Mifid II

Ullink Extends Partnership with LiquidMetrix for Best Execution

New tool aims to enhance connectivity and trading infrastructure to achieve delivery of best execution services.

FactSet Pairs its OEMS with CG Blockchain's Distributed Ledger

This is an early-adoption example of an OEMS being coupled with tools on a live blockchain.

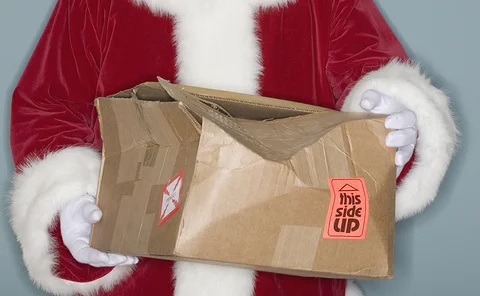

Europe’s Mifid Monster Lurches to Life

January 3 went smoothly for many, but the launch of Europe's far-reaching reform package wasn't without problems.

SimCorp Enhances Alternatives Offering for its Dimension Platform

Other updates to the platform include Mifid II compliance, a strategy builder for Solvency II requirements and collateral management workflows.

ION's Openlink Acquisition Shows Deeper Strategic Moves at Work

The Openlink deal is the latest in a string of acquisitions by ION as it consolidates power in treasury, derivatives and commodities, with the help of Carlyle Group.

NEX and Delta Capita Team Up for SFTR Solution

NEX Regulatory Reporting partners with Delta Capita to offer SFTR compliance service.

February 2018: All Hunky Dory in the Land of Mifid II

Despite a few teething problems, Victor says Mifid II, which took effect on January 3 this year, is a net positive for the capital markets.

Client Reporting Remains Top Mifid II Implementation Challenge

A November 2017 survey of fund managers found client reporting was their biggest concern in the lead-up to Mifid II, and it remains so in the weeks following the regulation’s entry into force.

Mifid II and the Emergence of the Connectivity Hub

With the second Markets in Financial Instruments Directive now in effect, firms are still adapting to the new requirements and their long-term implications. Richard Bentley, chief product officer at Ullink, explores how the industry can remain compliant…

TradeData Bows Historical Symbology Archive for Regulatory Analysis

Euromoney TradaData’s Forensyx service helps regulators investigate historical transaction reports.

Eurex to Suspend Swiss Operations

Eurex Zurich will cease operations at the end of March, citing conflicts between Mifid II and a new regulatory framework in Switzerland.

GLMX Plans European Expansion with $20 Million Fund Raise

Repo trading platform will use funds to fuel European expansion.

Irish Stock Exchange Becomes Ireland's First LOU

The exchange can now issue, renew and update LEIs via its online services website, ISEdirect.

January 2018: Getting Your Bitcoin’s Worth

Financial firms spent a lot of last year focused on Mifid II compliance, but also clearly spent significant time following the ups and downs of cryptocurrencies - and assessing whether to invest in this new asset class.

Post-Mifid II, Shelved Projects May See New Life

Tech chiefs and vendors see chance to revisit missed opportunities—in time.

Esma’s LEI Xmas Extension: Last-Minute Gift or Lump of Coal?

Jamie Hyman talks with an LEI issuer, advocate and end-user about how Esma’s LEI grace period will impact operations during the first half of 2018.

Goldman Leads $38 Million Funding Round for Visible Alpha

Fintech firm to complete integration of Alpha Exchange and expand into Europe and Asia, with eye on potential further acquisitions.

Bermuda Stock Exchange Confirms Status as LEI Issuer

The exchange is able to issue LEIs to listed and unlisted Bermuda-domiciled companies.

Aquis Tech Links SIs, Counterparties via Connectivity Hub

Hub allows counterparties to continually adjust which stocks they want to interact with.

Mifid Data Runs Aground with Issues at European Regulators

Glitches and halts mark first few weeks of transparency requirements at systems operated by regulators.

So This Is Mifid (II), and What Have You Done?

John reflects on how Mifid II has dominated the news in recent months and asks if the industry is really ready for such a sea change at a time when new regulation is now just part of doing business.

Raymond James Enlists Red Deer for Mifid II Research

Raymond James is using Red Deer's Mifid II solution to help manage research consumption.

AFTAs 2017: Most Innovative Third-Party Technology Vendor—Infrastructure—UnaVista

UnaVista, the London Stock Exchange Group’s (LSEG’s) platform for matching, reconciliation and reporting, makes its debut at the AFTAs as winner of the most innovative third-party technology vendor (infrastructure) category, at a time when industry focus…

2017 AFTAs Winners' Circle: SmartStream Technologies

Historically, collaboration between banks hasn’t yielded much success—except, perhaps, when it comes to reference data. James Rundle talks with Peter Moss, CEO of SmartStream’s Reference Data Utility (RDU), about how the project came about, and how it’s…