OEMS

OTAS Tech Enhances Portfolio Management Functionality, Looks to EMS Space & Sell Side for 2015

OTAS will also roll out out a new natural-language generation engine

OTAS Technologies Previews Move into Sell-Side and EMS Spaces, Preps OTAS Views

OTAS will also roll out out a new natural-language generation engine

Instinet to Focus on Automated Routing for Newport Platform

The broker recently enhanced Newport's position management capabilities.

Instinet Aims at Sell Side with Newport 3 Enhancements

The release includes new ETF trading capabilities.

Eze Software Discusses RealTick Enhancements, What's Ahead

Version 11.4 is due out Q2 2015.

Eze Software Unveils Latest Version of its RealTick EMS

Eze Also Upgraded its RealTick Mobile Solution.

Summit: Fixed Income Needs Collaboration, Better—Not Faster—Tech

More collaboration and better technology can bring liquidity back to fixed income

TradingScreen Adds Eris Exchange

Move is first of its kind of for a broker-independent EMS

Liquid Introduces Beta Mobile Application

OEMS provider Liquid Holdings has begun rolling out the beta version of LiquidMobile to select platform users.

Citi Expands Total Touch to European Equities

The investment bank's hybrid block equities offering for institutional investors is launching in Europe, with 560 symbols initially supported.

smartTrade Adds New OMS Functionality

smartTrade Technologies has added new functionality to its Order Management System (OMS) to support both e-orders and manual trading books and optimize clients' trading flow across multiple desks on a global scale.

Ex-Millennium Partners CTA Spinoff Taps Liquid

The Mada Group, a recently-launched commodity trading advisor (CTA) specializing in energy, agriculture, and metals futures, has chosen Liquid for its investment processes and middle-office operations.

Olivetree Securities Updates OTAS for UK-Based Best Ex

The London-based agency brokerage is now using its former spin-off OTAS Technologies' TradeShaper for trade management and market microstructure analysis, as well as best execution oversight capabilities.

REDI Buys, Integrates BAML's InstaQuote EMS

Execution management system (EMS) provider REDI Global Technologies has completed its year-long acquisition of BofA Merill Lynch's multi-asset InstaQuote platform, clients, and personnel.

Merlon Capital Partners Expands with SimCorp

Sydney-based Merlon Capital Partners is now using SimCorp Dimension's Front Office suite after a two-month deployment, extending a relationship first established in 2010.

NBAD, Celer Partner on Electronic FX

National Bank of Abu Dhabi says it will partner with London-based Celer Technologies to develop global market e-commerce applications for foreign exchange (FX) and related markets.

Liquid, ConvergEx Pen Agreement

OEMS provider Liquid and prime services division of ConvergEx have signed a joint marketing agreement wherein Liquid will be offered to ConvergEx's roster of hedge fund, family office, mutual fund, and registered advisor customers.

Thomson Reuters Adds FlexTrade EMS to Eikon

Thomson Reuters has integrated FlexTrade’s execution management system (EMS) and Autex indications of interest (IOI) data into its flagship desktop, Eikon.

Extending 'Continuum of Innovation', BlackRock and Tradeweb Ally on Electronic Rates Trading

A recently announced and newly-integrated electronic trading solution will fuse Tradeweb's marketplace with Aladdin for order management, pricing, and execution of interest rate products and derivatives, serving only to deepen one the industry's longest…

Krungsri AM Upgrades Charles River Implementation

The Bangkok-based asset manager is now using the ninth version of IMS, as well as Charles River's FIX Network and Data Storage offerings for electronic trading and real-time price provision at the local Stock Exchange of Thailand (SET).

Nomura AM Expands Charles River Implementation

The asset management arm of the Japanese banking giant, with 33 trillion yen ($323.5 billion) under management, has successfully migrated its equity business onto Charles River's IMS, with domestic and international fixed income, foreign exchange, and…

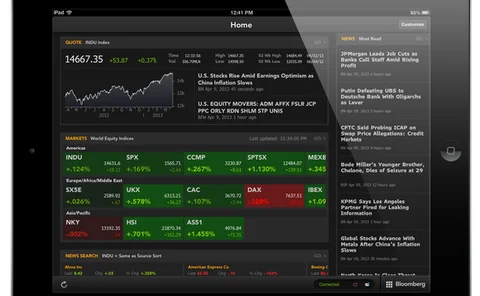

Regional Fixed Income Dealers Get Bloomberg Service

Bloomberg has unveiled its Electronic Trade Order Management Solution, or ETOMS, a managed service used by US regional broker-dealers to access and engage fixed income electronic markets as both liquidity providers and liquidity takers.

ITG Targets Emerging Hedge Funds with New OMS, EMS

Will Geyer, head of platforms at ITG, and John McKeon, managing director of platforms, discuss the broker's latest applications.

ITG Releases Trade Management Systems for Hedge Funds

New York-based execution and research broker ITG has launched a product suite for hedge funds that includes a hosted order management system (OMS) and execution management system (EMS).