Best execution

This Week: Cboe, Euroclear; Société Générale, Bloomberg/Sustainalytics

A summary of some of the past week’s financial technology news.

This Week: Deutsche Borse; State Street; IHS Markit; MSCI; & more

A summary of the week's financial technology news.

Sell side pushing for bilateral connectivity for fixed income

Fixed-income liquidity providers, battling tighter margins, want to execute directly with clients, but are buy-side and tech firms willing to absorb the connectivity costs?

Charles River, Wave Labs team up for enhanced OEMS

The strategic partnership will involve a three-part integration including system connectivity, combined visualization and the creation of client feedback loops.

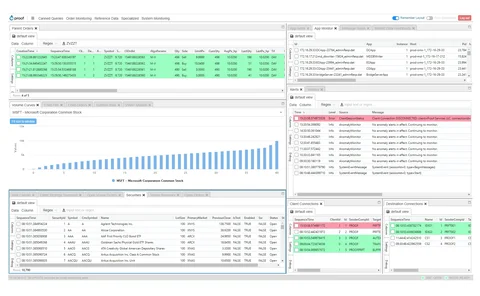

Burden of Proof: Meet the IEX breakaways looking to shake up broker algos

Founded with the principles of “transparency and academic rigor,” some say Proof’s model and technical approach is a test case for a new generation of cloud-native broker startups.

New entrants want to feed bond market’s hunger for data

In the absence of a consolidated tape for debt securities in the EU, vendors with different approaches to distributing fixed-income market data are emerging.

Inside RBC’s Aiden project: 5 years of deep learning

Aiden, a trading platform launched last year, is the product of five years of experimentation with deep learning by RBC Capital Markets on top of an additional five years of hypothesizing about what best execution would one day require.

BMLL partners with quants for HFT regulation

Researchers from a Paris university are using the provider’s data and coding environment to build models for more efficient regulatory approaches.

CDS trading remains stubbornly human

Buy-sider traders remain skeptical of the benefits of algo execution for credit derivatives.

US competing consolidators grapple with pricing uncertainty as SEC, exchanges battle over new Sip regime

Vendors who want to provide consolidated market data under the SEC’s new system can’t make plans until they know how they are going to be charged for market data. But the fee schedules are mired in legal action and confusion.

OTC FX options market gears up for faster electronification

The share of electronic trading in the market remains low, but a host of factors promise to change that for good.

Funds urged to scrutinize outsourcing models to reduce data leakage

Asset managers can choose from a range of trade-outsourcing models, but some traders say certain providers’ data-sharing techniques carry greater risk of information leakage.

Has Covid stopped the clocks on FX timestamp efforts?

Budget reallocation may not be the only factor stalling standardization progress, say market participants.

Futures trading algos ripe for disruptive new entrants

Algorithm development specialist BestEx Research is making a play to address inefficiencies in futures trading algorithms.

SEC’s Market Data Infrastructure Rule Not Easily Said or Done

The finalized equities market infrastructure reforms will make a difference, but some market participants are calling for additional clarity.

TradingHub Looks to Analyze Aggregated Client Data to Improve Market Abuse Risk

The service would aim to allow buy-side firms to proactively monitor for trading abuse, rather than react after the event.

Industry Still at Odds Over Use Case for an EU Consolidated Tape

Market participants say they want a high-quality, centralized source of market data for EU equities. But who and what is it actually for?

Covid Could Cause US Regulators to Rethink Surveillance

Not having specific requirements and procedures for firms to refer to ended up putting some funds in a tough place during the pandemic’s early days.

Waters Wrap: The NEX Brand Slowly Disappears (Plus Market Data Fights & AI Integrations)

Anthony looks at what's become of NEX since the CME acquisition, as well as discussions over odd lot reform and S&P's Kensho implementation.

Exchanges, SEC At Odds Over Odd Lots

Industry insiders warn that the regulator’s attempts to modernize equities data by redefining trading lots will fall short of the mark if odd lot orders remain unprotected.

TradingScreen Continues OMS Expansion on the Buy Side

Vendor firm will release enhancements to allocation, pre-trade compliance, and reporting and analytics in September.

Scrutiny and Frictions Follow EMS Vendors into Fixed Income

Aggregators are facing resistance from venues and attracting the attention of regulators.

Covid-19 Reveals Need for Better Comms Plug-Ins for Traders

Traders should have real-time voice modules in trading systems and the ability to add detailed notes to replicate trading floor experience.

EU Consolidated Tape: Support Wanes With Lack of Answers

With regulators slow to answer industry questions relating to how a CT should be built and what it's for, development has slowed.