Cloud

SFDR pushes fund administrators to rethink ESG offerings

Some fund admins prefer to build ESG products in-house, while others, notably Northern Trust, consider it ‘inefficient’ from a cost and time perspective.

Cloud: Capital markets’ Swiss Army knife

The best uses of the cloud so far have been as an enabler of performance and innovation. The best uses yet to come could reshape AI. So, Max warns, if you think cloud is about cutting costs, you’re thinking about it all wrong.

This Week: Bloomberg, VoxSmart–GreenKey, EDM Council, Northern Trust, Anna-DSB, and more

A summary of some of the past week’s financial technology news.

People Moves: Canoe Intelligence, Transcend, Clear Street, Gresham Technologies, and more

A look at some of the key "people moves" from this week, including Vishal Saxena (pictured), who joins Canoe Intelligence as chief technology officer.

Waters Wrap: Owning the data & doing something unique with it—the ultimate alchemy

Based off of Max Bowie’s recent deep-dive feature, Anthony says that the world of alt data M&A—and the factors that drive these deals—is likely to change in the near future. For an analogy, just look to sushi.

Google-Greenwich: Financial firms agree on cloud's ubiquity, but vary widely on use cases

New research highlights predicted growth areas for cloud computing—and the tools it enables, such as AI and machine learning—in the capital markets. Spoiler alert: Google says cloud is becoming as ubiquitous as the search giant itself.

Alt data’s second inning: Brace for a long M&A game

The alternative data sector is still relatively nascent, and as such buy-side firms have struggled with how best to incorporate these non-traditional sources of information. While sources say that there will be continued M&A in the market, how those…

Waters Wrap: Get ready for the low-code, no-code explosion

Anthony looks at some recent developments in the low-code and no-code spaces, and tries to better understand what’s hype and what’s reality.

Ion expands into OTC markets with Clarus deal

With the deal, the tech titan adds real-time swaps margin analytics to its post-trade services for listed derivatives.

Waters Wrap: Some random thoughts about Big Tech disruption and M&A in Q4

Anthony looks at what he thinks will be the biggest topics during the last quarter of 2021.

A tale of two titans: Microsoft vs. Bloomberg

Bloomberg has fended off rivals to its business for years but Jo believes a more credible threat may be emerging.

People Moves: FactSet, AFMA, Finos, Tradeweb and more

A look at some of the key "people moves" from this week, including Linda Huber (pictured), who joins FactSet as chief financial officer.

Waters Wrap: Cloud, AI, Interop: The evolutions driving fixed-income progress

Anthony believes these advancements will provide the opening for Big Tech firms to created outsized influence that will change financial technology forever.

People Moves: Tradeweb, BondLink, Boosted.ai, Transcend, and more

A look at some of the key "people moves" from this week, including Devi Shanmugham (pictured), who joins Tradeweb as global head of compliance.

‘Connect’ schemes will force Chinese buy side IT overhaul

Initiatives that provide greater access to international markets, like the Stock Connect and Bond Connect programs, will drive change at Chinese asset managers struggling with legacy trading technologies.

The market data vending machine: The pros and cons of self-service procurement

Brokers and exchanges have begun rolling out “self-service” portals that allow clients to choose data and services on an a la carte basis. Opinions vary on whether they are the Holy Grail or a poisoned chalice.

Waters Wrap: Google-Symphony—Something to see here?

Anthony wonders if there are any tea leaves to be read as a result of Symphony migrating its platform from AWS to Google Cloud.

This Week: Bloomberg, Broadridge, Rimes, Glue42, and more

A summary of some of the past week’s financial technology news.

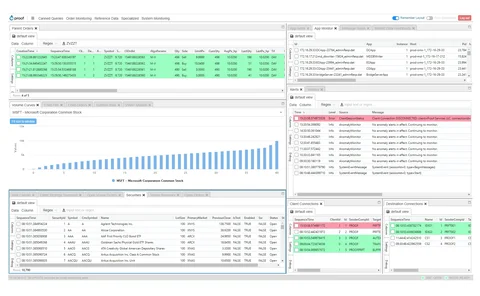

Burden of Proof: Meet the IEX breakaways looking to shake up broker algos

Founded with the principles of “transparency and academic rigor,” some say Proof’s model and technical approach is a test case for a new generation of cloud-native broker startups.

Holding Pattern: As Trading Technologies awaits new owner, the vendor adjusts development strategy

The Chicago-based futures trading platform recently rolled out a new OMS offering, while other projects, like its Echo Chamber market data platform, have been put on pause until a sale goes through.

Swedish bank finds Covid-19 recovery insights in alt datasets

High-frequency data such as human mobility data and plastic shipments can help investment professionals understand the post-pandemic economic reopening.

People Moves: LedgerEdge, JP Morgan, MarketAxess, Enfusion, and more

A look at some of the key people moves from this week, including Michelle Neal (pictured), who has joined enterprise software vendor LedgerEdge as CEO of US operations.

This Week: Nasdaq, NSCC, State Street, OpenFin/Broadridge, and more

A summary of some of the past week’s financial technology news.

Investment bank wraps up major tech overhaul after Covid-19 setback

Stifel Europe weathered 2020 volatility and switched vendors in looking to simplify its middle- and back-office functions and increase tech investment.