Europe

Accelerated clearing and settlement, private markets, the future of LSEG’s AIM market, and more

The Waters Cooler: Fitch touts AWS AI for developer productivity, Nasdaq expands tech deal with South American exchanges, National Australia Bank enlists TransFicc, and more in this week’s news roundup.

DLT and digital contracts for market data: Has the hammer found the nail?

Waters Wrap: A new platform that a custom-made DLT underpins is coming to market. Anthony examines its merits and, surprisingly, finds a lot.

Bond CT hopeful Etrading unveils free tape prototype ahead of tenders

The vendor hopes to provide the long-awaited consolidated tape for bonds in the EU and the UK, demonstrating its ability to do so through ETS Connect.

Big xyt exploring bid to provide EU equities CT

So far, only one group, a consortium of the major European exchanges, has formally kept its hat in the ring to provide Europe’s consolidated tape for equities.

Hyperscalers to take hits as AI demand overpowers datacenter capacity

The IMD Wrap: Max asks, who’s really raising your datacenter costs? And how can you reduce them?

Market data woes, new and improved partnerships, acquisitions, and more

The Waters Cooler: BNY and OpenAI hold hands, FactSet partners with Interop.io, and trading technology gets more complicated in this week’s news round-up.

New study reveals soaring market data spend led by trading terminals

The research finds that 2024 was a record year for overall market data spend, supported by growth in terminal use, new license schemes by index providers, and great price variation among ratings agencies.

How to navigate regional nuances that complicate T+1 in Europe

European and UK firms face unique challenges in moving to T+1 settlement, writes Broadridge’s Carl Bennett, and they will need to follow a series of steps to ensure successful adoption by 2027.

JP Morgan, Eurex push for DLT-driven collateral management

The high-stakes project could be a litmus test for the use of blockchain technology in the capital markets.

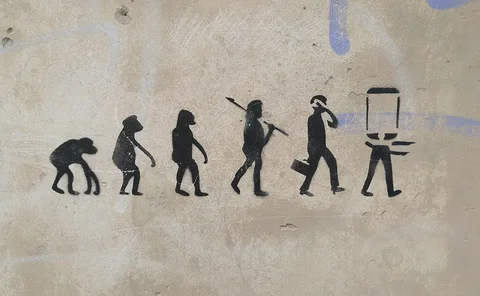

For AI’s magic hammer, every problem becomes a nail

A survey by Risk.net finds that banks are embracing a twin-track approach to AI in the front office: productivity tools today; transformation tomorrow.

‘I recognize that tree’: Are market data fees defying gravity?

What do market data fees have in common with ‘Gilmore Girls’ and Samuel Beckett? Allow Reb to tell you.

On GenAI, Citi moves from firm-wide ban to internal roll-out

The bank adopted three specific inward-facing use cases with a unified framework behind them.

FactSet-LiquidityBook: The buy-side OMS space continues to shrink

Waters Wrap: Anthony spoke with buy-side firms and industry experts to get a feel for how the market is reacting to this latest tie-up.

European exchange data prices surge, new study shows

The report analyzed market data prices and fee structures from 2017 to 2024 and found that fee schedules have increased exponentially. Several exchanges say the findings are misleading.

We’re running out of datacenters! (But maybe AI can help?)

The IMD Wrap: Datacenter and cloud adoption is being pushed to its limits by AI. Will we simply run out of space and power building AIs before AI figures out how to fix it?

Regis-TR and the Emir Refit blame game

The reporting overhaul was been marred by problems at repositories, prompting calls to stagger future go-live dates.

Agentic AI and big questions for the technologists

Waters Wrap: Much the same way that GenAI dominated tech discussions over the last two years, the road ahead will feature a lot of agentic AI talk—and CIOs and CTOs better be prepared.

Big questions linger as DORA compliance approaches

The major EU regulation will go live tomorrow. Outstanding clarifications and confusion around the definition of an ICT service, penetration testing, subcontracting, and more remain.

Artificial intelligence, like a CDO, needs to learn from its mistakes

The IMD Wrap: The value of good data professionals isn’t how many things they’ve got right, says Max Bowie, but how many things they got wrong and then fixed.

Data costs rose in 2024, but so did mitigation tools and strategies

Under pressure to rein in data spend at a time when prices and data usage are increasing, data managers are using a combination of established tactics and new tools to battle rising costs.

DORA flood pitches banks against vendors

Firms ask vendors for late addendums sometimes unrelated to resiliency, requiring renegotiation

In 2025, keep reference data weird

The SEC, ESMA, CFTC and other acronyms provided the drama in reference data this year, including in crypto.

CDOs evolve from traffic cops to purveyors of rocket fuel

As firms start to recognize the inherent value of data, will CDOs—those who safeguard and control access to data—finally get the recognition they deserve?

Band-aids vs build-outs: Best practices for exchange software migrations

Heetesh Rawal writes that legacy exchange systems are under pressure to scale to support new asset classes and greater volumes, leaving exchange operators with a stark choice: patch up outdated systems and hope for the best or embark on risky but…