Liquidity

Futures trading algos ripe for disruptive new entrants

Algorithm development specialist BestEx Research is making a play to address inefficiencies in futures trading algorithms.

Pictet Asset Management enlists Finsemble to overhaul fixed-income, FX workflows

The Swiss bank’s asset management division has been working with Cosaic for a bit over a year, and has used Finsemble to automate heavy workflows in FX pricing, money market yields, and credit.

MarketAxess Eyes Predictive Capabilities for Fixed Income Liquidity

The trading platform is working to develop its pre-trade automation capabilities to predict a bond’s likelihood of execution, and helping buy-side clients navigate fixed income trading protocols.

At the ‘Fringes of Realism’: Agent-Based Models Take Hold Among Quants

Agent-based modeling has taken root seemingly everywhere throughout the last decade, from theoretical physics, to military operations, to public health, to ride-sharing apps like Uber, and to a much lesser extent, finance. However, a year such as 2020…

This Week: RepRisk/JP Morgan; TP Icap; Moody’s/MioTech; FTSE Russell; SimCorp & More

A summary of some of the past week’s financial technology news.

People Moves: DTCC, Evaluate, Capitolis, Facteus, HazelTree

A look at some of the key "people moves" from this week, including Bob Stewart (pictured) who has been appointed executive director of ITP product management.

Broadridge Onboards Clients to Corporate Bonds Platform Set to Launch Next Year

The vendor's LTX platform leverages a neural network to navigate the complexity of the corporate bond market, and is expected to launch in the first quarter of 2021.

Covid-19 Disrupts Innovation in US Treasuries Market

The pandemic has caused setbacks in electronification and streaming in the US government bonds market.

IEX Makes Expansion Bid as New Limit Order is Approved

The Investors Exchange is now looking to propose a second new order type for NBBO non-mid liquidity.

This Week: MEMX, IUAM/SS&C, Northern Trust, EBS and BME

A summary of some of the past week’s financial technology news.

Exchanges, SEC At Odds Over Odd Lots

Industry insiders warn that the regulator’s attempts to modernize equities data by redefining trading lots will fall short of the mark if odd lot orders remain unprotected.

Multicast: The ‘Holy Grail’ for Getting Exchanges to the Cloud

Cloud providers are hunting for a way to bring multicasting to the cloud for low-latency market data distribution, unlocking the gateway for traditional exchanges to shift core infrastructure to the cloud without negatively impacting high-speed trading.

oneZero Expands into Institutional Market

The vendor has been adding members to its team with buy-side and wholesale broking backgrounds.

SmartStream Launches Tool for Intraday Liquidity Stress Tests

The module allows clients to perform stress testing on demand, integrated with data from the vendor's cash and liquidity management solution.

Buy-side Firms Reject EMS Brokerage Charges

Some users favor a licence fee over per-trade charging—and have forced vendors to make the switch.

Liquidnet Pilots New Analytics Platforms After Acquisitions

The company's Investment Analytics unit is the combination of OTAS, Prattle, and RSRCHXchange deals.

This Week: HKEX, ICE, Clearstream, Broadridge, IHS Markit and more

A summary of some of the past week’s financial technology news.

Big xyt Readies New Liquidity & Trade Analytics Tools

The vendor is beta testing three new data and analytics tools that will give greater insight into their best options to liquidate positions quickly during volatile market conditions.

This Week: Northern Trust/BackRock, Nasdaq, IHS Markit/OpenGamma, MEMX, and More

A summary of some of the past week’s financial technology news.

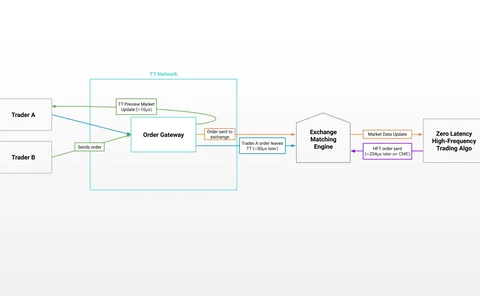

Trading Technologies Unveils New Futures Market Data Feed

As the fight over market data fees in the futures market heats up, the Chicago-based trading platform provider is rolling out a new platform that provides a free view of market order flow for TT platform users.

SmartStream’s Haytham Kaddoura on Lockdown, AI and Managed Services

SmartStream’s CEO chats to Victor Anderson about Covid-19, infusing AI technology across the firm's product range, and the need for faster and more accurate liquidity management tools.

Amid Public Market Volatility, Emerging Technologies Boost Investor Confidence in Private Markets

As the private markets grow, so does investor appetite for them, particularly as public markets hurt. Emerging technologies are helping.

People Moves: AWS, DTCC, Refinitiv, CloudMargin and More

A look at some of the key recent 'people moves', including Adam Honore (pictured) who joins Amazon Web Services from CME Group.

People Moves: Euronext, RJO, CloudMargin, And More

A look at some of the key people moves from this week, including Georges Lauchard, new chief operating officer at Euronext (pictured).