Northern Trust

Strategies and Practices to Maximize Opportunity Within the New Derivatives Market Webcast

Waters gathered leading industry experts for a webcast on May 15, 2013 to discuss the challenges of electronic trading in the over-the-counter derivatives market, including the pressure inflicted on infrastructure and the impact of associated regulations…

Northern Trust Unveils Online Form PF Solution

Northern Trust Hedge Fund Services, the fund administrating arm of the Chicago-based bank, has released a new online module that will allow clients to draft, review and finalize their Form PF submissions.

Looking for the Finish Line

Stories and features in the May issue of Inside Reference Data identify remaining hurdles for legal entity identifier, question how widely understood are the LEI's benefits, and explore drives to secure its value

Northern Trust Opens Office in Frankfurt

Northern Trust has opened an office in Frankfurt, Germany.

JP Morgan, Northern Trust Search For Data Quality

In an Inside Reference Data webcast, panelists shared the factors driving their work to improve upon data quality, and the obstacles affecting those efforts. Michael Shashoua reports

Client Reporting: The Road to Empowerment

Quarterly investment reports have long provided the sandwich filling between investment managers and their clients. Vendors have helped to automate the process, but Steve Dew-Jones considers how technology can take this process to the next level.

Building on Data Quality Foundations webcast

Inside Reference Data gathered leading industry experts for a webcast on April 17, 2013 to discuss how firms are dealing with new regulation and standards by improving data quality to better support data management for risk management purposes.

Getting a Grip On The Investment Book of Record

Accurate start-of-day positions are essential for the successful operation of the front office, but are not always immediately available. Nicholas Hamilton discovers how an investment book of record can be used to ensure portfolio managers and traders…

Front-Office Data Focus Spurs IBOR Push

Data management and aggregation are perennial challenges for all market participants. But for buy-side firms, elements of these disciplines have crystallized into an Investment Book of Record—an overview combining position-level data, cash flows,…

Risk, Cost and Geographical Concerns Limit Shorter Settlement Moves

As Europe moves towards T+2, or settling two days after trade date, moves to further shorten settlement cycles are unlikely to be mandated by regulators, panelists and attendees at the FPL EMEA Trading Conference said last week.

Optimize: The How and Who

Collateral optimization is a reality for a few institutions, an attainable goal for a few others, and a pipe dream for the rest. In the second part of his feature on optimization, Jake Thomases checks in on who is optimizing and who isn’t, and on what an…

AIFMD: No Alternative to Harmonization

With the Level 2 measures of the Alternative Investment Fund Managers Directive now published, managers and third-party providers are analyzing whether they have all the data and technology they need for compliance

Northern Trust Adds Risk, Performance Info to Data Direct Platform

Northern Trust announced that it is adding additional risk and performance data that will allow institutional and wealth management clients to make more informed comparisons through its Data Direct offering.

Optimize: The Whens and the Whys

Collateral optimization systems are coming into vogue as a means of handling some of the obligations of Dodd–Frank and EMIR. In part one of a two-part feature, Jake Thomases examines exactly what about the current market is prompting the adoption, and…

Bridgewater Taps Northern Trust for Hedge Fund Servicing

Bridgewater Associates has selected Northern Trust for hedge fund servicing as it tries to improve its middle- and back- office processes.

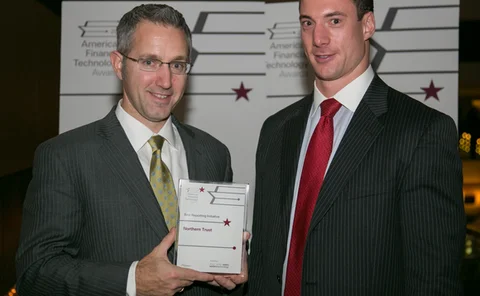

American Financial Technology Awards 2012: The Winners and Why They Won

The American Financial Technology Awards, now in their eighth year, seek to acknowledge the best IT projects, driven by buy-side and sell-side end-users themselves. Waters congratulates this year’s winners.

American Financial Technology Awards 2012: Best Reporting Initiative — Northern Trust

Often, the best IT implementations are paradoxically those that reduce users’ reliance on IT. When Northern Trust went looking to replace its legacy enterprise reporting system, this was exactly what the firm was trying to achieve. As Dan Houlihan, head…

Northern Trust Brings on Grady for Fund Services

Chicago-based Northern Trust has hired longtime State Street employee Nancy Grady as head of fund administration and fund accounting for North America.

Waters Announces 2012 American Financial Technology Awards Winners

Last night, Waters hosted the eighth annual American Financial Technology Awards banquet, following the Waters USA conference, at the New York Marriott Marquis in Times Square.

Wells Fargo Exec: Some Hedge Funds Uncomfortable With Vendors' Evaluated Prices

A valuations executive at the fund administrator told delegates at this week's Frankfurt Financial Information Summit that although pricing and valuations vendors believe they have become much more transparent, some hedge funds are still not comfortable…

Euroclear To Launch Online Service For Corporate Actions

EasyWay has been developed in close collaboration with five financial firms and will provide users with a consolidated view of corporate actions data, including uninstructed balances, pending instructions and tri-party collateral

Price, Value, Track: Data the Missing Link in Reformed Swaps Execution

The industry is rapidly confronting swap execution facilities (SEFs), but initiatives surrounding lesser-traded contracts and standardization are required to bring to the swaps market true transparency.