Algorithmic trading

Dash Plans Redesigned OEMS Release for Q4

Blaze 7 will feature an enhanced, integrated suite for options volatility traders.

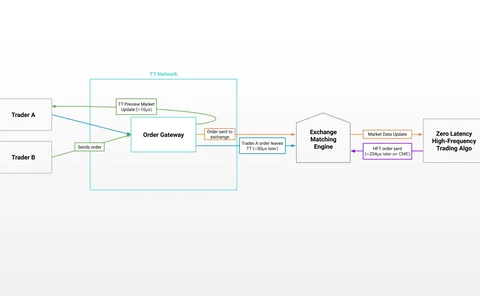

Trading Technologies Unveils New Futures Market Data Feed

As the fight over market data fees in the futures market heats up, the Chicago-based trading platform provider is rolling out a new platform that provides a free view of market order flow for TT platform users.

Barclays Revamps BARX Platform Using OpenFin

Executives from Barclays discuss why the bank is transforming its BARX trading platform and what that might mean for the future of trading desktops.

Aegon Asset Management Partners with ACA Compliance for Surveillance

The firm is using ACA's Decryptex to identify fraudulent trading behavior.

Ex-JP Morgan Trader Tackles Complex Computing with New Programming Language

Concurnas founder says his language will help traders work more easily with concurrent computing and offer a Python-like syntax with Java-scale performance.

Nasdaq Updates Surveillance Offering to Build Trader Profiles to Catch Spoofing

The company is combining different data sources to help users spot market abuse and manipulation.

Wavelength Podcast Ep. 175: Tradeweb's Billy Hult

Duncan Wood interviews Tradeweb's Billy Hult about the changing trading landscape.

Horizon Software Adds Market-Making, Hedging Algos to Library

Clients can use the algos from the libraries to connect to their existing algos and strategies.

Systematic or Discretionary: Point72’s Granade Says Lines Are Blurring

At Waters USA, the chief market intelligence officer of hedge fund Point72 discussed how tech and data are disrupting traditional ideas about investing.

The Rise of the Algo Wheel

An examination as to how the buy side is embracing algo wheels and where the challenges still remain.

People Moves: Finastra, Luminex, Itarle, West Highland & More

A look at some of the key "people moves" over the last week, including Lisa Fiondella (pictured), who joins Finastra.

LSEG Building New Algo-Testing Tool

The exchange group is developing new regtech products while looking to move these offerings to the cloud in 2020.

Bad Clocks Block FX Best-Ex

To get a good deal in fast-moving FX markets, buy-side firms need to know the time. Some of them don’t.

Lawyer: Don’t Punish the Programmers

Smart contract developers should not be responsible for violations of regulation perpetrated on the blockchain, says Katten special counsel.

As Passive Investment Drives Closing Auction Volumes, Chi-X Takes Aim

Chi-X launched MatchPoint to meet the demand for anonymous trades during the closing auction.

QuantConnect Wants to Create a ‘League’ for Algo Testing

The crowd-sourced trading platform is looking to create a competitive arena for quants to test their algorithms.

The Secret Source: Machine Learning and Open Source Come Together

A deep-dive into how capital markets firms are using open-source tools to experiment with machine learning.

Banks Embrace the Use of Synthetic Data

Banks have long been using synthetic data to validate solutions, but tech advancements and regulatory pressure have established this practice as a crucial step in the development and testing of technologies.

HFT Firm Potamus Looks to Outsourced Trading, New Asset Classes

Potamus has seen its US equities platform grow in the past year.

Morgan Stanley Explores Using AI to Better Trade Equities

The bank is also looking at using AI for intelligent IOI suggestions based on clients’ trading profiles.

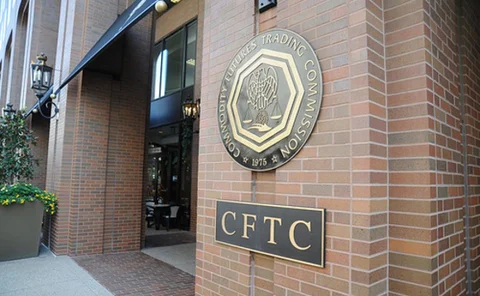

Could CFTC Bring Back Reg AT?

The CFTC's new chair could reopen the controversial algo-trading rules—if he gets time.

Not Random, and Not a Forest: Black-Box ML Turns White

Bayesian analysis can replace random forest with a single, powerful tree, writes UBS’s Giuseppe Nuti.

News ‘Flash’: MT Newswires, ICE Give Clients Early Look at Stories

By distributing stories prior to performing its full editing process, MT Newswires can give ICE clients several crucial minutes of exclusive advantage, compared to mechanical latency improvements that might deliver mere fractions of a second.

Horizon Plans Enhancements to Algo Framework

New modules will allow users to modify certain aspects of algorithmic code.