Feature

Putting a price on your head (of data): The ROI of a CDO

The chief data officer has become recognized as a key role in a financial firm’s ability to manage its data assets, and reduce costs and risk. So why is it also so notoriously short-lived?

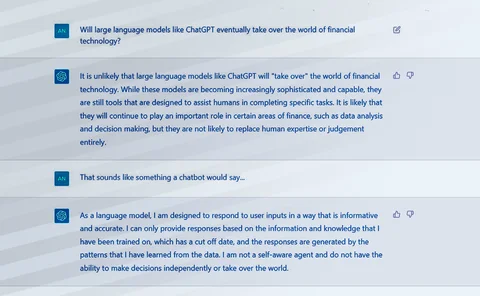

Large language models: Another AI wave has come—what could it bring?

Since the release of ChatGPT, excitement and hype have been abundant across industries for this form of generative AI. For capital markets, the wave of innovation that could result may be a few years away but it’s worth paying attention to—and being…

Financial firms rethink after cyber insurance premium spike

Brokers say there are signs pressure is easing, but quantum hacking threat could transform market

Can algos collude? Quants are finding out

Oxford-Man Institute is among those asking: could algorithms gang up and squeeze customers?

Banks express concern over top venues’ bid for EU consolidated tape

End-users are worried about the repercussions of handing over a data monopoly to the heavyweight operators in the fixed income space.

Reg SCI expansion set to increase broker-dealer systems scrutiny, reporting

The SEC is preparing to drastically expand the scope of Regulation SCI, which covers IT systems critical to the smooth functioning of the markets. But in the absence of formal proposals so far from the regulator, how can affected firms prepare for new…

Broken chains: how DLT code switch compounded ASX fail

Sources say that vendors will suffer the most in the fallout from ASX’s “paused” blockchain settlement project.

Bot’s job? Quants question AI’s model validation powers

But supervisors cautiously welcome next-gen model risk management

FX primary venues seek reversal of fortunes

EBS and Refinitiv fight to restore market share—but bilateral trading may be too entrenched, dealers say

Could cloud kill the data licensing debate and shake up pricing models?

Market participants say cloud has the potential to reimagine data licensing. But moving to the new operational model comes with a raft of unanswered questions.

Industry mulls identifier schema for digital assets

As crypto markets face a reckoning in the wake of the FTX scandal, standard-setters and industry participants say identifiers for tokens are key for the industry’s stability.

Chill winds blow for Capitolis’s equity swap platform

The fintech’s effort to revive off-balance-sheet funding runs into market and regulatory turbulence.

Data brain drain may prompt move to managed services for market data management

A shortage of data professionals with suitable experience to run large financial firms’ data organizations could drive firms to completely outsource the management and administration of their third-largest expense.

Gold standard: Are golden copies losing their luster?

The concept of a “golden copy” is well established. But what happens when buy-side firms want to differentiate themselves by launching new services, only to find themselves maintaining multiple “single” sources of data—or worse, none at all?

It’s amateur hour: examining retail trading and options data

Cutting-edge data shows non-professionals are driven by news events and a desire to make a quick buck.

DLT could give FX its ‘Netflix moment’

Blockchain’s proponents say faster settlement times make the technology akin to TV’s streaming revolution.

Pick a lane: Anna DSB to rival CDM coded swaps reporting?

Dual machine-executable rules are set to create choice—and maybe bifurcation—for swaps reporting

Amid macro storm clouds, a silver linings playbook for fintech

Banks and VCs believe inflation and rising interest rates will result in winners as well as losers

Putting location in its place: Geolocation data market contractions highlight importance of cost, context

All is not well for providers of geolocation data, with some slashing staff or shutting down entirely. Those still thriving are the ones who realize it’s no longer all about “location, location, location.”

From pharma to finance: Cracking the DNA of data management

Enterprise data management has traditionally addressed any aspect of financial data across an organization. But as investment firms’ portfolios of enterprise data broadens in definition to include other types of non-financial data, EDM projects must also…

Sell side ramps up outsourced trading desk services for still-skeptical buy side

A raft of new entrants are offering outsourced trading services to buy-side firms, anticipating a wave of takeup among larger asset managers, driven by cost and coverage needs. But are they aiming too high?

In the world of financial data, context—not content—is the new king

For years, the mantra of the market data world has been ‘content is king.’ But with trading strategies now more dependent on being able to see the big picture, the value of context could quickly overtake the data itself.

Plaintiffs in Cusips lawsuit argue the codes aren’t copyrightable

Firms file “aggressive” motion to have legal case resolved early, saying Cusip’s operators and owners have no basis to charge for the codes.

New datasets illuminate risky ‘pledged securities’ for investment analysis, due diligence

Until now, information around this opaque type of dataset has been hard to find, though it’s becoming increasingly important to financial analysts.