Derivatives

Inside the company that helped build China’s equity options market

Fintech firm Bachelier Technology on the challenges of creating a trading platform for China’s unique OTC derivatives market.

For AI’s magic hammer, every problem becomes a nail

A survey by Risk.net finds that banks are embracing a twin-track approach to AI in the front office: productivity tools today; transformation tomorrow.

Nasdaq leads push to reform options regulatory fee

A proposed rule change would pare costs for traders, raise them for banks, and defund smaller venues.

On GenAI, Citi moves from firm-wide ban to internal roll-out

The bank adopted three specific inward-facing use cases with a unified framework behind them.

European exchange data prices surge, new study shows

The report analyzed market data prices and fee structures from 2017 to 2024 and found that fee schedules have increased exponentially. Several exchanges say the findings are misleading.

Regis-TR and the Emir Refit blame game

The reporting overhaul was been marred by problems at repositories, prompting calls to stagger future go-live dates.

Ongoing uncertainty, volatility force new tech approach to collateral management

With market volatility and geopolitical uncertainty here to stay, Nasdaq’s Gil Guillaumey argues that firms must rethink their approach to collateral management.

TMX launches ATS in US

The move represents the first expansion of the exchange group’s markets business outside of Canada.

In 2025, keep reference data weird

The SEC, ESMA, CFTC and other acronyms provided the drama in reference data this year, including in crypto.

Too ’Berg to fail? What October’s Instant Bloomberg outage means for the industry

The ubiquitous communications platform is vital for traders around the globe, especially in fixed income and exotic derivatives. When it fails, the disruption can be great.

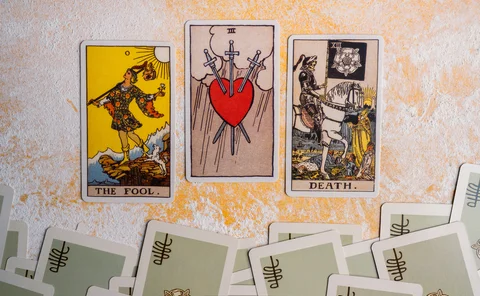

ForecastEx, event contracts, and a new way to think about markets

Waters Wrap: Anthony speaks with the former CEO of OneChicago David Downey about his new venture and the future of prediction markets.

Derivatives pricing with AI: Faster, better, cheaper

Pascal Tremoureux, head of quantitative research at Murex, describes the firm’s mission to replicate derivatives pricing models through machine learning—slashing time and costs in the process

Northern Trust adds fixed-income capabilities for outsourced trading in Asia-Pacific

The custodian bank now offers 24/6 fixed-income trading coverage with desks in Chicago, London, and Sydney.

Aussie asset managers struggle to meet ‘bank-like’ collateral, margin obligations

New margin and collateral requirements imposed by UMR and its regulator, Apra, are forcing buy-side firms to find tools to help.

Interactive Brokers looks beyond US borders for growth opportunities

As retail trading has grown in volume and importance, Interactive Brokers and others are expanding international offerings and marketing abroad.

Déjà vu for common domain model

Piecemeal progress on ambitious derivatives data standard raises questions over business case

JP Morgan touts DLT, tokens for collateral management

Distributed-ledger technology could make moving non-cash collateral more efficient, said managing director Toks Oyebode during an Isda conference on Thursday.

Ace high or busted flush? Digital Asset’s mixed fortunes mirror DLT adversity

The vendor hoped to remodel post-trade using blockchain technology—and it still might—but its bumpy progress raises questions over the future of DLT in finance.

Waters Wrap: CME, Google and the pursuit of ultra-low-latency trading

CME Group and Google have announced Aurora, Illinois, as the location for the exchange’s new co-location facility. Anthony explains why this is more than just the next phase of the two companies’ originally announced project.

Hong Kong looks for digital response to trade reporting burden

New swaps reporting framework will include more fields than requirements in US or Singapore.

Banks, vendors mine AI for corporate FX hedging

New machine learning algos can help corporate clients adjust hedging ratios, but tech’s effectiveness is limited by data quality, experts caution