Net asset value (Nav)

Northern Trust offers internal fund accounting, data tools to clients

Regulations and a mandate to enhance quality and transparency in a bid to improve the investor experience are pushing buy-side firms to have more oversight of their third-party providers.

SS&C initiates buy-side migration to front-to-back Aloha platform

Migrations will vary based on the size of the firm, with smaller ones likely to take a 'big bang' approach while larger firms will opt for a gradual transition.

Brown Brothers Harriman continues AI ‘transformation’ of fund accounting unit

A new tool that helps business users test and validate their own POCs is set to join the bank’s ranks alongside its other AI projects implemented over the last two years: Linc, Guardrail, and Ants.

Enlighten Tech Helps Northern Trust Find Resources to Share the Covid Workload

To keep its asset servicing functions running smoothly, Northern Trust is using technology from performance management analysis software vendor Enlighten to identify available resources.

Brown Brothers Harriman Re-Imagines AI Ecosystem After March Market Madness

Unprecedented volatility in March is leading the bank to double down on its AI systems in a big way.

Covid-19 Piles Pressure on Fund Accounting

Fund administrators are dealing with unprecedented volumes of pricing information and exceptions.

Brown Brothers Harriman To 'Transform' Its Fund Accounting Service by 2021

The bank is in the throes of a hefty transformation project within its Investor Services division, which began with machine-learning efforts last year.

Machine Learning Takes Hold in the Capital Markets: Some Examples

WatersTechnology looks at 16 projects in the capital markets that involve machine learning to show where the industry is heading.

Brown Brothers Harriman Automates NAV Reviews with Machine Learning

The bank is looking to automation in the middle and back offices as it seeks to exploit emerging technologies.

Brown Brothers Harriman Releases Secondary-NAV Tool for Administrator Oversight

The firm has bolstered its middle-office outsourcing tools with the release of InfoNAV and aims to include AI features in the future.

BNP Paribas Gets into 40 Act Business with Janus Henderson Deal

Andrew Dougherty of BNP Paribas Securities Services talks to WatersTechnology about this recent acquisition and what it means for unit going forward.

Europe Can Benefit from US Experience in Money Market Reform

As European firms move to comply with data and reporting requirements under MMF Reform, they can learn from a similar initiative introduced seven years ago in the US

Jupiter AM Goes Live on Milestone pControl Oversight for Fund Data Automation

Jupiter Asset Management implements oversight solution to automate collection of fund valuation data, daily NAV prices verification.

Firms Unprepared for NAV Changes, Audit Expert Says

Starting October 14, US institutional money market fund valuations must float

MUFG Fund Services Taps Markit for Bond Pricing

The prices will support MUFG's NAV calculations for fund clients

The NAV Crash: Mess at BNY Raises New Questions For Big Funds, Custodians Alike

Should crucial calculation errors have the buy side rethinking an entrenched model?

Fair Value to the Fore

Alternatives to securities pricing needed as Athens stock market remains closed

Electra Releases Dynamic Snapshot for Reconciliation

New function automates re-reconciliation.

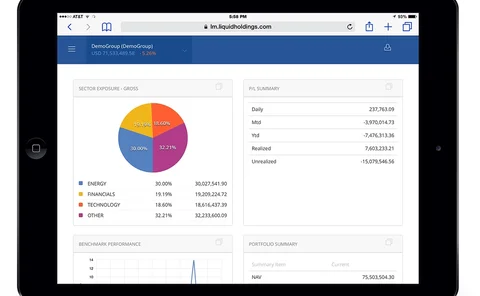

Liquid Goes Mobile with Risk Analytics App

The solution is device-independent and provides real-time risk data.

Facing New Requirements, Money Market Funds Respond with Tracking, NAV Drill-Down Tools

Finer informational granularity required as rule adjustments creep up.

Markit Debuts 'Enhanced' iNAV Service

Markit has launched an intraday net asset value (iNAV) service for exchange-traded products that combines securities pricing data from global exchanges with the vendor's proprietary fixed income evaluated prices, which it calculates for more than 2.3…