Market data

The IMD Wrap: AI efforts will force renewed focus on data in 2024

Machine learning and generative AI offer a tremendous opportunity to help users obtain more insights from raw data, but these tools first need perfect datasets on which to base their decisions.

Quant shop preps NLP-powered index for physical climate risk

Sharp rise in extreme weather events prompts PGIM Quant to aim for better climate-risk pricing

Waters Wrap: Big Tech’s capital markets expansion continues

Anthony looks back at some of the major cloud and AI projects involving the likes of Amazon, Google, IBM, Microsoft, and/or Snowflake in 2023.

Breaking news: How the Grinch stole data

Will the greedy Grinch get his comeuppance for trying to steal the Whos’ valuable market data at Christmas? Max Bowie investigates.

Hunting for reliable low latency, HFTs look to novel techs in 2023

WatersTechnology looks at advancements in market data latency technology and what role the cloud can play.

BMLL adds Canadian data amid global expansion strategy

The market data vendor plans to add more equities and futures exchanges in 2024.

Multicast in the cloud—no longer a pipe dream

Colt Technology explains the process it went through to make it possible to distribute multicast market data in the cloud.

The IMD Wrap: Exchange, data vendor audits continue to rankle end-users—what will change in 2024?

While the data auditing process has been contentious for a long time, Max looks at some of the positive improvements made in 2023 and explains why more improvements need to be made in the New Year.

Buy side unconvinced of corporate bond streaming benefits

Managers see limited utility of streamed prices in the once OTC-only asset class.

Waters Wrap: On EMSs, regulation, and (among others) BlackRock Aladdin

Regulators in the US and Europe have turned their sights on execution management system providers. Anthony examines some of the questions the industry is trying to answer.

The IMD Wrap: Dining on data, from pay-as-you-go to all-you-can-eat

Max puts on his best Anthony Bourdain voice to reminisce about seminal sushi experiences, and to look forward to the future, where perhaps the industry will also adopt more consumption-based approaches to market data (and hopefully more sushi).

What is Aladdin Trader? BlackRock’s fixed-income tool still a mystery

Sources tell WatersTechnology that Aladdin Trader will expand on the platform’s ‘limited’ execution functionality.

The IMD Wrap: Are server life extensions putting profits before performance?

Cloud providers are having to make more hardware available to keep pace with takeup—including older machines that under previous policies would have been retired already. But the move is proving profitable … and risky.

Goldman Sachs looks to ‘Amazon’-like ecosystem with MarketView launch

The new research and collaboration tool is delivered through Goldman’s Marquee platform.

The IMD Wrap: Price you gotta pay

With regulators taking aim at data providers in the ongoing war over data fees, Max says that data doesn’t need to be free, but it should be transparent, that price increases should accompany increases in value, and that technology already exists to…

Opra outages cause consternation in options markets

UBS warned clients they were looking at “bad data” on options screens

The IMD Wrap: Talkin’ ’bout my generation

As a Gen-Xer, Max tells GenAI to get off his lawn—after it's mowed it, watered it and trimmed the shrubs so he can sit back and enjoy it.

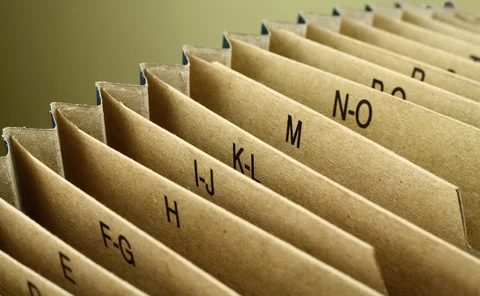

Data catalog competition heats up as spending cools

Data catalogs represent a big step toward a shopping experience in the style of Amazon.com or iTunes for market data management and procurement. Here, we take a look at the key players in this space, old and new.

Bloomberg creates one-stop shop for portfolio managers on Terminal

PM <GO> is a new workstation meant to support buy-side decision-making from analysis to implementation.

Has cloud cracked the multicast ‘holy grail’ for exchanges?

An examination of how exchanges—already migrating to the cloud—are working to solve the problem of multicasting in a new environment.

Waters Wrap: Market data spend and nice-to-have vs. need-to-have decisions

Cost is not the top factor driving the decision to switch data providers. Anthony looks at what’s behind the evolution of spending priorities.

The consolidated tapes are taking shape—but what shape exactly?

With political appetite established on both sides of the Channel, attention is turning to the technical details.

Shining a light on fixed income

Fixed income as an asset class has presented the market with several challenges due to the OTC model by which the bulk of securities are traded

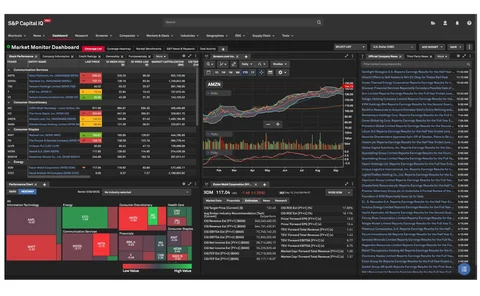

S&P tests ‘ChatIQ’ genAI search tool in revamped CapIQ desktop

The new tool is the culmination of integrating recent acquisitions, including IHS Markit, ChartIQ and Kensho.