AI

Quants look to language models to predict market impact

Oxford-Man Institute says LLM-type engine that ‘reads’ order-book messages could help improve execution

The IMD Wrap: Talkin’ ’bout my generation

As a Gen-Xer, Max tells GenAI to get off his lawn—after it's mowed it, watered it and trimmed the shrubs so he can sit back and enjoy it.

JP Morgan pulls plug on deep learning model for FX algos

The bank has turned to less complex models that are easier to explain to clients.

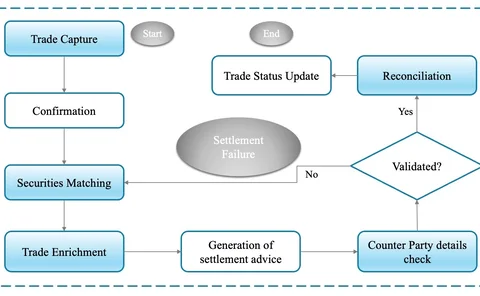

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.

The causal AI wave could be the next to hit

As LLMs and generative AI grab headlines, another AI subset is gaining ground—and it might solve what generative AI can’t.

Tech spend, AI fuel JP Morgan’s fight against Big Tech giants

JP Morgan Chase, which has spent more than $15 billion this year on technology, intends to invest even more to compete against tech behemoths.

Europe’s AI Act is taking shape. How will the UK respond?

As the EU pushes through a historic AI Act, its neighbor is left wondering how to keep up.

Google bullish on AI benefits in the face of fears over unchecked growth

Tech giant quells fears over a Skynet-style reality, stressing a risk-based approach to AI usage during a panel in London on Thursday.

LiquidityBook buys Messer in effort to beef up portfolio management capabilities

The OEMS provider has purchased the Hong Kong-based PMS provider—but don’t say it’s solely a play for the buy side.

SEC squares off with broker-dealers over data analytics usage

The Gensler administration has ruffled feathers in the broker-dealer community with a new proposal seeking to limit their use of predictive data analytics. But at the heart of this deal is something far more seismic: one of the first attempts by the SEC…

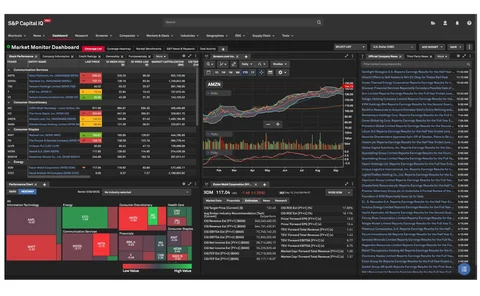

S&P tests ‘ChatIQ’ genAI search tool in revamped CapIQ desktop

The new tool is the culmination of integrating recent acquisitions, including IHS Markit, ChartIQ and Kensho.

Technology trends in capital markets: Transforming the sell-side FX front office

The capital markets landscape is witnessing a technological revolution – a wave transforming the sell-side FX front office. Firms such as smartTrade Technologies are at the forefront of this transformation, leveraging technologies such as artificial…

Waters Wavelength Podcast: David Hardoon dissects language models

David Hardoon returns to talk about the field of language and how it’s the ‘heart and soul’ of artificial intelligence.

Inside look: How Big Tech is using generative AI to win over finance

Execs from Amazon, Google and IBM explain their capital markets strategy when it comes to rolling out new AI tools.

Snowflake: Data strategy essential for AI

The cloud data platform provider continues to make investments in data quality and cleansing.

Crypto: Too important to ignore

This WatersTechnology rapid read survey report examines the crypto finance priorities of institutional investors, how far along they are on their crypto journeys, the challenges in entering and participating in this market, and what they value most when…

Waters Wavelength Podcast: IBM on generative AI

This week, John Duigenan from IBM joins the podcast to discuss generative AI.

AI in sheep’s clothing? Wolfe Research develops finance chatbot

The bot is trained using financial and ESG data, but won’t replace humans—yet—says the firm.

Waters Wavelength Podcast: Generative AI: The philosophical considerations

Steve Rubinow joins the podcast to discuss artificial intelligence and the hype cycle of generative AI.

BoE model risk rule may drive real-time monitoring of AI

New rule requires banks to rerun performance tests on models that recalibrate dynamically.

Amazon bullish on AWS growth, signals more investment in generative AI

Tech giant’s cloud computing arm grew customer base in Q2 despite cost-cutting among users

HSBC hikes tech spend, scales up AI projects

The bank is hoping to turn higher technology costs to its advantage, investing in its new digital trade platform and increasing its exploration of generative AI.

Deutsche Börse ‘cannot afford’ to miss out on generative AI; SimCorp deal on schedule

The exchange group wants to be at the forefront of the emerging technology field and has extended its partnership with Google into AI.

Microsoft, Google highlight LLM capabilities for future growth

Satya Nadella and Sundar Pichai both touted the advancements their respective companies have made in the field of generative AI during their earnings calls.