Resilience

DORA stalls over identifier dispute

A disagreement over how to classify third-party tech providers on a reporting form known as the “register of information” has held up preparations for the highly anticipated operational resiliency rule in Europe.

Industry associations say ECB cloud guidelines clash with EU’s Dora

Responses from industry participants on the European Central Bank’s guidelines are expected in the coming weeks.

Deciphering Dora and developing operational resilience

This webinar explores how firms can develop the necessary operational resilience to maintain the integrity of their services in the event of operational disruption

Big questions remain over Dora’s critical third parties

Industry looks for clarity on critical third parties ahead of July 17 regulatory technical standards for the EU’s Digital Operational Resilience Act.

Dora technical standards shoot for break in the clouds

One goal of the EU’s latest ICT risk act is to mitigate cloud concentration. Some experts say it may make it worse.

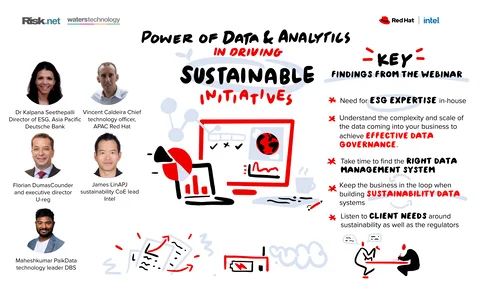

Operational resilience using the cloud

This webinar focuses on the business and operational benefits to firms on the back of their cloud strategies, across an industry that is often unforgiving to those not able to guarantee 100% uptime, operational robustness and competitiveness

Citi’s internal cloud project gets open-sourced

Through Finos, a project that started internally to help Citi get a better handle on its cloud controls now includes the likes of Goldman Sachs, Morgan Stanley, RBC, BMO and LSEG.

The IMD Wrap: Are server life extensions putting profits before performance?

Cloud providers are having to make more hardware available to keep pace with takeup—including older machines that under previous policies would have been retired already. But the move is proving profitable … and risky.

Dora ‘critical tech vendor’ designation could cast a wide net

Experts think cloud services, data providers and software firms are all in regulators’ sights.

Hacked off: banks demand answers after Ion cyber attack

Clients have been left in the dark about the ransomware attack that disrupted futures trading last month.

Ion cyber outage continues as banks rely on workarounds

ABN Amro, Macquarie, RBC among firms hit; ransom deadline tomorrow, but service may be down for days

Operational resilience and security drive DTCC’s agenda

As capital markets firms continue their digitization drive and look to the cloud for increasingly large swaths of their technology and data needs, they also inadvertently expose themselves to a range of operational risks.

Adaptive pushes low-latency open-source messaging

The London-based consultancy is looking to engage firms and exchanges on its Aeron messaging technology, which it acquired earlier this year.

If it ain’t broke, break it: Back-office tech reform may benefit front-office returns

Better data visibility across multiple systems could provide a driver for technological change in the world of post-trade.

BNY Mellon CDO: ‘Transformational’ data-centric model tackles data quality issues

BNY’s Eric Hirschhorn says processes—not just the data itself—need to be examined, and points to a data-centric approach.

Is an EMS an exchange? Vendors alarmed by scope of Reg ATS amendments

Some industry participants are worried that proposed amendments to Regulation ATS could see the trading perimeter expanded to include a wide array of messaging systems.

Charles River adds AWS to build out multi-cloud strategy

The vendor is also using Microsoft Azure and is rolling out a new Ibor product in the cloud.

Reg ATS: SEC 'bowing to public pressure' in reopening proposal

The US markets regulator has extended the comment deadline on a proposal to regulate Treasuries venues after it faced a storm of complaints from the public and financial industry.

Cost, security concerns dampen banks' appetite for multi-cloud infrastructures

As firms make progress on cloud adoption, they are discovering that multi-cloud strategies for individual businesses can not only duplicate costs, but can also inadvertently downgrade a firm's resiliency.

From burst to bust: What happens when cloud runs dry?

After years of initial resistance, the capital markets have come to depend heavily on the compute capacity of the public cloud. But increasing market volumes are rapidly outpacing the cloud capacity that organizations thought would be sufficient for…

Risky business: Moody’s attempts to carve out space in overrun ESG market

In the past two years, Moody’s Analytics has acquired four vendors that the ratings specialist hopes to integrate for ESG offerings in a crowded market.