Natural language processing

Broadridge CEO Tim Gokey Maps Out Technology Path

Gokey discusses Broadridge's aim to be a one-stop shop for users and how it sees emerging technologies as its future.

AI in the Cloud: How the Two are Making for a Perfect Match

As more financial institutions are starting to expand their usage of AI, they are turning to the cloud to help scale up. However, there are things to consider before doing so. Wei-Shen Wong examines.

Liquidnet Targets Long-Term Investors with New Business Unit

The new business unit will unify Liquidnet's last three acquisitions: Prattle, RSRCHXchange, and OTAS.

A Look Inside UBS's Quantitative Evidence & Data Science Team

Led by Bryan Cross (pictured), the asset manager's QED team aims to blend quant and fundamental to find unique solutions to new problems.

Allianz Global Investors Adopts NLP Signals in Equities

The investment manager's move to tackle unstructured data is starting with sell-side analyst reports.

Lost in Translation: The Genesis of the Data Translator

An examination of the ‘data translator’ role and how it can help forward a firm’s data agenda.

GreenKey To Release Front-End Dashboard For Analyzing Audio Data

The new tool, called the Blotter, will be a window into unstructured audio data as a form of operational alpha for the buy and sell sides.

SS&C Advent Embraces AI for Product Development

The company is using machine learning and natural-language processing technology to enhance its Tamale and Geneva platforms.

Quantum Computing’s Academic Question

A look at how banks, vendors & colleges are partnering to solve finance problems using quantum science.

Finra to Expand Use of Machine Learning for Market Surveillance

The regulator already uses machine learning to identify spoofing and layering activities.

Tapping AI for Buy-Side Growth

Asset managers wanting to thrive in today’s landscape of squeezed margins must learn how to capitalize on innovative AI tech to deliver top-line growth, according to SS&C Technologies.

Liquidnet Expands Analytics Portfolio with Prattle Buy

Liquidnet plans to use Prattle's natural-language processing and machine learning capabilities to boost its analytics offerings.

History Repeating: The Challenge of Stock Classification in a Fintech World

It's easier than ever for companies to expand into new business lines. As a result, it's more challenging to make like-for-like comparisons of stocks.

NYSE President Sees Tech as Key to Big Board's Next Evolution

A look at the massive tech projects (and legal battles) underway at the NYSE, which are being led by Stacey Cunningham.

Geopolitical Risk Data Moves from Foreign Intelligence to Fund Management

As nations and markets become increasingly interconnected, geopolitical risk has become top of mind for portfolio managers.

Banks Brace for ‘World’s Largest Corporate Action’ as Libor Switch Looms

The transition away from Libor is a mammoth task for the banking sector—one that the industry is increasingly finding itself woefully unprepared for. By Hamad Ali

A Blueprint for Alternative Data in Asset Management

UBS Asset Management’s data chief sets out his recommendations for using alternative data in the investment process.

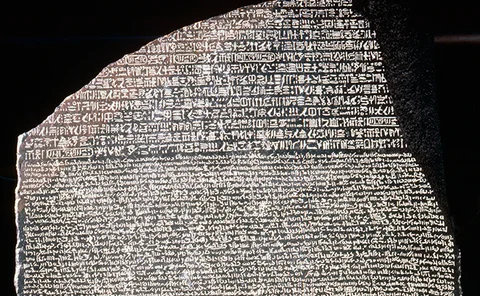

Firms Carve Rosetta Stones for Non-English AI Surveillance

Development of machine learning and natural-language processing is now turning to languages other than English to keep a better eye on traders and the market. But how easy is it to teach a machine a new tongue?

Deep Learning: The Evolution is Here

Advancements in AI have led to new ways for firms to generate alpha and better serve clients. The next great evolution in the space could come in the form of deep learning. WatersTechnology speaks with data scientists at banks, asset managers and vendors…

Mosaic Smart Data Releases Machine Learning-Powered Reporting Feature

Mosaic will use natural language generation to create real-time fixed-income trade reports.

Evolve or Die: Asset Managers Cultivate Data Science Teams

Firms are using machine learning and natural-language processing tools—no longer to grab an edge, but merely to remain competitive.

Mind Your Language: Surveillance Systems Tackle Conduct Risk

While advanced voice analytics technologies have been around for years, banks have often used them as a blunt instrument, or a regulatory checkbox. Now they are increasingly seeing them as useful tools for managing conduct risk and employee protection…

Waters 25: A Look Back on the Last Two Decades

Waters examines some of the most important events in financial technology of the past 25 years.

Banks Increasingly Using Market-Abuse Systems for #MeToo

The Senior Managers Regime and #MeToo campaigns are making banks increasingly conscious of employee conduct