Nasdaq OMX

Nasdaq Unveils Capital Venue for Private Companies

Nasdaq OMX has launched Nasdaq Private Market, its new capital marketplace for private companies.

Nasdaq Extends New Feed Tests

Nasdaq OMX has delayed the end of beta testing for a suite of enhanced datafeeds by two weeks to ensure direct feed subscribers have adequate time to test the new versions.

TPI, Nasdaq Ally for eSpeed Treasury Data, Sales Deal

Tullett Prebon Information (TPI), the data arm of interdealer broker Tullett Prebon, and Nasdaq OMX have struck a partnership for TPI to integrate benchmark US Treasury bond data from Nasdaq’s eSpeed electronic trading platform into its products and…

UTP Votes to Adopt Nasdaq SIP Recommendations

The UTP Operating Committee, the industry body that oversees the administration of the consolidated feed of quote and trade data on Nasdaq-listed stocks─known as Tape C or the Unlisted Trading Privileges (UTP) Plan─has approved recommendations put…

Exchange Data Revenues Run Gambit of Gains and Losses

Major exchanges reported a mixed bag of fourth-quarter financial results, with some reporting spectacular gains as a result of acquisitions and new initiatives, and others reporting lower revenues from data sales as a result of fewer subscriber numbers.

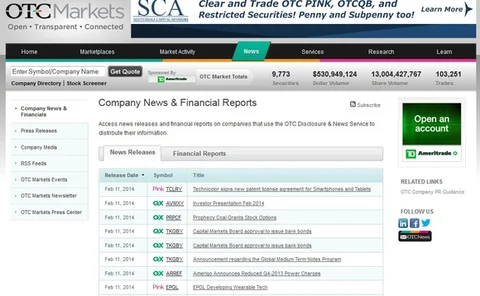

OTC Markets, Nasdaq Ally on Company News Distribution

New York-based over the counter equities exchange OTC Markets Group has struck an agreement with Nasdaq OMX to integrate its OTC Disclosure & News Service with Nasdaq's GlobeNewswire corporate news distribution platform for Nasdaq-listed companies,…

Nasdaq Opens Test Centers Ahead of March Datafeeds Migration

Nasdaq OMX has made test environments available in its Carteret, NJ and Ashburn, VA datacenters for clients to test live data in new versions of its market data feeds that the exchange will roll out next month.

TradeGuard is Nasdaq's New Risk Management Product

Nasdaq OMX has expanded and rebranded its risk management solution, FTEN, now known as TradeGuard.

Data Demand Drives Second Nasdaq India Office

Nasdaq OMX has opened a new development office in Bangalore, with the goal of boosting its global technology offerings and to meet growing demand in India for data products, exchange solutions and new listing opportunities.

Nasdaq Opens Bangalore Tech Unit

Nasdaq OMX has announced the opening of a new office in Bangalore, India, dedicated to technology development.

Nasdaq Quits SIP Over Lack of Tape Progress

Nasdaq OMX plans to cease operating the Securities Information Processor (SIP) that collects data on Nasdaq-listed stocks, calculates a best bid and offer, and distributes the consolidated feed of quote and trade data─known as Tape C or the Unlisted…

Hardware Failure Hits Nasdaq Options Data, Trading

Nasdaq halted trading in options symbols starting with the letters A through M on its Nasdaq Options Market on the morning of Friday, Jan. 10, after the exchange experienced an issue with processing data from the Options Price Reporting Authority.

Borsa Istanbul Takes Nasdaq Data, Trading Platforms

Nasdaq OMX will supply Turkish exchange Borsa Istanbul with technology and advisory services─including the provision of a new market data distribution system─under the terms of a deal that will also see Nasdaq take a five percent stake in the exchange,…

Borsa Istanbul Signs Landmark Deal with Nasdaq OMX

Borsa Istanbul, the Turkish stock exchange, has signed an agreement with Nasdaq OMX to strengthen its position as financial hub in the Eurasia region.

At Nasdaq, 2014 Signals a Change in Market Tech Customers

Nasdaq OMX’s customer base has changed in three ways over the course of 2013. All three began more than a year ago, but have accelerated that pace of late.

Nasdaq Delays New Feeds Test

Nasdaq OMX has delayed the start of testing for enhanced versions of its US equity datafeeds covering its Nasdaq Stock Market, BX and PSX marketplaces until the end of January.

2013 Review: Traders Weigh Importance of Fast Data vs Big Data

While still a focus for high-frequency traders with latency-sensitive strategies, the latency arms race appeared to have reached a stalemate in 2013, with low latency a necessity but ultra-low latency more of an expensive luxury, with some firms…

2013 Review: For Exchanges in 2013, Life’s a Glitch

US stock and options exchanges suffered such significant outages in 2013 that regulators step ped in to bring the markets to task over the failures, many of which were linked to problems with the exchanges’ ability to disseminate market data.

2013 Review: Data Licenses Cause Friction Between Exchanges, Users

As exchange revenues from traditional activities such as trading continue to stagnate, more trading venues continued to increase market data fees and to change licensing policies to charge fees for datasets they previously made available at lower rates…

InfoReach Adds eSpeed Fixed Income Data

Chicago-based trading technology provider InfoReach has integrated market data from Nasdaq OMX's eSpeed fixed income market into its trading application to support direct execution on eSpeed.

Nasdaq's Sears: FinQloud to Expand from Storage into Better Access

Nasdaq FinQloud's Julia Sears foreshadowed an expanded business model at Waters USA.

ADX Gets Ready for X-Stream

The Abu Dhabi Securities Exchange (ADX) has launched a series of tests ahead of its move to Nasdaq OMX's X-Stream trading platform.

US Exchanges, SEC Mull Anti-Data Glitch Proposals

In the past month, stock and option exchanges have agreed and submitted to the US Securities and Exchange Commission recommendations to strengthen the performance of the US capital markets infrastructure, following several well-publicized data failures…