Waters

Limiting fat-finger errors: Using AI, the ESA and Mosaic aim to make traders more efficient

The European Space Agency is looking to apply space technology and AI to help financial firms better manage risk and find alpha-generating signals. Mosaic Smart Data is now four years into a partnership with the organization and is taking aim at…

LSEG-Tora: A tale of crypto, Asia expansion and (more) integration burdens

When LSEG acquired Refinitiv, it added Eikon, FXall, and AlphaDesk to its portfolio of execution platforms. In February, the exchange also bought Tora, which has a stronghold in Asia, as well as a presence in crypto. While sources say there are clearly…

Europe’s banks brace for Russia-backed cyber retaliation

Beefed-up sanctions on Russia’s largest banks spark IT security alert; 100s of computers brought down in Ukraine

Waters Wrap: Google’s cap markets play portends a shift in trade tech philosophies

According to Google’s Phil Moyer, the capital markets are shifting from a world where location determined liquidity, to one where accessibility will be the main differentiator for exchanges. Anthony explores what this could mean for trading firms going…

SmartStream 2021—SmartStream's Endeavors Not Going Unnoticed

SmartSteam’s endeavors haven’t gone unnoticed. It won the best AI technology and best sell-side middle-office platform categories in the 2021 Sell-Side Technology Awards, while in WatersTechnology’s Data Awards, it walked away with the best reference…

The good, the bad, and the ugly of financial democratization

From crypto and Web3 to Robinhood and Reddit, democratization underscores it all. While it’s a largely benign concept that aims to level the playing field between institutions and individuals, it’s also really hard to get right.

Eliminating the human touch: Examining RBC’s tech infrastructure evolution

The Canadian bank’s tech infrastructure unit is using Kubernetes as it looks to become a “truly end-to-end digital enterprise.”

This Week: SS&C; DTCC; LPA & More

A summary of the latest financial technology news.

People Moves: Tradeweb, Rimes, CME, LiquidityBook, and more

A look at some of the key people moves from this week, including Renaud Larzilliere (pictured), who joins Rimes as COO.

Asset managers seek greater transparency into ESG index providers’ ratings

While there is no consensus on whether ESG ratings providers should be regulated, asset managers largely agree that more transparency into their vendors’ methodologies is needed.

SEC sets its sights on fixed-income platforms with Reg ATS revamp

US regulator’s mammoth January proposal has something in it for most US trading systems, but Jo suspects it will be the definitions of exchanges that hit the hardest.

Memx data fees tackle professional vs. non-professional audit risk

The exchange delivers on its promise to reduce the cost of exchange data, but subscribers still face an administrative cost burden associated with the lower user fees.

Tech vendors rethink risk in era of surging options volume

As options volumes soar, technology vendors are thinking about new risks posed when legacy infrastructure meets increasingly complex markets.

People Moves: ASX, Nasdaq, Capco, FDIC, and more

A look at some of the key "people moves" from this week, including Edwin Hui (pictured), who joins Capco as executive director and APAC data lead.

This Week: Bloomberg/HSBC, Refinitiv/Microsoft, IBM, Jump Trading, & more

A summary of the latest financial technology news.

One view to rule them all: Buy side firms seek to unify their data

Asset management firms still struggle to consolidate their data so that it speaks the same language across different business lines. Some new SaaS-based investment management vendors are aiming to solve this.

Banks offer crypto clearing but, shhh, don’t tell

Top dealers clear crypto futures for select clients despite smorgasbord of risks

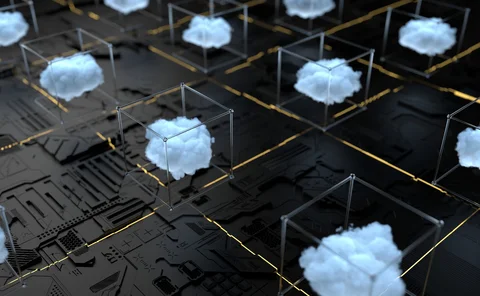

Waters Wrap: Data ownership & storm clouds brewing

Thanks to technological advancement, firms are finding new ways to monetize data. While the question of “who owns the data” was never a pressing one in the past, Anthony says that there are reasons to believe that will soon change.

Looming court battle could void SEC’s market data efforts

Litigation preview: What will the big exchanges argue in a court case to reverse the SEC’s initiatives?

People Moves: MarketAxess, FCA, Cowen, IQ-EQ, and more

A look at some of the key "people moves" from this week, including Nash Panchal (pictured), who joins MarketAxess as chief information officer.

This Week: SimCorp; Liquidnet; Appital; Qontigo & more

A summary of the latest financial technology news.

Cost, security concerns dampen banks' appetite for multi-cloud infrastructures

As firms make progress on cloud adoption, they are discovering that multi-cloud strategies for individual businesses can not only duplicate costs, but can also inadvertently downgrade a firm's resiliency.

How NN IP uses machines to read the market—and itself

Dutch manager being acquired by Goldman uses machine learning to ‘augment’ its analysts

Danske Bank turns to licensing optimization for cost savings in the millions

In a cloud world, IT asset management can save on operational and compliance costs and get the most out of software usage. But it's important to find the right people for the job.