major exchange outage. He also discusses innovation in the realm of ESG, and Esma’s new data analytics platform.

Goldman tackles climate risk controls

Lender joins other banks in translating physical and transition threats into controls framework

UBS AM builds model for quantifying greening of heavy industry

The asset manager's quant research arm, QED, has published a framework for valuing companies in industries like cement or steel that transition to more sustainable tech.

SF quant firm uses 'nearest neighbor' machine learning for equities predictions

Creighton AI is using a regression-based approach to machine learning to help make predictions about the excess return of a stock relative to the market.

Deep XVAs and the promise of super-fast pricing

Intelligent robots can value complex derivatives in minutes rather than hours

The ESG Holy Grail doesn’t exist… yet

As buy-side firms strive to stand out in a maturing ESG-driven market, they will look for data in areas where coverage is still poor.

Beyond ratings: Vendors look to fill ESG data gaps

Start-ups and non-traditional data providers are exploiting niches where investment professionals can't rely on ratings.

Acadian builds ‘green screen’ to auto-filter ESG phoneys

The $110 billion quant investor is creating an automated system to spot greenwashers.

In fake data, quants see a fix for backtesting

Traditionally quants have learnt to pick data apart. Soon they might spend more time making it up

Goldman inks modeling, data tie-up with MSCI

The move to cross-sell risk analytics could herald further content deals for the bank’s Marquee platform, says its sales chief.

Quandl goes live with new dataset for measuring dollar value of patents

The data vendor’s product is its first that aims to sort what it believes to be truly innovative companies from the pack.

BMLL partners with quants for HFT regulation

Researchers from a Paris university are using the provider’s data and coding environment to build models for more efficient regulatory approaches.

This Week: Refinitiv, State Street, FlexTrade, FactSet/Microsoft, Cboe, and more

A summary of some of the past week’s financial technology news.

PanAgora’s CIO & head of sustainable investing explain firm’s ESG framework, best practices

Waters Wavelength Podcast Interview Series: PanAgora’s George Mussalli and Mike Chen hit on topics including building predictive models using point-in-time data, and balancing ESG portfolios.

Futures trading algos ripe for disruptive new entrants

Algorithm development specialist BestEx Research is making a play to address inefficiencies in futures trading algorithms.