Trading Tech

Jonathan Kellner to Lead MEMX

The former CEO of Instinet is named as the head of the newest US stock exchange.

MarketAxess' Dutch Approval Gives Greenlight for EU Expansion

The firm will be authorized to operate its trading and reporting businesses from the Netherlands post-Brexit, enabling it to expand its footprint in the European markets.

Velocity Ledger Taps Prime Trust for Digital-Asset Custody

Velocity Ledger Financial will also soon launch an issuing-and-settlement platform to tie together different kinds of blockchains.

Hod Heads Strategy at Digital Asset

The data and fintech veteran will be responsible for identifying new areas of potential opportunity for the distributed-ledger technology vendor.

Blockchain Security Firm Curv Releases New Cryptography Protocol

The protocol, which aims to eliminate the need for private keys, will be baked into its new digital asset service.

ChartIQ Nabs Ex-Bloomberg Product Guru Sorenson to Drive Expansion

Sorenson's experience in driving product strategy for analytics applications will help ChartIQ accelerate its expansion.

Wavelength Podcast Episode 155: Martin Boyd of FIS; A Look at the CAT

First, some pointed comments about the Consolidated Audit Trail and then Martin Boyd discusses the fintech market.

Liquidnet is Rebuilding its Algo Infrastructure

The venue operator is building its own container to house current and future algorithmic offerings.

Bracing for Data Disruption in a No-Deal Brexit Scenario

In February, UK and EU regulators made announcements expected to shed light on the future of data sharing and alleviate some uncertainty post-Brexit, but industry experts say the latest statements fall short of lifting the real burden on affected firms.

CAT's Future Still Cloudy as NMS Committee Declines to Name New Processor

Technical specifications will remain the same even as the committee works on finding a new database operator.

Trading Technologies Debuts Infrastructure-as-a-Service Offering

Vendor embarks on new strategy with Graystone Asset Management as its first client on the platform.

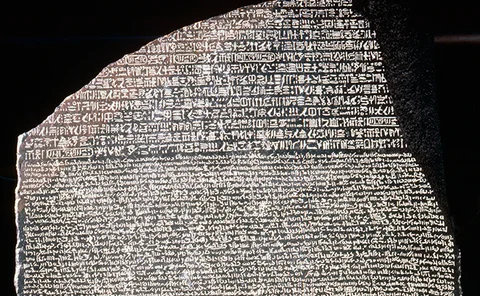

Firms Carve Rosetta Stones for Non-English AI Surveillance

Development of machine learning and natural-language processing is now turning to languages other than English to keep a better eye on traders and the market. But how easy is it to teach a machine a new tongue?

Lucena-WSH Alliance Broadens Buy-Side Exposure to Quant Event Data Signals

Lucena will provide a pre-packaged signal based on Wall Street Horizon's earnings dates revision data, for buy-side firms without the in-house resources to analyze the raw data themselves.

Crowded Alt Data Market Makes Standing Out Difficult for Providers

As alternative data companies battle for capital and a coveted spot in investment managers’ portfolio strategies, they are turning to bespoke marketing and partnerships to stand out in an industry where firms still struggle with data science resources.

Crypto Research Firm Chainalysis Gets $30 Million in Funding

The funding will be used to open a research hub in London.

CLS Sees Growing Buy-Side Demand for FX Settlement Risk Solutions

Buy-side participants are now more aware of the risks associated with FX settlement, and are getting more involved in managing them.

Banorte Digitizes Risk Operations

One of the largest financial institutions in Mexico is digitizing core risk and compliance functions to consolidate operations, reduce reconciliation costs and future-proof its IT infrastructure.

Wavelength Podcast Episode 154: Bryan Cross, UBS Asset Management

Bryan Cross, who heads UBS Asset Management's QED group, joins to discuss alternative data and AI.

Fundamental Interactions Launches Auto-Hedging Tool for New Exchanges

Automated hedging service aims to jump-start liquidity at start-up venues, using proprietary mechanics to minimize slippage and boost profitability.

CAT’s Tale: How Thesys, the SROs and the SEC Mishandled the Consolidated Audit Trail

WatersTechnology investigates the torturous journey to create a stock-trading database for the US, and where the project goes from here.

SGX Marches On

The SGX is focusing on "smaller" projects, rather than big-bang investments as it seeks to renovate and integrate its technology.

Crypto Markets Turn Traditional for Tools of the Trade

As interest in cryptocurrency trading refuses to wither, despite a bearish year, traders are increasingly calling for institutional-grade tooling from traditional markets to further develop the asset class.

JP Morgan's FX Algo Tool Launches on Bloomberg Terminal

Algo Central helps manage FX algo execution in real time.

Startup Fincross to Onboard Clients, Launch Crypto Custody in Q2

Subject to regulatory approval, the newly created digital asset investment bank plans to launch a custody solution in April.