Trading Tech

Startup Arialytics Exits Platform Sales, Re-Positions as Data Vendor; Nests with RavenPack

Rye, NY-based analytics startup Arialytics has repositioned its offering over the last six months to now solely sell predictive indicators generated by its Aria cross-asset-class predictive analytics platform─which the vendor unveiled last May─rather…

Access to Equity Syndication, Hedge Fund Allocation Drives Two-Sided Growth at US Capital Advisors

Boutique broker-dealers often grow out of teams leaving larger wirehouses, just as David King's did at UBS on the way to co-founding Houston-based US Capital Advisors (USCA). But like proprietary trading desks spinning off, these firms often discover new…

Imagine Adds New Risk Service, Eases Spreadsheet Reliance

Last week, Imagine Software announced it was expanding its Imagine Financial Platform (IFP) and App Marketplace with the launch of Imagine Risk Services. Officials say this latest rollout will provide users with greater customization for portfolio…

Datacom Expands TradeView Monitoring Appliance

East Syracuse, New York hardware switch vendor Datacom Systems has released version 1.6 of its FPGA-accelerated TradeView appliance for monitoring multicast gap, traffic and microbursts.

CME Clearing Europe Set To Expand Swaps Support

CME Clearing Europe, the Chicago Mercantile Exchange (CME) Group's European clearing house, has received Bank of England approval to add a number of derivatives to its interest-rate swap service.

CMC Picks Colt as Datacenter Provider

London-based derivatives dealer CMC Markets has signed a 12-year agreement with UK-based network and hosting services provider Colt to act as its preferred datacenter provider, in a move to boost operational efficiency and increase clients' connectivity…

Kinetix Adds New Regs Support to Data Compliance Tool

Princeton, NJ-based trading technology provider Kinetix Trading Solutions has added support for new regulations to the Pre-Trade Verification module of its Monaco trading platform, which combines market data with trading firms' databases of counterparty…

March 2014: Breaking the Habit

Microsoft Excel as an operational tool is as flawed as it is ubiquitous on Wall Street—even the regulators are guilty of over-reliance on spreadsheets—but Victor says cutting back on its use in favor of automated processes can mean serious long-term…

EFront to Streamline Portfolio Monitoring for Private Equity

EFront, a Paris-based provider of alternative investment solutions, believes its latest product will reduce the process of gathering portfolio company data by private equity investors from weeks to hours. FrontPM offers portfolio monitoring and analysis…

Interactive Data Adds MT Newswires' US, Canada News to Market-Q Desktop, App

Interactive Data has integrated US and Canadian news and analysis from MT Newswires─a division of Midnight Trader─into its Market-Q web-based data terminal and its accompanying Market-Q Mobile platform.

Aviva Investors Goes Live with Commcise Commission Management

London-based asset manager Aviva Investors has implemented a commission sharing agreement (CSA) and share-of-wallet management software solution from Commcise.

Perseus Buys TLV for Low-Latency CME-ICE Microwave Data

Network provider Perseus Telecom has acquired Broadview, Illinois-based TLV Networks, which operates a low-latency microwave network connecting Chicago-based futures exchange matching engines, from wireless network infrastructure design and management…

JSCC Taps Calypso for Client-Clearing Services

The Japan Securities Clearing Corporation (JSCC), a member of the Japan Exchange Group, has gone live with Calypso Technology’s system for client clearing of JPY interest-rate swaps (IRS) and collateral management.

Linedata Reporting Now Accessible On Mobile Devices

Linedata has made its Linedata Reporting service accessible via mobile devices, allowing end-investors access to real-time fund data when away from their desks.

Eris Exchange Achieves Open Interest Milestone: What's Next?

The venue's chief operating officer, Michael Riddle, discusses why more of the same is in store. After all, why fix what isn't broken?

Imagineer Partners with Abacus

Abacus Group, which provides hosted IT solutions to hedge funds and private equity firms, will host Imagineer Technology Group's Clienteer software platform in the AbacusFLEX private cloud.

Singapore Exchange Upgrades Corporate Actions

The SGXNet data entry portal and SGXNews information delivery service will collect and distribute data using ISO standard messages starting March 24, moving away from PDF submissions

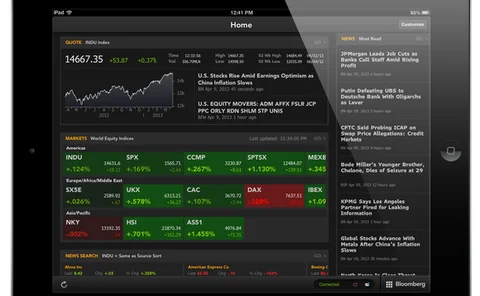

Regional Fixed Income Dealers Get Bloomberg Service

Bloomberg has unveiled its Electronic Trade Order Management Solution, or ETOMS, a managed service used by US regional broker-dealers to access and engage fixed income electronic markets as both liquidity providers and liquidity takers.

ASX Eyes Upgrade to T+2 Settlement

The Australian Securities Exchange (ASX) is considering shortening its settlement cycle for cash market trades in Australia.

Raiffeisen Bank Taps Broadridge for CEE Reconciliations

Broadridge Financial Solutions has announced it will provide automated reconciliation processing to Vienna-based Raiffeisen Bank International across six of the bank’s regional subsidiaries.

Tokyo Stock Exchange Offers Corvil Latency Measurement to Network Clients

The Tokyo Stock Exchange is to begin offering Dublin-based technology vendor Corvil's CorvilClear latency performance management solution to trading firms connected to its Arrownet network on an as-a-service basis, to provide them with visibility into…

Recognia Names CFO MacAskill New CEO

Ottawa, Canada-based technical analysis software vendor Recognia has appointed Kenneth MacAskill chief executive, replacing founder Rick Escher, who has stepped down from the CEO role but will remain actively involved in the company and its board of…

Bond Analytics Vendor Hessegim Adds Fitch ratings data

Israeli fixed income software provider Hessegim Software has added credit rating data from Fitch Solutions-the software arm of ratings agency Fitch-to its Prafis fixed income analytics desktop.

Moody's Analytics Adds Structured Finance Portal

The new web-based platform will provide enhanced content to a range of portfolio managers, underwriters, and risk professionals, with an initial focus on collateralized loan obligations (CLOs).