BlackRock

As ETFs Grow, So Too Must Risk Models, Pricing Matrixes

Institutional investors represent 36 percent of a total $2.1 trillion US ETF pool.

SR Labs Bolsters Management Team with FinTech Vet Nagy

Appointment of industry veteran will strengthen the vendor's management for the next level of growth, officials say.

Robomania's Robust Rise

How much should institutional investors look into the fresh influence of robo-advisors?

APFIC Panel: Buy Side: Complexity, Cost Top Asia Data Challenges

Buy-side firms in Asia are dealing with Increasingly complex asset classes, customer requirements and regulatory environments

Buy Side Still Taking Wait-and-See Approach to Symphony

Palo Alto, Calif.-based startup messaging provider Symphony Communication Services has attracted investment from a "Who's Who" of 19 financial institutions plus more than $100 million raised in a recent round of funding from investors including tech…

Achieving Alpha: Can Data Lead the Way?

APFIC panel asks: Is data a value-add for the buy side?

BlackRock's Godrich: OpenStack, Software-Defined Data Centers Increasingly on the Rise

The money manager's chief technologist sang the praises of open-source technologies at BST North America.

Beyond the Credit Crunch: The New Credit Risk Landscape

John Brazier takes a look at the credit risk space to find out what has really changed since the credit crunch.

JPMorgan Asset Management's Curt Engler: Building Bigger Better

As head of trading for JPMorgan Asset Management’s massive US equities desk, Curt Engler talks his firm's growing buy-side presence.

BlackRock Buys FutureAdvisor, Bolstering Robo Capability

Money manager chases Fidelity into automated portfolio construction.

Bringing Standardization to the Fixed Income ETF Space

BlackRock and several other fixed-income heavyweights are joining forces to provide a new standard to calculate yield, spread and duration for fixed income ETFs.

Bringing Standardization to the Fixed Income ETF Space

BlackRock and several other fixed-income heavyweights are joining forces to provide a new standard to calculate yield, spread and duration for fixed income ETFs.

Darkness Rising: Can Dark Pools Cure What Ails Credit Trading?

There is widespread agreement that buy-side firms need to trade with each other to boost dwindling credit market liquidity, and at least 15 platforms are preparing to make it happen. In part one of this two-part feature, Kris Devasabai looks at the…

Real-Time Risk: One Size Doesn't Fit All

Real-time risk management can be a vital tool to HFT environments, but it can be a superfluous luxury to many other market participants.

Fixed Income Attribution May Be Messy, But Apply It to Alternatives, Presenters Tell TSAM

Congress delegates discussed ways to fix, expand attribution processes.

Nevirs Trades BlackRock for Franklin Templeton

Data vet has also served at Interactive Data, Thomson Financial and Moody's over a 24-year career in market data.

No Risk Management Without Technology, Says Blackrock’s Fishwick

Technologies that underpin investment risk management are fundamental says Blackrock co-chief risk officer.

BlackRock Ups Counterparty Due Diligence with Thomson Reuters Org ID

Buy-side giant complements existing process with outsourced service.

Japan Unconvinced of Big Data’s Potential

Firms still waiting for 'eureka' moment on Big Data's value in capital markets.

Notebook: Some More Industry Feedback on Fixed-Income ETFs

Industry experts give their thoughts on the fixed-income ETF space.

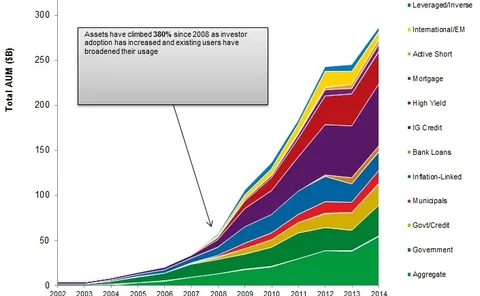

Fixed-Income ETFs: Pricing, Tech Evolve in This Rapidly Growing Space

The fixed-income ETF market is not yet 15 years old, but since 2007 the space has grown exponentially as institutional investors have taken notice of these increasingly liquid products. Anthony Malakian explores the reasons behind the interest in fixed…

Old Bonds, New Pillars

Where to go for analytics-based intelligence is changing with needs.

Competing on Tech Keys BNP Paribas Sec Services' Growth, Says CEO

Acquisitions, analytics demand significant investment

Rebuffing HFT, Nine Buy Sides to Launch Luminex Dark Pool

Fidelity will have the largest ownership stake in Luminex Trading & Analytics