Python

Breaking out of the cells: banks’ long goodbye to spreadsheets

Dealers are cutting back on their use of Excel amid tighter regulation and risk concerns.

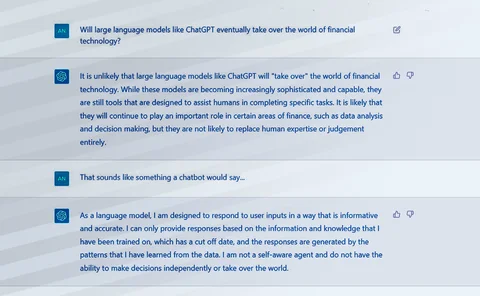

Large language models: Another AI wave has come—what could it bring?

Since the release of ChatGPT, excitement and hype have been abundant across industries for this form of generative AI. For capital markets, the wave of innovation that could result may be a few years away but it’s worth paying attention to—and being…

Bot’s job? Quants question AI’s model validation powers

But supervisors cautiously welcome next-gen model risk management

Academics use granular data for futures market predictions

Researchers at NYU’s Courant Institute of Mathematical Sciences are using granular futures data from BMLL for research on less-covered futures markets.

Man Group revamps data science platform to tackle data deluge

The London-based investment manager spent four “long and intense” years rewriting its data science platform, Arctic.

Slow burn to a big bang: How the new wave of tech is changing market data platforms

For decades, market data platforms have been critical components of financial firms’ trading infrastructures. But with changing user needs and emerging technologies gaining ground, will the platforms of the past be replaced by upstart challengers—or can…

Once taboo, open-source skills now sought by Goldman Sachs, Morgan Stanley and other top sell sides

The world’s biggest banks want the new talent to possess at least some open-source technology skills, which was unthinkable a decade ago. It’s a win for advanced open-source practitioners, but how did it materialize? The answer is likely a not-so-even…

Refinitiv’s CodeBook targets financial programmers with built-in data access

Since it soft-launched the coding environment last year, Refinitiv has added an item browser to allow coders to look up financial information.

UBS AM builds model for quantifying greening of heavy industry

The asset manager's quant research arm, QED, has published a framework for valuing companies in industries like cement or steel that transition to more sustainable tech.

Broadway Technology 2.0: Post-Ion split, the vendor reimagines its future

Broadway will look to build out its fixed income trading workflows, grow its as-a-service offering, lean into the low-code movement, while considering new asset classes to expand into—all while once again competing with Ion.

Esma to ink deal for big data capabilities

The regulator is ditching its legacy architecture to cope with massive volumes of reported data and new supervisory responsibilities.

Goldman inks modeling, data tie-up with MSCI

The move to cross-sell risk analytics could herald further content deals for the bank’s Marquee platform, says its sales chief.

Goldman Sachs Takes Aim at Interoperability, Analytics with Marquee Enhancements

The bank’s recent moves signal what could become a managed services offering, as Goldman further embraces cloud, open source, and APIs.

BMLL Now Has 5 Years of Order Book Data Available

Quants and data scientists can now access five years of Level 3 data through the vendor's Data Lab platform for use in alpha generation.

Refinitiv Begins Move Away from Eikon, Thomson One with Debut of 'Workspace'

The new platform is first being targeted at advisors and wealth managers, and will eventually be available for traders, analysts, portfolio managers, quants, and developers.

Data Issues Still Hamper AI—But AI Can Fix Them

Instead of waiting for data quality to be sufficient to power AI models, those at the cutting edge are building models to bridge the gaps in the data, and apply it to more sophisticated use cases.

Low-Code Movement Gains Converts, but Skeptics Remain

What if you could create your ideal, fully-functional application without writing a single line of code? With low-code and no-code platforms, you can—with a catch … or two, or three, or four.

Waters Wrap: The NEX Brand Slowly Disappears (Plus Market Data Fights & AI Integrations)

Anthony looks at what's become of NEX since the CME acquisition, as well as discussions over odd lot reform and S&P's Kensho implementation.

OneMarketData Advances on Cloud Migration and Extends Asset Class Coverage

The vendor will roll out new coverage across OTC derivatives, fixed income, and FX in the third and fourth quarters.

ActiveViam Embraces Python for its In-Memory Database

The vendor is building off its April release of an enrichment tool for Python notebooks.

RFA Taps AI for Managed Data Services Platform

Cloud data platform includes fully managed warehousing, ingestion, and analytics, with AI-enabled security functions.