Algorithmic trading

Mexico's BMV to Use Nasdaq Smarts for Market Surveillance

Smarts will help monitor predatory HFT practices

RiskVal, Quantitative Brokers Partner on Fixed Income Trading Platform

RVQB will use QB's algorithm Legger in an end-to-end platform

Clearpool Unveils Iris in Aim to Improve Dark Pool Execution

Iris aims to combat more nimble high-frequency traders.

Waters USA 2014: Revisiting the Kill Switch Debate

Are kill switches efficient, or more trouble than they're worth?

Cantor Fitzgerald Adds IEX To Algo Suite

IEX's SOR and ATS will be used on Cantor Connect Clean Algo Suite

Waters USA 2014: Analytics in the Trading Landscape

Analytics technologies are evolving with the trading landscape

ITG Releases Posit Marketplace 3.0 Dark Pool Algorithm

In an effort to effectively tap dark pool liquidity and leverage the tools dark venues provide, brokerage ITG announced the launch of the Posit Marketplace 3.0 algorithm.

PDQ Rolls Out New Auction Venue

Alternative trading system PDQ has unveiled Auction1, an electronic equity auction designed for larger orders with heightened sensitivity to market impact.

Tabb Delivers ‘Clarity’ with Trade Data, Routing, Fill Rate Analytics

Research firm Tabb Group has unveiled a new trade data and routing analysis service, dubbed Clarity, that will help market participants monitor and benchmark the impact on execution price performance of routing strategies for US equities trades that…

Tabb Unveils Trade Routing, Fill Rate Analysis Service to Improve Buy-Side Execution

Research firm Tabb Group has unveiled a new trade data and routing analysis service, dubbed Clarity, that will help market participants monitor and benchmark the impact on execution price performance of routing strategies for US equities that include…

ConvergEx Enhances Open-Close Algorithms

New York-headquartered brokerage ConvergEx has upgraded its opening and closing auction algorithms for the NYSE, NYSE Arca and Nasdaq exchanges.

September 2014: Change Is the Only Constant

Machine learning and artificial intelligences are reshaping algorithms into adaptive programs that can adjust on the fly, which Victor says could end up all but eradicating losses.

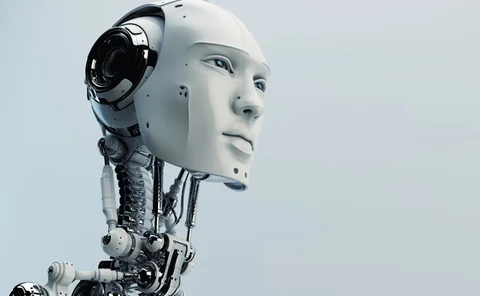

Ghost in the Shell: AI Expands Beyond Algos

As market movements become faster and more complex, it is impossible for humans to react quickly enough to those changes, requiring machines to step in. Now, artificial intelligence is extending its reach beyond algorithms, permeating other aspects of…

Neonet Enhances Functionalities with Visual Trader Platform

Agency broker Neonet has announced the enhancement of its trading interface with Visual Trader, the Spanish trading platform owned by Bolsas y Mercados Españoles (BME).

European Firms Grapple with Algo-Tagging Rules

Although the flagging and tagging of algorithms is only currently required in Germany, under the German HFT Act, it is slowly making its way into Pan-European law. Marina Daras looks at the German rule to see how the algo labeling requirement under Mifir…

TradingScreen Launches PairsHub

Technology vendor TradingScreen has debuted PairsHub, its electronic execution interface that connects with pair-trading algorithms from tier-one investment banks.

Instinet Adds Philippines Support

Instinet has announced that the Philippines has become the 12th Asia-Pacific capital market to be added to its direct market access (DMA) and algorithmic trading platforms.

Volant Expands Execution Services through REDIPlus

Market-maker Volant Trading has rolled out extensions to its execution services for options traders, allowing them new capabilities through the REDIPlus execution management system (EMS).

TradeTech Paris: Mind the Gap

The annual TradeTech event taking place in Paris has triggered a lot of debate, ranging from the legitimacy of high-frequency trading (HFT) practices, to the need for accurate and reliable Transaction-Cost Analysis (TCA) tools and the future of dark-pool…

Flash Boys: Michael Lewis' Latest Book Makes Waves Across the Capital Markets

The release of Michael Lewis' latest book, Flash Boys, has caused a stir on Wall Street. Since Monday, the author and his interviewees, as well as his depicted villains, have been plastered across television programs and the internet, defending and…

FBI Probes Ultrafast Trading

The Federal Bureau of Investigation (FBI) is investigating high-speed buying and selling of securities on US markets, in an attempt to determine whether firms engaged in this practice are contravening rules on insider trading.

Panel Scrutinizes Trading Algos and Visualization Tools in FX Market

A panel of foreign-exchange (FX) practitioners analyze the results from the recent Tibco-sponsored survey on FX trading practices, arguing that electronic trading in the asset class doesn't necessarily equate to algorithmic trading.

Simulation Tools Key as Managed Futures Funds, CTAs Optimize Execution

A potent mixture of in-house, futures commission merchant, and boutique brokerage-provided algorithms now play a part in commodity trading advisors’ and managed futures funds’ trading activities. Tim Bourgaize Murray examines why a new cadre of…

FXCM Integrates Seer Trading Solution for Algorithmic Testing

US-based foreign exchange (FX) broker Forex Capital Markets (FXCM), has integrated Seer Trading’s technology with its offering, giving clients the ability to test and develop algorithmic trading strategies.