Pricing & Valuation

A Transparent View of Pricing

As transparency becomes a key requirement in the pricing and valuations space, financial firms have many questions for their vendors about input data, market color and pricing methodologies, writes Nicholas Hamilton

Evaluated Pricing Head Blance Leaves SIX

Ian Blance has left SIX Financial Information after almost four years as head of its evaluated pricing business, and has returned to independent consulting. Mirko Silvestri fills Blance's former role at SIX.

Evaluation Stand-Outs

Regulatory demands push evaluated pricing providers to reveal more details of how they produce the data they have on offer. Max Bowie hears how end-users of data are collaborating closer with the providers as a result

Clarus Taps Icap Data for SEF Data Analysis

Clarus Financial Technology, a London-based provider of swaps benchmarks, reporting and analytics software, and risk management tools, is distributing benchmark derivative pricing from interdealer broker Icap as part of its SDRView Professional service…

Pricing: the Meaning and Impact of Transparency -- Webcast

On November 13, 2013, five industry experts took part in an Inside Reference Data webcast exploring how requirements for increased levels of transparency are affecting the pricing and valuations space

Nittan Capital Opts for GFI's Fenics Pro

Tokyo-headquartered interdealer broker Nittan Capital has deployed London-based interdealer broker GFI's Fenics Professional pricing and risk management system for foreign exchange options in its Singapore and Hong Kong operations to improve workflow…

Nittan Capital Chooses Fenics for FX Options Risk and Pricing

Nittan Capital, an Asia-Pac interdealer broker specializing in derivatives, has deployed Fenics Professional, a pricing and risk management system for FX options, in its Singapore and Hong Kong offices.

Nasdaq Goes to SPA for MFQS Makeover

Nasdaq OMX's Mutual Fund Quotation Service (MFQS), a pricing system that collects and disseminates daily price, dividends and capital distributions data for mutual funds, money market funds, unit investment trusts and annuities, is now pricing structured…

SuperDerivatives Bolsters SDX, DGX Data Coverage with Credit Options

Derivatives pricing, data and risk management software vendor SuperDerivatives has added volatility surfaces for a range of credit indexes to its SDX multi-asset pricing platform for pricing structured products and its DGX market data terminal.

Interactive Data, Icap Strike Data Distribution Deal

Interactive Data has signed a licensing agreement with Icap Information Services, the data services arm of interdealer broker Icap, to make the entire universe of Icap data available on its Consolidated Feed of data from more than 450 exchanges and over…

GFI Adds Next-Gen Exotic Pricing Models to Fenics

London-based interdealer broker GFI has launched a new version of its Fenics FX options pricing and risk tool with enhanced mathematical models, including a Local Stochastic Volatility (LSV) pricing model to enable users to price complex exotic options,…

TR Bows Canadian MBS Pricing

Thomson Reuters has launched an evaluated pricing service for Canadian mortgage-backed securities as part of its Thomson Reuters Pricing Service that prices 2.5 million global fixed income securities, derivatives and loans daily, to help clients assess…

GlobalRisk Releases Interest Rate Swap Valuation Module

Chicago-based risk analysis technology provider GlobalRisk has launched a new interest rate swap (IRS) valuation component of its FirmRisk risk management platform, dubbed the GRC SwapEngine, to provide traders, hedge funds, brokerages, futures…

Thomson Reuters Adds TPI Indian Bond Data to Eikon

Thomson Reuters has added real-time data on over-the-counter bond markets in India from Tullett Prebon Information, the data arm of interdealer broker Tullett Prebon, to its Eikon desktop terminal and datafeeds, to provide clients with greater…

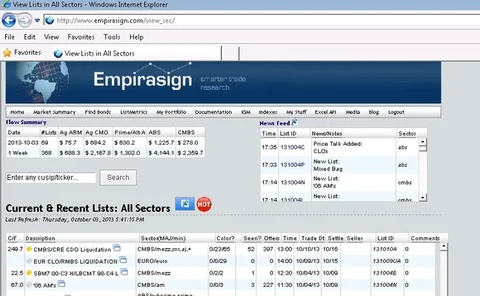

Empirasign Expands Agency Mortgage Data

New York-based Empirasign Strategies, a provider of dealer offerings and “trade color” for mortgage and asset-backed securities, has expanded its database with the addition of data on Agency Fixed Rate Specified Offerings, to complete its coverage of…

Thomson Reuters Taps TPI for China Bond Data

Thomson Reuters has added real-time Chinese bond data from Tullett Prebon Information, the data arm of interdealer broker Tullett Prebon, to its Eikon desktop terminal and standalone data applications, to provide domestic and international customers with…

Platts Forges Metals Partnership with Germany's MVS

Energy and commodities data provider Platts has struck a deal to take an undisclosed investment stake in German iron ore and steel data provider Minerals Value Service and become the exclusive distributor of MVS's web-based value-in-use tool, which…

IDC Automates Vantage Workflow

Interactive Data has enhanced the workflow module of its web-based Vantage application for viewing the data behind evaluated prices, such as anonymous trades, quotes, dealer runs and market posts, to include automated routines and price tests to enable…

Wells Fargo's Johnson Discusses Regulations' Effect on Valuations

Michael Shashoua speaks to Daniel Johnson of Wells Fargo Global Fund Services about the challenges for valuations teams created by AIFMD and IFRS 13

Interactive Data Upgrades Workflow for Fixed-Income Web Portal

The pricing and data vendor says enhancements to its Vantage web portal will allow users to avoid the manual price review processes usually required to explore price movements

Thomson Reuters Expands TRPS Evaluations with CDO Pricing

Thomson Reuters has unveiled a new collateralized debt obligation pricing service, providing end-of-day valuations based on asset-level analysis by the vendor's evaluators for CDOs on asset-backed securities, commercial real estate, and trust preferred…

Tradition Taps Bloomberg Price Fixings for Volatis Trading Platform

Interdealer broker Tradition is to use daily price fixing observations from Bloomberg's independent valuation services for derivatives and structured notes, to provide prices that more accurately reflect realized volatility to Volatis, the broker's newly…

Bloomberg Supplies Fixings Valuation for Tradition's Volatis

Volatis, the interdealer broker's newly-launched hybrid platform for negotiation and trading of realized volatility futures, will use daily fixing observations from Bloomberg.

SocGen Bond Prices on Thomson Reuters Trading Platform, Data Services

Société Générale has begun contributing cash bond prices to Thomson Reuters' Fixed Income Trading electronic platform, expanding the bank's price distribution to a broader base of trading desks at private banks and wealth managers, while increasing the…