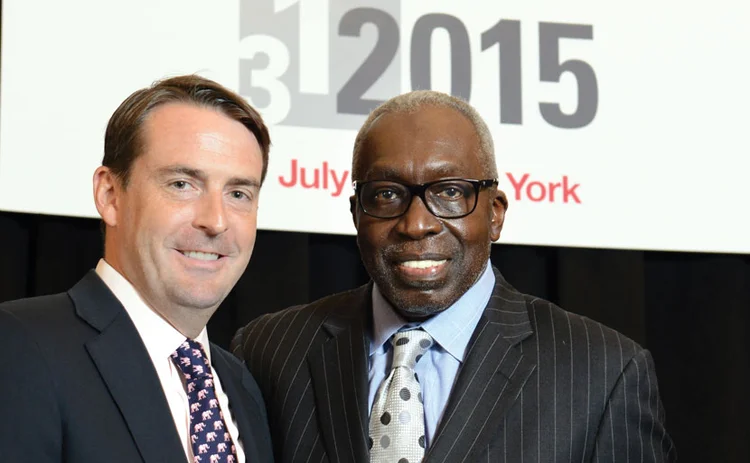

Waters Rankings 2015: Best Crossing Network Provider ─ Instinet

Instinet wins for the second year in a row.

Instinet and its central limit order book (CLOB)-style dark pool CBX has once again taken the top spot among the industry's crossing network providers. It's the second straight year that Instinet, the New York-based, agency-only broker owned by Nomura, has won the category.

According to Tom Whelan, managing director for Instinet, the fact that CBX has no tiering or special internalization is one of the reasons why it's been voted by Waters' readers as the crossing network of choice for the second consecutive year.

"It's in an agency wrapper, and the fact that the technology is sound and we don't really have any issues, people can really count on it," Whelan says. "People like the liquidity that's there. You know exactly what you're getting with time-price priority."

Instinet's latest enhancements to the CBX platform this past year were a US Volume Weighted Average Price benchmark cross (VWAP cross) and Market On Close Cross benchmark cross (MOCX).

The former, according to Whelan, has seen good growth rates, doubling in size since last year. A significant reason for that increase is due to adjusting its messaging option. With the VWAP cross, which is forward priced, Instinet provides the option to hold on to the fills instead of issuing them back. Only a balance, not a trade, is given back, and the shares are held on to. This option proved to be better for some firms in terms of workflow, according to Whelan, and caused an increase in participation.

MOCX, which is currently in the midst of a soft release, allows firms to match, offsetting market on close orders. Instinet's product suite has access to MOCX, offering a workflow to route unfilled orders to various exchanges for the closing auction.

"Our consistency and our agency model are reasons that people trust us and come to all of our services and products every day," Whelan says. "I think sound technology, that's part of it. We're up and available every day and have very few problems."

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Awards & Rankings

Witad Awards 2025 winner’s interview: Maureen Downs (Connamara Technologies)

Video interview with Connamara Technologies co-founder, and winner of the trailblazer vendor category in the 2025 Witad Awards, Maureen Downs

Buy-Side Technology Awards 2024 winner’s interview: FactSet

Video discussion on FactSet’s trio of wins in the 2024 BST Awards

Witad Awards 2025: Vendor professional of the year (business development)—Ripple Bhullar, Kyndryl

Ripple Bhullar, vice president, head of US capital markets and diversified, at Kyndryl, wins vendor professional of the year (business development) in the 2025 Women in Technology and Data Awards.

Witad Awards 2025: Technology leader of the year (vendor)—Mary Cecola, Broadridge Financial Solutions

Mary Cecola, CTO for asset management at Broadridge Financial Solutions, wins technology leader of the year (vendor) in the 2025 Women in Technology and Data Awards.

Witad Awards 2025: Trailblazer (Lifetime achievement) award (vendor)—Maureen Downs, Connamara Technologies

Maureen Downs, co-founder and chair of Connamara Technologies, wins the Trailblazer (Lifetime achievement) award (vendor) in the 2025 Women in Technology and Data Awards.

Witad Awards 2025: Legal/compliance professional of the year—Devi Shanmugham, Tradeweb

Devi Shanmugham, global head of compliance at Tradeweb, wins legal/compliance professional of the year in the 2025 Women in Technology and Data Awards.

Witad Awards 2025: Technology innovator of the year (end-user)—Ruchi Acharya Saraswat, RBC Capital Markets

Ruchi Acharya Saraswat, managing director, head of strategy and transformation, business and client services technology at RBC Capital Markets, wins technology innovator of the year (end-user) in the 2025 Women in Technology and Data Awards.

Witad Awards 2025: Best company for diversity and inclusion (end-user)—BNP Paribas Portugal

BNP Paribas Portugal wins best company for diversity and inclusion (end-user) in the 2025 Women in Technology and Data Awards.