News

Ex-First Derivatives' Richards Starts Advisory Firm

Dale Richards, previously a data management executive and strategist at First Derivatives, has founded Island 20 Ventures, based in Toronto

ICBC Financial Services Uses XSP to Adopt ISO 20022

Industrial and Commercial Bank of China Financial Services is now using the XSPrisa software from SunGard's XSP business to process corporate actions in ISO 20022, rather than using the DTCC's CCF files

xCelor Adds FPGA Filtering, ‘Muxing’ to Single-Digit Nanosecond Switch

Chicago-based low-latency switch and data technology provider xCelor has released a new version of its XPM switch series, XPM², that allows users to run their own applications on the switch itself, and adds features for filtering incoming multicast…

Nasdaq Increases UTP Tape SIP Capacity

Nasdaq OMX, operator of the Securities Information Processor (SIP) for the consolidated feed of quote and trade data on Nasdaq-listed stocks—known as Tape C, or the Unlisted Trading Privileges (UTP) Plan—has announced that it will increase the bandwidth…

Bayes Analytic Preps Price Prediction Engine

Bainbridge Island WA-based startup Bayes Analytic is preparing to launch a new stock analysis and trading recommendation engine that leverages advanced trading algorithms and machine learning to predict future price movements based on past trading…

Estimize Hires Product, Design Heads

Estimize, a New York-based provider of crowd-sourced earnings estimates and mergers and acquisitions predictions, recently hired Josh Dulberger as head of product and analytics, and Cynthia Koo as head of design, to support the creation of its new…

BNP Paribas Securities Services Tackles Big Data Issue with NeoLink

BNP Paribas Securities Services’ CEO Patrick Colle says big data offers both opportunities and challenges.

Quartet FS Taps ‘Many-Core' Processors to Boost for ActivePivot V5

In-memory analytics technology provider Quartet FS is planning to roll out version 5 of its ActivePivot data aggregation and analytics platform in June, which features improved microprocessor technology that will make the platform 10 times faster,…

Twitter Acquires Firehose Provider Gnip

Social media network Twitter has announced its acquisition of Gnip, a data provider that is one of the few to have access to the so-called "firehose" of the micro-blogging service's information.

Seeking Alpha Mulls Breaking Out Research Platform into Separate Subscriptions

Financial news, analysis and transcript website Seeking Alpha is considering spinning off components of its investment research platform into standalone products in order to reach a broader audience of hedge funds, investment advisors and retail traders.

GW&K Taps Fidessa Sentinel For Compliance

The $20 billion Boston-based investment manager will use the vendor's Sentinel Compliance Service to reduce operating costs across its taxable fixed income, municipal fixed income, institutional, advisory, and private client businesses.

Sell-Side Technology Awards 2014: The Winners

Waters magazine is pleased to announce the winners of the second annual Sell-Side Technology Awards. The Awards were held on Tuesday evening, April 15, at the Marriott Marquis in New York.

Deutsche Börse, Thai Exchange Ink MoU

Deutsche Börse and the Stock Exchange of Thailand (SET) have signed a Memorandum of Understanding (MoU), which will see the two venue operators enhance securities and derivative market links between Germany and Thailand.

Clearstream Approaches Taiwan Direct Settlement

International central securities depository (ICSD) Clearstream has announced that it has moved a step further towards enabling direct settlement in Taiwan, by opening an account with the country's CSD.

Cordatum Appointed Sales Agent for Financial Machineries' Trade Data Analytics

Cordatum Associates, a London-based consultancy providing advisory services around market data sales and procurement to content providers has signed a global sales agreement to act as sales agent for Milan-based startup risk and quantitative analytics…

What Data Will Be on the Cloud in Three Years? No Idea

Asked what type of data they might put onto a public cloud in two or three years that they aren’t putting on the cloud now, the members of an infrastructure modernization panel at the North American Trading Architecture Summit in New York couldn’t come…

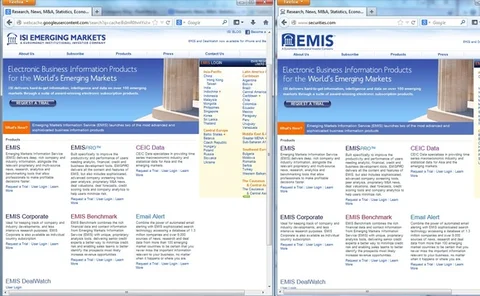

ISI Emerging Markets Rebrands as EMIS

Emerging markets data provider ISI Emerging Markets has changed its name to EMIS in a bid to simplify its branding and reflect its data product brands.

Options Cuts NJ Network Latency

Infrastructure-as-a-service provider Options (formerly Options IT) has reduced the latency on its network route between the vendor's datacenter facility in Carteret, NJ and CenturyLink Technology Solutions' (formerly Savvis) NJ2 datacenter in Weehawken,…

Sifma tells FSOC Chair: More Regulators Must Require LEI

The Securities Industry and Financial Markets Association has highlighted the fact that only one US regulation requires the legal entity identifier and more than twice as many entities in Europe have registered for the identifier than in the US

Twitter Buys Tweet Data Distributor Gnip to Grow Social Data Biz

Social media microblogging site Twitter has acquired Boulder, Colo.-based social media aggregator Gnip for an undisclosed sum.

EC to Clarify FX Reporting Rule Under EMIR

The European Commission (EC) has launched a public consultation in an attempt to clarify and harmonize the definition and reporting of derivatives contracts falling under the European Market Infrastructure Regulation (EMIR).

Volante Adds Hadoop Support for Big Data Management

Integration of Hadoop into the Volante Designer data integration product will help users avoid manual development work when creating Hadoop-based applications

Data Tech Vet McDowell Moves to Ullink

Simon McDowell, a veteran technology and operations executive at several data technology vendors, has joined trading technology and connectivity services provider Ullink as global sales operations director.

Moscow Exchange to Publish New Russian Market Volatility Indicator

The Moscow Exchange announced that, starting Wednesday, April 16, it will begin publishing a new index that provides an indicator of Russian volatility designed to give investors and traders a wider range of tools to assess the market.