Burden of Proof: Meet the IEX breakaways looking to shake up broker algos

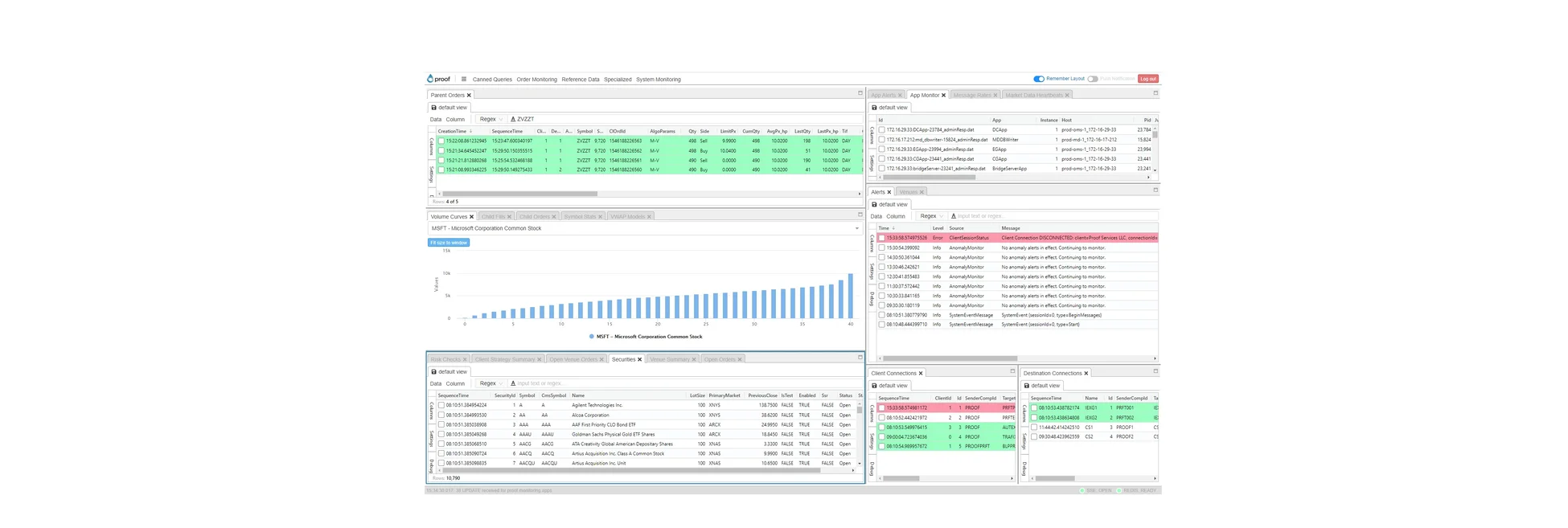

Founded with the principles of “transparency and academic rigor,” some say Proof’s model and technical approach is a test case for a new generation of cloud-native broker startups.

Proof Trading, a startup agency broker-dealer founded by former IEX executives Daniel Aisen and Allison Bishop, is about to launch its second trading algorithm in a bid to deliver more efficient and lower-impact execution.

The firm’s first algorithm, which went live in March, is a VWap (volume-weighted average price) execution algorithm. The second algorithm, expected to go live at the start of August, serves as both a liquidity-seeker and impact minimizer, which first seeks out large blocks of

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Technology

Waters Wavelength Ep. 309: FIA Boca

This week, Tony and Nyela discuss Nyela's week spent in Boca Raton, Florida, covering the FIA Boca conference as well as the current developments around 24/7 trading in US equity markets

FIS’s BPaaS strategy: Delivering a competitive edge

Simon Roche and Neil Mardon from FIS discuss the firm’s BPaaS strategy and how it stands out in the highly competitive “as-a-service market”

FIS execs discuss details of the firm’s BPaaS strategy

How FIS delivers business, tech and operational benefits to capital markets firms in the highly competitive as-a-service market

A fireside chat with SmartStream’s Akber Jaffer

A fireside chat with SmartStream’s chief executive to discuss his first 15 months at the helm of the business and SmartStream Air 9.0—the firm’s new AI-driven reconciliations platform.

The future of trading takes shape

The future of trading across the capital markets and the drivers likely to shape the ever-evolving industry

A fireside chat with FactSet’s David Mellars

FactSet’s private markets data strategy, the relationship between risk and performance on the buy side and fixed income track record

Ultra-low latency trading: How low can you go?

AMD discusses the technological advances that are taking high-frequency trading to new lows—known as ultra-low latency trading.

Pledging the ledger: At the tipping point of blockchain networks that work together

Interest in distributed ledger technology (DLT) is gaining momentum, sparking lively debates among proponents and detractors. The key question is: which version of DLT is suitable for advancing financial markets—public/permissionless or private/permissioned networks?