Data Management

Hacked off: banks demand answers after Ion cyber attack

Clients have been left in the dark about the ransomware attack that disrupted futures trading last month.

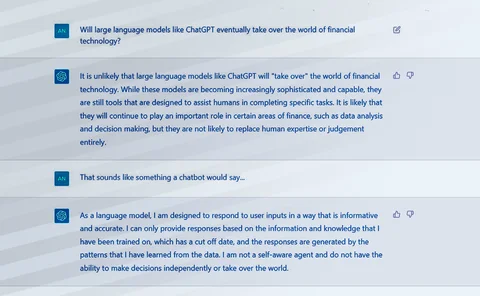

New chatbots reveal limitations of legacy API development

As large language models that underpin the likes of ChatGPT and Bard come to market, vendors and trading firms are starting to see the benefits—and challenges—that open APIs provide.

The buy-side burden: Capturing every document, everywhere, all at once

Ensuring that buy-side firms capture all relevant disclosures from funds—especially in the private markets—can be an onerous and costly task. Accelex is aiming to change that.

Market data consumers buy the same products at massively different price points

A new study finds that asset managers are paying several times more than their peers for the same services—but why? And can it be fixed? Does it need to be?

DTCC’s blockchain for CDS trades finds no takers

Sources say the industry is not yet ready to fully adopt wide-scale implementations of distributed-ledger technologies.

Index fees fatigue: Regulators, startups move in on the big 3 providers’ $5 billion business

Users of index data often complain about the fees they have to fork out, particularly to the likes of S&P, FTSE Russell, and MSCI. WatersTechnology examines the state of the industry and what will disrupt the status quo.

Waters Wrap: ChatGPT, data officers, and reaching new frontiers

As banks clamp down on large language models like ChatGPT, Anthony says that CDOs can help firms experiment with these chatbots while developing the proper governance structures.

After Xignite buy, ex-SunGard execs eye hedge funds, international markets for Quodd

Quodd’s recent acquisition of API data vendor Xignite will provide a springboard to launch the data vendor into new customer segments and markets.

Ion in the fire: three banks call in lawyers after hack

Banks are examining service-level agreements for possible breaches

Confidential computing won’t save you from data breaches—but it can help

A Google exec and a Stevens Institute director lay out the potential and the pitfalls of this emerging cloud computing technology for data protection.

Defendants in Cusip suit make their case for dismissal

Cusip Global Services and its affiliates have filed a joint motion to dismiss the anti-trust class-action lawsuit.

MSCI’s multi-cloud strategy aims to provide a new window into investment data

The MSCI One platform already runs on Microsoft Azure, and MSCI is building a new investment data platform on Google Cloud to utilize the search giant's AI and NLP capabilities.

Waters Wrap: The DTCC, Cusip and questions of a monopoly

While the companies that oversee Cusips find themselves embroiled in a lawsuit, Anthony questions where the DTCC stands in this unfolding drama.

After slow start, the ‘Big 3’ fixed-income consortium taps Finbourne as partner for CT bid

The Bloomberg, Tradeweb and MarketAxess consortium switched out its advisory firms at the end of last year to jumpstart its bid for the tape.

Privacy-enhancing tech and data pooling—a new way to turn the tide on financial crime

Technological innovations have given some players cause to hope that cross-institutional data sharing could become a reality in spite of concerns around data protection.

Ion: after the hack, the clean-up

Some clients are now using Ion systems again, but synchronizing data with CCPs could take days.

Ion cyber outage continues as banks rely on workarounds

ABN Amro, Macquarie, RBC among firms hit; ransom deadline tomorrow, but service may be down for days

Inside look: Taking aim at data processing blockages

A startup is looking to automate the bulk of banks’ data processing workflows.

SEC’s $5M Bloomberg BVAL fine targets ‘dark magic’ in fixed income pricing

Recent actions against Bloomberg and Ice for violations relating to evaluated pricing services suggest the US regulator may be setting the stage for stricter regulations to govern the sector.

Putting a price on your head (of data): The ROI of a CDO

The chief data officer has become recognized as a key role in a financial firm’s ability to manage its data assets, and reduce costs and risk. So why is it also so notoriously short-lived?

Large language models: Another AI wave has come—what could it bring?

Since the release of ChatGPT, excitement and hype have been abundant across industries for this form of generative AI. For capital markets, the wave of innovation that could result may be a few years away but it’s worth paying attention to—and being…

Waters Wrap: For data managers, the new problems are the same as the old

While much attention has been given to cloud, AI, blockchain and other buzzwords, without a proper data foundation, those tools will not deliver the results that have been promised.

Industry participants: ‘Digital Token Identifier’ aims to increase interop, usage

While some trading firms are welcoming the use of a new non-proprietary code for identifying digital tokens, the onus will be on local regulators to enforce its adoption.

Brown Brothers Harriman unifies busy suite of AI products

It’s a new world, contend BBH’s Kevin Welch and Josh Fine. After a few years of experimentation that yielded several AI products for the bank and its clients, it was time to put the puzzle pieces together to serve a different way of working post-Covid.