MarketAxess

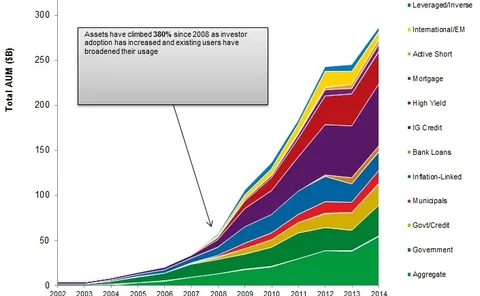

Fixed-Income ETFs: Pricing, Tech Evolve in This Rapidly Growing Space

The fixed-income ETF market is not yet 15 years old, but since 2007 the space has grown exponentially as institutional investors have taken notice of these increasingly liquid products. Anthony Malakian explores the reasons behind the interest in fixed…

MarketAxess Debuts ‘Axess All' EU Bond Trade Tape

Fixed income trading platform MarketAxess has launched Axess All, a service that provides aggregated pricing and volume for the most actively traded European bonds, and which the company describes as the industry's first intraday tape of trade data for…

MarketAxess Appoints Krein as Head of Research

Krein joins from Nasdaq OMX to lead institutional credit markets research.

T+2: Catalyst for Change

The move to a shortened settlement period from three days to two, commonly referred to as T+2, is set to shake up the European buy-side community when it comes into force on October 6. Marina Daras looks at the impact T+2 could have on transaction…

Tabb Appoints Perrotta as Head of Fixed-Income Research

New York-based research and consultancy firm Tabb Group has appointed industry veteran Anthony Perrotta as its new head of fixed-income research. Perrotta will report to Larry Tabb, the firm’s founder and CEO.

Swann Glides into Xtrakter Data Role

European fixed-income trade matching and regulatory reporting service provider Xtrakter has appointed Kevin Swann as head of data, responsible for the development and commercial direction of the company's data products.

MarketAxess Bows European BASI Liquidity Measure

New York-based fixed income marketplace operator MarketAxess launched a new indicator on Thursday, Feb. 6 called the European Bid-Ask Spread Index (BASI), which tracks liquidity in the European corporate bond market by comparing the prices of actively…

Consolidation, Algo Trading Coming to Corporate Bonds Platforms

At a recent Tabb Group conference on fixed income, a panel measured the electronic future of corporate bonds.

MarketAxess Expands Match to Wider User Base

MarketAxess has announced that its MarketAxess Trade Crossing Hub (Match) now offers a wider range of single-name credit-default swaps (CDS) to a larger universe of potential institutions.

MarketAxess SEF Online with Traiana's CreditLink

MarketAxess says it has completed the first live trade through its swap execution facility (SEF), using risk checks provided by Traiana's CreditLink hub.

MarketAxess Gains Temporary SEF Status

Electronic trading platform operator MarketAxess has received temporary approval from the US Commodity Futures Trading Commission (CFTC) to operate as a Swap Execution Facility (SEF).

MarketAxess Files SEF Application with CFTC

Electronic trading platform operator MarketAxess has submitted its application to the US Commodity Futures Trading Commission (CFTC), in order to become a swap execution facility (SEF).

E-Trading Corporate Bonds: Act Two?

In part one of his two-part feature on the electronic trading of corporate bonds, Jake Thomases traveled back in time to understand why an early explosion of credit trading platforms disappeared almost as soon as it arrived. In part two, he asks whether…

Liquidity Fragmentation in Fixed Income is Here to Stay, Says iTB CEO

Michael Chuang has made a big bet that history will not repeat itself when it comes to a massive collapse in the number of fixed income trading platforms.

What Does the Partnership Between BlackRock and MarketAxess Say About Aladdin?

BlackRock made big news last year by opening up its Aladdin corporate bond trading platform to the broader market. Some feel that its recent alliance with MarketAxess means it has already thrown in the towel.

MarketAxess Completes Xtrakter Acquisition, Appoints Urtheil

MarketAxess has completed its acquisition of Xtrakter, the former subsidiary of Euroclear, which provides regulatory transaction reporting.

Back to Basics

Features and functionality are nice, but without a decent front end, even the most advanced trading engine can have a false start.

Tough Times Ahead for the Broker-Dealer

Enhanced connectivity requirements, big bank resurgence and regulation all weigh heavy on the broker-dealer landscape.

Fixed Income special report

November 2012 - sponsored by: MarketAxess, MTS

MarketAxess to Expand Xtrakter Data, Post-Acquisition

MarketAxess mulls expanding Xtrakter's market data services as part of acquisition