Waters

Waters Rankings 2021 Winner's Interview: S&P Global Market Intelligence

Victor Anderson chats to Teddy Kahn and Eamon Troy about S&P Global Market Intelligence's AI category win in this year's Waters Rankings.

Charles River, Wave Labs team up for enhanced OEMS

The strategic partnership will involve a three-part integration including system connectivity, combined visualization and the creation of client feedback loops.

Waters Wrap: Can interop connect the bond market better than consortiums? (Yes)

Anthony says that if trading firms want to take advantage of new datasets in fixed income and advancements in machine learning, they’re going to first have to embrace interoperability.

People Moves: Exegy, SEC, Clearwater Analytics, KopenTech, Lightspeed, Databricks

A look at some of the key people moves from this week, including Craig Schachter (pictured), who joins Exegy as chief revenue officer

T+1—A Step in the Right Direction

Next-day or T+1 settlement of fixed income trades might seem a pipe dream, but there are few insurmountable operational or technology reasons why such a move cannot happen. As is invariably the case with the capital markets, the regulators hold the key,…

This Week: Symphony, Nasdaq, Interactive Brokers, Finos, MSCI, and more

A summary of some of the past week’s financial technology news.

Market data hopefuls await deadline with bated breath

August 9 is when regulators could approve the governance plan for the new system of datafeeds in the US. Jo says this would be an important step forward for those hoping to create new businesses under the regime.

Capitolis to acquire LMRKTS

Deal for multilateral compression provider latest in wave of post-trade tie-ups, as SA-CCR bites

As fixed income edges toward automation, the interop movement is cutting in

Valantic FSA, a European solutions provider, wants to remake the fixed-income tech scene in interoperability's image, taking on incumbents like Ion Group.

Cloud-based Data Services—Identifying the Benefits and Potential Pitfalls

At least one silver lining emerged from the Covid-19 pandemic for the financial services industry: most capital markets firms on both sides of the industry appear to have coped well with the initial disruption. Pretty much all of these firms have adapted…

Waters Wrap: Google-Symphony—Something to see here?

Anthony wonders if there are any tea leaves to be read as a result of Symphony migrating its platform from AWS to Google Cloud.

People Moves: Theta, Google, B2C2, Tourmaline, and more

A look at some of the key "people moves" from this week, including Paul Flanagan (pictured), who joins Theta as strategic sales advisor.

Show your workings: Lenders push to demystify AI models

Machine learning could help with loan decisions—but only if banks can explain how it works. And that’s not easy.

This Week: Bloomberg, Broadridge, Rimes, Glue42, and more

A summary of some of the past week’s financial technology news.

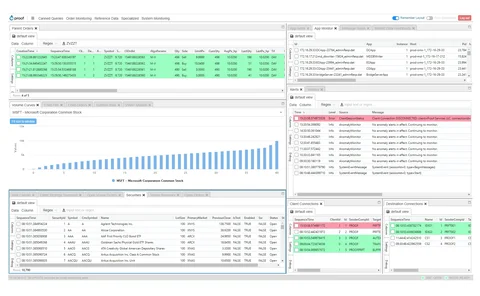

Burden of Proof: Meet the IEX breakaways looking to shake up broker algos

Founded with the principles of “transparency and academic rigor,” some say Proof’s model and technical approach is a test case for a new generation of cloud-native broker startups.

Holding Pattern: As Trading Technologies awaits new owner, the vendor adjusts development strategy

The Chicago-based futures trading platform recently rolled out a new OMS offering, while other projects, like its Echo Chamber market data platform, have been put on pause until a sale goes through.

Research management systems vie to double as data, analytics providers in one-stop-shop bid

RMS providers Sentieo and MackeyRMS feel the pressure to become quasi-data and analytics providers in their quest to cover the gamut of the buy-side research analyst workflow.

Swedish bank finds Covid-19 recovery insights in alt datasets

High-frequency data such as human mobility data and plastic shipments can help investment professionals understand the post-pandemic economic reopening.

People Moves: LedgerEdge, JP Morgan, MarketAxess, Enfusion, and more

A look at some of the key people moves from this week, including Michelle Neal (pictured), who has joined enterprise software vendor LedgerEdge as CEO of US operations.

Power to the People

Information is a valuable commodity in the financial services industry, although its real value is only fully realized when it is interpreted and shared across the business. This is the domain of Macrobond, which not only provides the broadest and…

Dutch asset manager turns to decision trees for currency predictions

APG has improved prediction accuracy for G10 currency movements after adopting decision tree-based machine learning.

This Week: Nasdaq, NSCC, State Street, OpenFin/Broadridge, and more

A summary of some of the past week’s financial technology news.