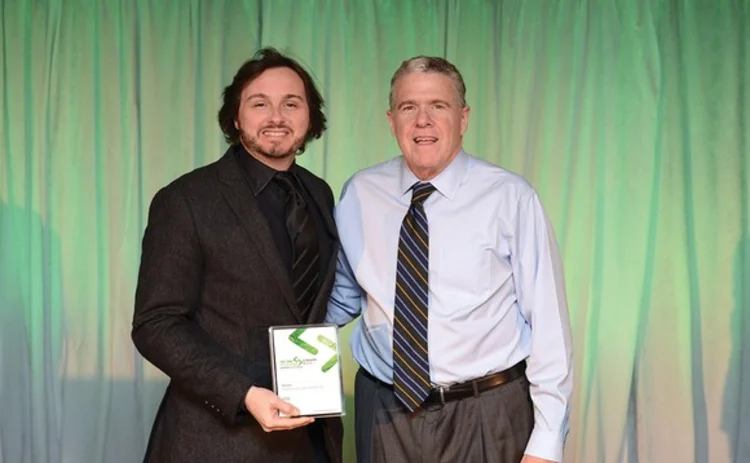

Sell-Side Technology Awards 2016: Most Promising Sell-Side Start-Up — R3

The firm was founded in September 2015 by a consortium of nine banks (that number has since swelled to 43)

One has to look no further than Markit's phenomenal success for an illustration of this efficacy: Back in 2003, Lance Uggla, the firm's erstwhile CEO, and a group of similarly minded credit default swaps (CDS) dealers sought to introduce transparency to the CDS market by producing a daily CDS pricing service underpinned by a consortium of banks' end-of-day CDS prices, which Markit would assimilate, homogenize, and sell back to the banks the following morning just before the market open. In many respects, New York-headquartered R3's story mirrors that of Markit.

The firm, founded in September 2015 by a consortium of nine banks (that number has since swelled to 43)-Barclays, BBVA, Commonwealth Bank of Australia, Credit Suisse, Goldman Sachs, JPMorgan, Royal Bank of Scotland, State Street, and UBS-wins this year's most promising sell-side startup for its work on the blockchain and distributed-ledger fronts. This is only the second year this category has been on offer, with Green Key Technologies winning the inaugural award.

Given the number technology firms currently evaluating or dabbling in blockchain and distributed-ledger technology, how has R3 gone about differentiating itself in what is likely to be a market that witnesses significant growth in the near future, along with large numbers of casualties offering nothing more than “me-too”-type services? According to R3, rather than building a blockchain or distributed ledger solution in isolation and then taking it to the banks, it has been collaborating with them from the off, allowing it to identify and address industry challenges first-hand. R3 and its partners collaborate on research, experimentation, design, and engineering to develop enterprise-scale shared-ledger solutions to meet banking requirements for security, reliability, performance, scalability, and audit.

R3 illustrates its considerable promise by also winning the best overall product of the year category (see page 60), even though the firm is a technology provider but does not have a product per se. So, does the support of a large number of banks guarantee success? No, but it does provide the consortium with a vested interest in ensuring R3’s future, and, if the industry’s futurists are to be believed and that 2016 is the year that blockchain and distributed-ledger technology starts to permeate large numbers of business processes, R3 has a bright future.

And, given that David Rutter, ex-chief executive of interdealer broker Icap, is at the firm’s helm, it’s only reasonable to expect big things from R3.

R3 and its partners collaborate on research, experimentation, design, and engineering to develop enterprise-scale shared-ledger solutions to meet banking requirements for security, reliability, performance, scalability, and audit.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Awards & Rankings

Women in Technology & Data Awards 2025 winner’s interview: Kaja Zupanc (Duco)

Kaja Zupanc won the Data science professional of the year (vendor) category in the 2025 Witad Awards.

Witad Awards 2025: Risk professional of the year—Anne Leslie, IBM Cloud

Anne Leslie, cloud risk and controls leader for EMEA at IBM, wins risk professional of the year in the 2025 Women in Technology and Data Awards.

Women in Technology & Data Awards 2025 winner’s interview: Maureen Downs (Connamara Technologies)

Interview with Connamara Technologies co-founder, Maureen Downs.

Buy-Side Technology Awards 2024 winner’s interview: FactSet

Video discussion on FactSet’s trio of wins in the 2024 BST Awards

Witad Awards 2025: Vendor professional of the year (business development)—Ripple Bhullar, Kyndryl

Ripple Bhullar, vice president, head of US capital markets and diversified, at Kyndryl, wins vendor professional of the year (business development) in the 2025 Women in Technology and Data Awards.

Witad Awards 2025: Technology leader of the year (vendor)—Mary Cecola, Broadridge Financial Solutions

Mary Cecola, CTO for asset management at Broadridge Financial Solutions, wins technology leader of the year (vendor) in the 2025 Women in Technology and Data Awards.

Witad Awards 2025: Trailblazer (Lifetime achievement) award (vendor)—Maureen Downs, Connamara Technologies

Maureen Downs, co-founder and chair of Connamara Technologies, wins the Trailblazer (Lifetime achievement) award (vendor) in the 2025 Women in Technology and Data Awards.

Witad Awards 2025: Legal/compliance professional of the year—Devi Shanmugham, Tradeweb

Devi Shanmugham, global head of compliance at Tradeweb, wins legal/compliance professional of the year in the 2025 Women in Technology and Data Awards.