Emerging Technologies

Quants look to language models to predict market impact

Oxford-Man Institute says LLM-type engine that ‘reads’ order-book messages could help improve execution

The IMD Wrap: Talkin’ ’bout my generation

As a Gen-Xer, Max tells GenAI to get off his lawn—after it's mowed it, watered it and trimmed the shrubs so he can sit back and enjoy it.

This Week: Delta Capita/SSimple, BNY Mellon, DTCC, Broadridge, and more

A summary of the latest financial technology news.

Waters Wavelength Podcast: The issue with corporate actions

Yogita Mehta from SIX joins to discuss the biggest challenges firms face when dealing with corporate actions.

JP Morgan pulls plug on deep learning model for FX algos

The bank has turned to less complex models that are easier to explain to clients.

LSEG-Microsoft products on track for 2024 release

The exchange’s to-do list includes embedding its data, analytics, and workflows in the Microsoft Teams and productivity suite.

Data catalog competition heats up as spending cools

Data catalogs represent a big step toward a shopping experience in the style of Amazon.com or iTunes for market data management and procurement. Here, we take a look at the key players in this space, old and new.

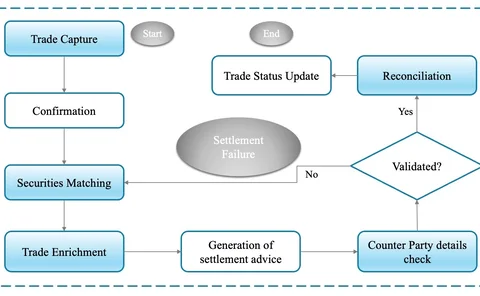

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.

The causal AI wave could be the next to hit

As LLMs and generative AI grab headlines, another AI subset is gaining ground—and it might solve what generative AI can’t.

This Week: JP Morgan, Broadridge, Lloyds, JSE, Schroders, and more

A summary of the latest financial technology news.

Tech spend, AI fuel JP Morgan’s fight against Big Tech giants

JP Morgan Chase, which has spent more than $15 billion this year on technology, intends to invest even more to compete against tech behemoths.

Waters Wavelength Podcast: Navigating the buy vs. build debate

Adaptive Financial Consulting’s Matt Barrett joins the podcast to discuss how firms decide to build or buy.

Getting up to speed: Shortwave Chicago-London link clocks under 25ms

Industry benchmarking body Stac reports audit findings on the latency and throughput of Raft Technologies’ Chicago-London links.

Europe’s AI Act is taking shape. How will the UK respond?

As the EU pushes through a historic AI Act, its neighbor is left wondering how to keep up.

This Week: Broadridge/UBS, Bloomberg, MarketAxess, ICE, and more

A summary of the latest financial technology news.

Google bullish on AI benefits in the face of fears over unchecked growth

Tech giant quells fears over a Skynet-style reality, stressing a risk-based approach to AI usage during a panel in London on Thursday.

Has cloud cracked the multicast ‘holy grail’ for exchanges?

An examination of how exchanges—already migrating to the cloud—are working to solve the problem of multicasting in a new environment.

This Week: FIX; DLT report; reporting fines; derivatives tech; startups and more

A summary of the latest financial technology news.

SEC squares off with broker-dealers over data analytics usage

The Gensler administration has ruffled feathers in the broker-dealer community with a new proposal seeking to limit their use of predictive data analytics. But at the heart of this deal is something far more seismic: one of the first attempts by the SEC…

Crypto ECNs aim to offer alternative to Clobs

CrossX and Cypator bring ECN-style trading and settlement to crypto, but rivals claim infrastructure isn’t ready

Waters Wrap: ICE, Nasdaq and differing views about cloud

As exchanges continue to embrace cloud, the decisions they make today will have long-lasting implications.

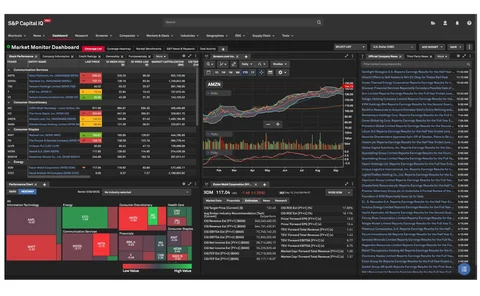

S&P tests ‘ChatIQ’ genAI search tool in revamped CapIQ desktop

The new tool is the culmination of integrating recent acquisitions, including IHS Markit, ChartIQ and Kensho.

This Week: EuroCTP, CME/DTCC, State Street, Broadridge and more

A summary of the latest financial technology news.

Waters Wavelength Podcast: How do firms create data products?

Standard Chartered’s David Sharratt joins the podcast to discuss creating data products.